The Naga Group / Nagacoin ICO: “Double Pumping” the Cryptocraze

I have had some posts on Bitcoin and Crypto currencies on the blog before. Overall I find the technology very interesting, but at least for Bitcoin I am not certain about the real value.

Things are though very different for a German company called “The Naga Group”. The company IPOed 5 months ago on July 10th in Germany in the lightly regulated “Scale segment”. Initially, its aim was to specialize in “disruptive Trading technologies”.

The disruptive technology is an App which is the “Tinder of Stock trading”. The product is a “social trading business platform” called Swipestox, trying to earn most of its money with advertising. I have looked up the App on the Google play store and it has been downloaded a 100.000 times which is OK, but not great. Interestingly the newest comment/rating is from beginning of September, so I am not sure how actively this App is used.

The company boasts 2 prominent pre IPO investors: Hauck and Aufhäuser, a well-known German private bank and Fosun, the conglomerate from China whose founder went “missing” some months ago, but then reappeared , Oh, and Fosun actually bought Hauck and Aufhäuser last year.

In the first 6 months of 2017, the company had around 4 mn EUR in Revenues and roughly the same amount of losses and virtually no cash on hand despite significant amounts raised from Fosun.

The IPO price was 2,60 EUR per share for 1 mn shares sold, Looking at the stock price, calling it volatile would be an understatement:

The first major spike in the stock price happened in July, when Naga released that they will create the “Naga Wallet” which will allow users to participate in Bitcoin, Ethereum and ICOs. Interestingly, also the Swipestox app claims to offer Cryptocurrencies but who cares ?

After spiking briefly, the stock price went down again and hibernated around 4 EUR when then in September Naga Group announced their own token sale, which surprisingly is called the “Nagacoin”:

In the course of the development of the NAGA Wallet (see Ad- Hoc Notification dated

18 July 2017) customers of The Naga Group AG as well as other interested parties

shall be enabled to buy a cryptocurrency – the Naga Coin, briefly NGC – by virtue of

an Initial Token Sale (“ITS”). The NGC shall be used by the buyers – inter alia – for

transactions on the existing and future trading platforms of the Naga group, namely

the platforms SwipeStox and SWITEX.

This pushed up the stock price again to around 15 EUR/share (~300 mn EUR market cap). Now, after a few months the ICO sale is starting in a few days. There is the usual Whitepaper, a more easily to digest 3 pager, a funky video and even a “financial model”.

The whitepaper mentions another project of Naga which is Cybo, a “crowd/artificial intelligence Robo Crypto Advisor”.

A pretty funny aspect of this ICO is that although they want to create a “Naga Wallet” to dominate crypto currencies, the recommend to open a free existing “myether wallet” in order to be able to receive the Naga Coins.

Even more funny is the main selling point of the Naga ICO:

I mean this is a convincing argument, right ? A successful IPO with 400% plus for shareholders really guarantees success for the ICO ? But wait a minute, didn’t the stock price go up because the announced an ICO ? And now the ICO is a guaranteed a success because the stock price went up ?

Congratulations, “the Naga Group”, you seem to have finally developed the first fully self-sustaining money machine. A successful ICO will increase the stock price which will increase the price of Nagacoins which will increase the stock price which will increase the price of Nagacoins….I am getting really dizzy writing this.

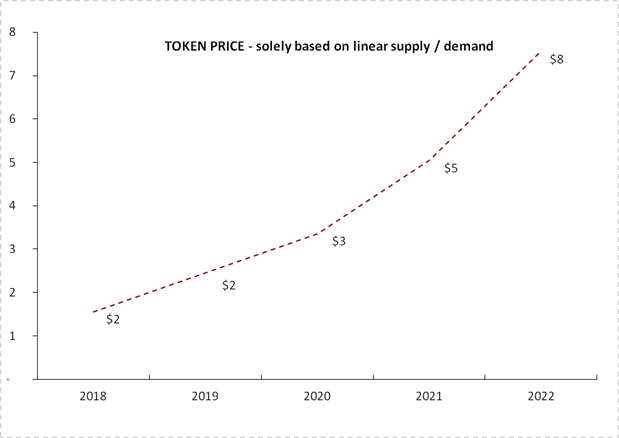

To make things more easy to understand, the financial model includes a price chart for Nagacoin:

With the stock being up 400% in 5 months, an 800% increase in the value of the Nagacoin seems to be on the very conservative side. Compare this to a recent spam comment I got on the blog:

Hello everyone, my name is Jones Franklin.I have invested with a bitcoin company that gives a 10% return every week, that is when you invest $1000 you get a return of $100 every week for life.I decided to share incase you are willing to invest on something.I will recommend the company to you.They are good and it has turned out to be the best investment i have made so far.You may wonder why i am sharing this with you.This is because of the commissions i get when i refer someone to them

What I also find quite fair is the fact that management only receives 17,5% of all ICO proceeds, 10% of proceeds are reserved for an (employee) option pool and 12,5% for “legal and advisory”. Besides a further 5% “bounty pool” and a 10% “M&A reserve”, that leaves more than half of the money to be spent for the Naga business, that sounds like a pretty good deal.

And why would anyone buy those shitty coins ? A fat discount of course. Early “investors” get a 30% “discount” and even extra coins if they recommend this to friends.

Edit:

I just found this sentence in the 6 month report:

The funds raised from the public will not be consolidated into NAGA’s balance sheet. The NAGA token-sale does not create any shareholdings. It will be a pure unit of account and therefore represents an extension of NAGA’sproduct range.

So it seems that the full proceeds go to somewhere else. Interesting.

[Irony off] – Double Pumping

As I mentioned in a previous post, I bought my first stocks almost exactly 30 years ago. So I have seen a lot of excesses in the market, mainly in the late 90ies and then again before the great financial crisis.

“The Naga Group” at first looks like a typical 1990ies stock promotion: Announce to do something spectacular and then sell only a little bit of stock and pump up the price with further spectacular news (but little actual achievements).

However the ICO aspect adds another tool to the stock promoters: With a successful IPO, they can actually create “value” for the company because any ICO proceeds are basically “free money” for the company. Other than debt, it doesn’t have to be paid back and other than issuing new shares it doesn’t dilute the promoters.

As in this case, promoters can take a direct cut of the proceeds and then profit again if their stock goes up. So for them it is a nice “double dip” and in total what I would call a “double pump”.

What I find interesting is the fact that issuing and actively promoting these coins in Germany is legal. Everything around investing, funds etc. is extremely regulated, but scamming “investors” with an ICO seems to be perfectly OK. I also find it interesting that Hauck and Aufhäuser as traditional private bank is involved in such activities. Maybe the Chinese owners think something like this is quite normal ?

The only question remaining is why we don’t see more companies doing this “double pump”. It seems a very simple and straight forward way to make lots of money with little effort for the promoters.

It will be interesting to see if and how many coins they are selling and how long this “double pumping” scheme will work. As an investor of course the only option is to stay as far away as possible from this. Plus, the names of the management and main advisors should go on one’s own “black list” of people where you want to stay away from, wherever they will appear later after this thing has imploded.

Pingback: Planet Blockchain by Miko Matsumura - Blockchain Today

By coincidence I found the “terms and conditions” of the NAGA ICO.

https://docsend.com/view/yxehrd2

The money seems to go to Belize. “Interesting” I would say.

Wow. The platform seems to be really good. Only 10 Javascript Errors.

I think the Naga Coin is going to be very safe !!1!

you do realize all unsold tokens will be burnt? with a 30 million token circulation the naga coins becomes one of the most valuable coins in the ico world. this will trade near $10 the first month on the exchange. this writer was probably the same preaching to everyone not to buy litecoin during its ico as well lol

Agreed. Buy what you can. Mortgage your house (one more time) and buy every Naga Coin you can get. You will become a Gazilionaire. Naga Coin will rule the world. Or the Galaxy. You can only win. There is no way to lose. 10$ in the first month, 100 $ in the second and at least 10.000 $ in the third. WHy so modest ?

x-) !

You just made my day…these crypto idiots will cry soon.

Why isn’t there a mandatory Identity verification done before we are allowed to buy the NGC. Does this mean anybody can get into this using multiple eMail accounts ?

It is not mandatory for less than 500$ transaction

Really good write up, and I also had a look at Naga, and nowhere can we find which “entity” will actually own the corporate portion of the tokens, and presumably the cash when those corporate tokens are sold. 94 page document with no actual financial statement-like information.

I did come across one which actually kept my attention for more than a few minutes though:

CRYPTO20: The First Tokenized Cryptocurrency Index Fund

Looks like an ICO which may actually be backed up by crypto assets, with an ability to convert your token into the underlying assets – in this case, the top 20 crytocurrencies by Market Cap. Looks to be designed based on ETF structures.

Any thoughts on this one?

My thoughts would be: If you want to gamble, make sure you are aware of the odds (and if someone is cheating). If you want to INVEST money, stay away as far as possible. Cryptocurrencies in my opinion are not investible in their current form.

Pingback: Confido 2.0 – "Our stock already did 400%, after 3 months, what will our token do?" "The Naga Group",seem to have finally developed the first fully self-sustaining money machine. | CryptoCurrency News

You guys are truly funny. An ICO like IONA has a 4 billion market-cap yet ICO which is backed by a publicly traded company comes to the forefront with just a 400 million marketcap and you are questioning it? Fact remains, when this ICO hits the exchange it will probably trade in the $20s and the ICO investors will make a killing. I tried investing 20 btc into this but unfortunately I am located in one of the countries where I can’t. I will have to wait till it gets on the exchange. But you guys should stop asking questions and jump aboard. As this ICO is a game changer for the crypto world. I sure wish I could invest in it.

Thanks for this insight. So you are saysing that an ICO like this should in general be valued with 20 times the market cap of the company which is somehow (but not directly associated) with the ICO ?

And yes, asking questions is really stupid, although I do not understand why a plain vanailla Ethereum based ICO is a “Game changer”. Maybe we just should stop thinking at all and invest BEFORE IT’S TOO LATE !!!!!!!!! And become INSANELY RICH AND BEAUTIFUL.

I did that and it worked. 😉

…

(hope a bit of humor does not hurt x-) )

You are now insane ?

MOVE! FAST! Leave your old life behind! Your new riches from the ICO will pay for all that.

This is not related to Naga, but it’s one more chapter in the ICO saga:

https://motherboard.vice.com/en_us/article/j5j34x/ethereum-startup-confido-vanished-after-people-invested-374k-ico

A start-up that simply disappeared after the ICO…

Thanks for the analysis i was a bit suspicious too about this company plus the fact that all of their news on google that are related to their company are preatty recent which is preatty weird, like if they were preparing this scam. Do you know other website that does Backgroung check other than ICOcheck and ICOrating?

Keep doing analysis like this for ICO

Thank you memyselfandi007. I was looking for some info like this. It sounded fishy since their IPO went up 400% in such a short time and yet they need to go with an ICO, they are either greedy or losing money. Also with a hard cap of 400 millions, an ICO price of 1$ the first thing that would happen as soon they hit the exchangers is that you will find your presale investment greatly undervalued! No ICO starts with a market cap of $400m.

Now you illuminate us on the reason why they got such a huge price increment after their IPO. Thank you.

You should put a share button on your posts. I will be happy to share this article. Also share your twitter if you have.

Congratz for this article !

Very clever, tx again

Please write more ICO related posts. This is really helpful for investors. You should submit your post to reddit. More need to know about this asap

I am not sure that I want to write more posts about ICOs. This “industry” just looks way to messy

Thanks for this. Another red flag is the vesting schedule. 17.5% of tokens for team and founders. 50% of Team Tokens will be locked up for 6 month. Other 50 % of Team tokens has no vesting schedule.

12.5% of tokens for legal and advisory with a 6 month vesting schedule. You can see it on https://icocheck.io/ which does background checks and due diligence for ICOs.

We are establishing one single interface and gateway to unite financial markets, virtual-goods and crypto-currencies via a unit of account – the NGC.

Everyone is entitled to their own opinion- but to take every strength and turn it into something bad is quite something. None of this changes the fact that we are the only ICO that has IPO’d – undergone deep due diligence and audit to be listed (talking about KPMG etc and not some website) – are backed by billion dollar firms, have a strong (the strongest capitalization), make millions in revenue, billions in volumes and are live. Some people might not like that.

Thanks for this “official” comment. However doing a mini IPO on a very losely regulated exchange is not that impressive. Plus, the millions of revenues are actually euqal to the same millions of losses. Again not so impressive.

And for the Record: The NAGA ICO has not IPOed. The company has IPOed but the relationship between the company and the ICO is very vague.

Dear Naga Coin ICO,

one question if you read this: How do I interpret this sentence from the 6 month report of “the Naga Group”:

“The funds raised from the public will not be consolidated into NAGA’s balance sheet. The NAGA token-sale does not create any shareholdings. It will be a pure unit of account and therefore represents an extension of NAGA’sproduct range.”

So what is the actual relationship between the ICO funds raised an the company ? Despite the fact that Managment takes a nice cut out of the proceeds ? I am happy to learn more about this.

“the only ICO that has IPO’d”

Where in the prospectus (https://thenagagroup.com/de/investor-relations/ipo-prospectus/) is the ICO mentioned?

I could not find it. The idea “developed” after the IPO at least officially.

Talking about KPMG: Naga is not audited by one of the “Big 4”.

Thank you for this mmi, I think there is a moral obligation to bring light against these clearly dubious “legal” practices.

“Promotion without dilution”. A dream comes true!

That also makes shorting very dangerous. With an ICO you suddenly create “real value” and shorts will be run over.

yes, shorting is very difficult. I think the freefloat of the stock is very small.

Ha! Wouldn’t touch this Naga with a bargepole. However, Nagacorp (HKG:3918) on the other hand is a highly undervalued casino with tremendous economics, which has just doubled capacity and the stock has yet to reflect this (and is my biggest current holding). Great read as ever – I also share the frustration with the crypto-hype that is apparent in your post.

Yep, that’s the “business model” of some (if not most) of these ICOs.

Actually, there are so many of these obvious scams that whatever ICOs/cryptos that may be interesting and sustainable in the long term will get a hit too, if (or better when?) this bubble finally implodes.

Thanks for the summary. I especially like the ironic part 🙂

Tom

Hi MMI,

thanks a lot for bringing up this topic. The problem is that most people who need this kind of information (the potential ‘investors’ in this kind of stock and in ICOs (I really love that term – Initial Coin Offering)) just don’t read your blog. They only read ‘financial porn’ (like ‘Der Aktionär’ or ‘Finanzen.net’).

Most haven’t figured out yet, that they are the new players of a ‘Hütchenspiel’ (shell game). At first they might be allowed to win a little bit, but in the end they will have nothing (except some 0 and 1 in their wallets).

I wonder when the first interventions from ‘official’ side will happen to end this more than obvious fraud. Or maybe they will do nothing for now and in the end they can say ‘See what happens when you don’t trust our money-system’…

Thank you for outing this scam! BTW: Pantaflix – another Hauck & Aufhäuser deal – looks extremely shady as well.

The German banking authority is warning, but for more they don’t have a permission by the law.

https://www.bafin.de/SharedDocs/Veroeffentlichungen/DE/Meldung/2017/meldung_171109_ICOs.html;jsessionid=D0CDE46FFD13855F1511EE0E01BDF804.1_cid390

German lawmakers might be too late in this case

Thanks for the link. This document is pretty “sad reading”.