My 6 observations on Berkshire’s 2015 annual report

One general remark upfront: The 2015 annual report wasn’t that exciting in my opinion. Actually, I didn’t plan to write a post on it. However, after reading a couple of posts on the topic, I though maybe some readers are interested because I haven’t seen those points mentioned very often elsewhere.

- Bad year for GEICO

GEICO had a pretty bad year in 2015. The loss ratio (in percent of premium) increased to 82,1% (from 77,7%), the Combined ratio increased to 98% and the underwriting profit fell by -60%. Buffett talks about the cost advantage a lot in the letter, but the only explanation forthe increase in loss ratios are found in the actual report:

In 2015, pre-tax underwriting gains were $460 million compared to $1.16 billion in 2014 and $1.13 billion in 2013.Throughout 2015, we experienced increases in claims frequencies and severities across all of our major coverages. Our lossratio, which is the ratio of losses and loss adjustment expenses incurred to premiums earned, in 2015 was 82.1% compared to 77.7% in 2014. As a result, we continue to implement premium rate increases where necessary.Losses and loss adjustment expenses incurred in 2015 increased $2.7 billion (17.1%) over 2014. Claims frequencies (claimcounts per exposure unit) in 2015 increased in all major coverages over 2014, including property damage and collisioncoverages (three to five percent range), bodily injury coverage (four to six percent range) and personal injury protection (PIP)coverage (one to two percent range). Average claims severities were also higher in 2015 for property damage and collisioncoverages (four to five percent range), bodily injury coverage (six to seven percent range) and PIP coverage (two to four percentrange). We believe that increases in miles driven, repair costs (parts and labor) and medical costs, as well as weather conditions contributed to the increases in frequencies and severities.

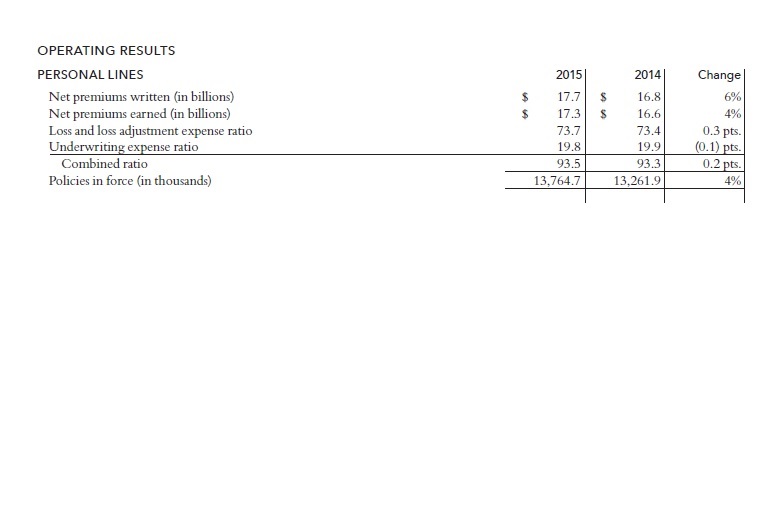

So they claim that overall “macro conditions” were responsible for this significant detoriation. There is however an easy way to verify this. One just needs to look at the annual report of Progressive, the other big US Auto insurer. This is their 2015 recap:

Although the Personal lines segment of Progressive includes other products as well, we can clearly see that the loss expense Ratio is more or less unchanged and car insurance is the majority of that business. So this doesn’t really fit with GEICO’s explanation. For me it is difficult to judge, but to me it looks like that GEICO has a specific loss and most likely underwriting problem. Maybe this is a result of the hunt for market share ? Who knows. Would maybe be a good question for the annual meeting.

One side remark: I did a little comparison of how Progressive would have perfomed against Berkshire over the last 5,10,15,20 and 25 years:

| Performance p.a. | |||||

|---|---|---|---|---|---|

| Years | 5 | 10 | 15 | 20 | 25 |

| Progressive | 13,30% | 5,96% | 12,35% | 13,41% | 14,60% |

| Berkshire | 10,43% | 6,47% | 7,24% | 8,90% | 13,60% |

| S&P 500 | 9,13% | 8,53% | 5,15% | 7,68% | 9,10% |

Interestingly, with the exception of the 10 year period, you would have done much better owning Progressive as a pure play direct insurer compared to Berkshire.

2. Very pesimistic view on (Re-)Insurance in general

Although Buffett is very upbeat on America in the letter, his comment on insurance in general and reinsurance specifically is extremely pesimistic. I do not recall having read something like this sentence before:

The prolonged period of low interest rates the world is now dealing with also virtually guarantees that earnings on float will steadily decrease for many years to come, thereby exacerbating the profit problems of insurers. It’s a good bet that industry results over the next ten years will fall short of those recorded in the past decade, particularly for those companies that specialize in reinsurance

So if you still look for a reason why he sold the MunichRe stake, here is the answer…..

3. No comment on Todd & Ted’s investment performance

Although he praises Todd Combs as facilitator for PCP deal, there is no comment on investment performance, neither “his” portfolio nor Todd & Ted’s.

4. BNSF

Two things were interesting in my opinion about BNSF. First the comment on depreciations:

Indeed, the depreciation charge we record in our railroad business falls far short of the capital outlays needed to merely keep the railroad running properly, a mismatch that leads to GAAP earnings that are higher than true economic earnings. (This overstatement of earnings exists at all railroads.) When CEOs or investment bankers tout pre-depreciation figures such as EBITDA as a valuation guide, watch their noses lengthen while they speak.

That is interesting and unfortunately he doesn’t explain this further. Did BNSF underinvest in the past ? Is there specific inflation ?

Earnings: Operativ profit at BNSF increased 10% to ~6,8 bn USD from 6,2 bn, that’s around 27% of total operating earnings. However revenues went down at BNSF by almost 10%. How did that work out ? Let’s look at the details:

The explanation is simply that the fuel bill dropped by almost 50% or 2 bn USD. So BNSF’s improvent (and thereore Berkshire’s at a whole) was purely driven by a windfall gain in lower fuel costs. Without that, I am not sure if Berkshire would have shown an increase in operating profit.

Edit: Part of the decrease in fuel costs most likely has been “passed through” to customers. However from the report is is not possible to determine where th improvement came from. Fuel costs fell more than sales and all other costs remained more or less constant.

4. Tax “float”

Buffett’s “tax float” is now almost as high as his insurance float. On page 60 we can find that the net deferred tax liability is now 63 bn USD.

5. PCC loan:

Interestingly, Berkshire used a 10 bn USD credit line to pay for the PC acquisition. I cannot recall that he used a credit line before.

On January 29, 2016 we completed our acquisition of Precision Castparts Corp. (“PCC”). At that time, we acquired all outstanding PCC shares of common stock, other than the shares already owned (about 2.7 million shares or 1.96%), for aggregate consideration of approximately $32 billion. We funded the acquisition with a combination of cash on hand and $10 billion borrowed under a new 364-day revolving credit agreement. See Note 22 to the accompanying Consolidated Financial Statements. We currently expect to issue new term debt in 2016 and use the proceeds to repay the revolving credit loan.

He also plans to issue debt (from the HoldCo ?) to fund the purchase, again something I haven’t seen before. With around 61 bn USD cash at year end, the strategy is not really “self explaining”.

6. 2015 Earnings quality

Overall, I found the 2015 earnings quality relatively poor. Yes, operating profit increased, but without the BNSF fuel “windfall”, they would have fallen.

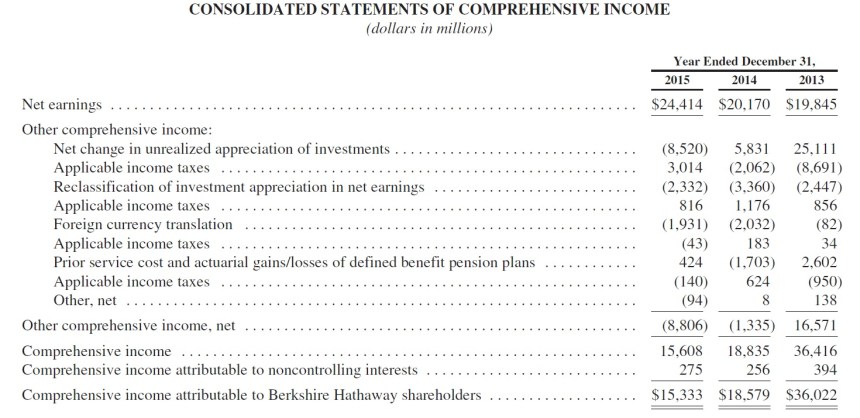

Net income was a “record” but if we look at Comprehensive Income, we see a different picture:

In the top line, net earnings increase every year, the “real” bottom line declines significantly. The reason is easy: Within the comprehensive income we see the mark-to-market losses (net) of the investment portfolio. And Buffett’s stocks clearly had better years than 2015.

For me, Berkshire is still largely a financial company and therefore comprehensive income is important. Buffett would clearly have investors to ignore this and look at operating profit instead.

1-In his recent CNBC interview Buffett quoted deaths and acident numbers for the first 3 quarters (the ones available) and mentioned that deaths increases for the first time from 30 to 32 thousand, an increase for the first time (they expected the number to continue declining as in the years before). So numbers seem to agree with him. There has been a difference for the other auto insurance companies in underwriting since the beggining of the year, which could be due to: more conservative reserving (Berkshire is known for that) or poorer underwriting (there should not be many differences in auto insurance, especially because the insured population changes very little from year to year and that wasn’t the case in previous years).

2-He had mentioned that before: if I recall correctly it is related both to the absence of major events recently and especially to the great and quick influx of money from funds (instead of reinsurance companies) which had put further pressures on prices. I remember correctly he thought that that could be a permanent adverse effect that should decrease the opportunity of favourable pricing in the future (the strength of Berkshire was having money to underwrite big after major catastrophes when the other companies were strugling, if the money comes easily from outside the industry through funds that opportunities can almost disappear)

3- He only mentions his managers when things go right and doesn’t even mention them when things go wrong. That is his praising method.

4- Already mentioned in previous posts. Comparison to the other railroads shows that it actually was a good year compared to 2014 (the others fell a lot while BNSF had a record year, due to a poor 2014 of course).

5- (you have too 4s) That includes also utility and BNSF deferred taxes

6- He has the cash to cover the revolving credit line. He also raised debt to fund BNSF purchase. He admited in the above mentioned interview that he would have paid less for PCC if interest rates were higher (which means that it only makes sense if 10M are paid with low cost debt). He usually times his debt issues very well so he likely decided to wait a few months to issue long term bonds

7- I disagree with using comprehensive income at Berkshire on a year to year basis. The really big investments are almost permanent (and must be due to their size) and as such year to year fluctuations are of little meaning. You should addapt those. I agree with him in using operating earnings + investments to value Berkshire (which have increased at the usual pace). You shouldn’t forget to use Kraft-Heinz at market value instead of equity value if you want to account for investments.

Ps: great post anyways

-Lower oil prices are not good for railroads because this lowers their cost advantage over trucks. Another example is that older airplanes are now used longer because their cost disadvantage is now lower compared to fuel efficient newer ones.

-Depreciation is also lower because railroads are very old and still use fully depreciated tracks atlhough useful life is up to 100yrs already. Interestingly capital expenditures are projected to fall for energy/railroad combined. How much is/was growth capex? I did not find this breakdown in the annual report and I believe it is necessary to value those businesses. Overall I was not impressed by the report.

For Geico onother reason was also the higher customer acquisition cost. Additionally they adjusted their reserves to reflect the now higher frequency and cost of incidents. If this year was not normal but rather bad they release those reserves in the future again. This looks conservative but no exact numbers given.

The problem with book depreciation being less than actual replacement costs is inflation. This is probably more of a problem for railroads because the new assets (rail, ties, ballast) are not that much improved from the replaced assets (except for concrete ties). So they are replacing assets at a higher price than the old historical price without much improvement in operating lives.

The fuel cost adjustments to customers have something like a three month lag, so when prices are going down BNSF’s fuel costs are going down faster than the fuel adjustment add ons charged to customers.

Thanks for the clarification. Both points make a lot of sense.

Well this backs up your thought that the profitability gains from lower fuel prices are a one time windfall gain.

At least to a certain extent.

Thanks for these very interesting remarks.

For info, Tilson has updated his Berkshire presentation: http://www.tilsonfunds.com/BRK.pdf

MMI,

I would love to read your view’s on buffet’s put option writing strategy on the S&P, if you have ever spent time contemplating it.

I am more of a value allocator than an interest compounder and am wondering if applying such a strategy to single name targets makes sense?

Best,

Tony

Tony,

I don’t think individuals should write put options on sngle stocks. What Buffett did was to write very long dated index put options without any collateral requirements. As a “Normal” investor you will not get the same deal. You wil only write short dated put options which will be priced pretty “efficient”.

If you find somthing for a 20 year put option on an index without collateral requirement, then you should consider it.

mmi

Very, very interesting.

I found an option last week on the Swedish OMX, maturing in 5ys and paying c. 10% per year with a strike of c.30% discount to today’s value and a margin requirement of 2:1.

I have never done this but am intrigued. Difficult to price besides Black Scholes (i.e. reflection of volatility).

I tried to “rebuild” a high yield index of these 30 corporates to see what yield they offer compared to the 10%, thinking that if corporates default, most junior sub debt will be written down massively so good proxy…..but quite a few of the 30 swedish Cos have not issued sub bonds (data skewed to a few large issuers).

I am genuinely intrigued by this approach but am finding hard to establish a winning strategy!

in a way, I have my watch list like every one with price entry target some 20 to 30% below current levels on a dozen or so stocks – I am just wonder if there is a way of making money while waiting for my the price to reach my target!

Tony

Those are European options. This is a huge advantage for Buffett. The options cannot be ecercised before the expiration date.

ALL saw a spike in losses in 4q2015 and PGR just announced adverse reserve development for December- so Geico is closer to the market than you imply.

Progressive had a 92% combined ratio in Q4, which is in line with the full year. there was no spike.

You should read what they said last week about reserve develeopment in January before you come across so confidently.

It was ALL which saw the spike BTW not PGR. State Farm (a mutual) also saw the adverse development.

It would be helpful if you would provide links. Allstate’s Q4 combined Ratio was 92% against 94% for the full year according to the Q4 investor call presentation.Auto CR was 98% in Q4, in line with the annual ratio, no spike here. GEICOs CR should be bether than Allstate because of the lower cost but it is not.

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9MzIxOTk2fENoaWxkSUQ9LTF8VHlwZT0z&t=1&cb=635901296215656911

I didn’t find any mentioning of adverse development. Usually they refer to earlier years anyway and should not be mixed up with calender year combined ratios.

You should link to the releases, that makes the discussion easier.

nice observations, probably point 6 explains point 3?

Interesting review with good original thoughts which is refreshing given most people are reluctant to look at anything from BRK with any sort of skepticism!

The only part I think you may be a little harsh is your view on comprehensive income which, as the table shows, is predominantly driven by unrealized changes in the value of BRK’s investment portfolio. WB and CM look at BRK’s intrinsic value in three parts a) the current market value per share of BRK’s investments and net cash, b) the pretax income of the operating businesses and c) how well BRK’s managers will deploy BRK’s capital in the future.

Because part a) picks up the current market value of BRK’s investment portfolio I agree with their use of pretax income before considering comprehensive income items. In other words those large swings in comprehensive income are already factored in to a calculation of BRK’s intrinsic value due to a) above.

Well, the calculation of intrinsic value is one thing, but the change in the intrinsic value is another thing. For such a incredibly complicated company like Berkshire, the Comprehensive income is in my opinion the best indicator how the year went for them overall. Just because Buffet doesn’t like the book value any more (after underperforming on that measure now for a couple of years), it desn’t mean that everyone has to follow him.

Re BNSF depreciation discrepancy, it may simply be poorly calibrated (too general?) accounting rules eg when you re-lay a section of track, the accounting rules may allow you to amortise in N years while the engineer tells you you have to do it every M years, where M < N.

I kind of agree with Tom on BSNF on the one hand you would rather have BSNF’s profit growth coming from rising revenue and cost efficiency gains, on the other hand isn’t it good that BSNF’s variable costs dropped a lot faster than the prices they charged? Isn’t that the sign of a good business? Of course if fuel prices were to go back up BSNF wouldn’t be able to raise revenue to compensate so you are right about it not being great quality, but I don’t think it’s worth writing off completely.

I had no time to read the report until now, so thank you for the write-up. One point, though:

“The explanation is simply that the fuel bill dropped by almost 50% or 2 bn USD. So BNSF’s improvent (and thereore Berkshire’s at a whole) was purely driven by a windfall gain in lower fuel costs. Without that, I am not sure if Berkshire would have shown an increase in operating profit.”

I am not sure if your argument is correct. Maybe the lower fuel prices led BNSF to decrease it’s prices? So revenue would not have fallen if fuel prices did not change? I don’t know about the time lags of pricing in railroads, but I often have the feeling that this fuel-price argument (which works the other way round too) in the transportation business is completely misunderstood. Fuel is a VARIABLE cost, after all. Gross profit is what matters, not revenue. (One could check the performance of other public railroads in this regard, which I did not do).

Tom

I guess you are right to a certain extent but there was also weakness in transported volumes especially with regard to coal.