DOM Security (FR0000052839)- A Hidden Champion with a “key to unlock” higher profits ?

Executive Summary:

Dom Security is a small French company specializing in commercial lock systems. The business itself is attractive, the valuation relatively cheap, although the company is a small player. The “kicker” in my opinion is the fact that the largest subsidiary, DOM Sicherheitstechnik Germany, had significant R&D expenses over the last few years, which, if things normalize, could lead to a significant profit increase within the next 2-3 years to the extent of +40-45% which should translate into a similar upside for the stock price.

Additionally, the rebranding in 2015 could lead to better profitability in other units and in turn to potentially higher multiples, which at the moment are only a fraction of the listed larger competitors.

WARNING: This is not investment advice. Do your own research. The presented stock is very illiquid, so be extra careful.

The Company:

Dom Security (until last year Securidev SA) is a company domiciled in France which, according to Bloomberg “manufactures conventional and electronic locks and security systems for households and industry.”

Key figures

Market Cap: 90 mn EUR

Sales 2015: 163 mn EUR

P/B 1,1

P/E (2015) 13,7

EV/EBIT 7,5 (not adjusted for pension)

Div. Yield 4,1%

10 year avg. Profit MArgin: 4,7%

10 year avg. ROIC 9,3%

10 Year avg. ROE 10,7%

10 Year FCF/NI 107%

The business

There is a decent write-up at Value Investors Club from 2 year ago which covers nicely the overall attractiveness of the locks business.

A quick Summary of the VIC post:

- Commercial locks is very good business (Installed base, significant share of after sales, local business, high barriers to entry)

- DOM Security sells significantly below private market value

- Potential catalyst if DOM founder decides to sell the company

I would agree fully with the first 2 points, although I am not sure about the 3rd, but more on valuation and catalysts later.

Maybe some more thoughts on the locks business and why it is so attractive:

- In many cases (with the exception of single family houses maybe), the locks themselves are not ordered by the ultimate client but by an intermediary. I live for instance in a relatively small unit with only 3 flats, but the lock system has been chosen by the landlord. I get the first set of keys for free but if I need a replacement, I need to pay. In many of those cases, the customer (i.e. my landlord) is less interested in the price but much more in service and the ease of doing business, as he doesn’t need to pay the bill later on. For a company, this is generally a good type of business because then price competition is less important

- Locks only represent a small part of the price for a building, but have a strong symbolic value. So again, price is not the key driver for chosing your lock (“Don’t you want to protect your family ?”)

- Barriers to entry: Lock systems are rarely exchanged. Dom’s French subsidiary for instance claims that their oldest installed systems is 125 years old.

- Technological change: This is something to monitor. For the last 100 years or so, the lock business has been a purely mechanical business. Now, electronic/electromechanical systems seem to be on the rise. One needs to check if the dynamics in the market changes. I do think however that this will be a slow change, mostly via new buildings. A friend of mine told me , that a new Electromechanical system (by chance one from DOM) needs its batteries changed every 2 years. The battery costs 30 EUR and needs to be exhanged by an expert. I don’t think that electronic replacement keys will be cheaper (for the end user) than the mechanical ones…..

- There is specific “Tailwind” in Germany: Break-ins especially in Germany are on the rise. I have seen several “special feature” broadcasts in the last week about burglary in Germany which is basically free advertisement. Very few home owners will try to safe money on their door lock in such a situation.

Overall, I do think that the lock business is a very attractive one with a favourable structure, relatively little capital requirements, low price sensitivity and decent earnings to FCF conversion.

The competition /comparables

There are 3 listed lock companies globally: Assa Abbloy, a Sweden based “roll up” which was mentioned among others in the Marathon book, Kaba, a Swiss based company and finally Allegion, a recent spin off from Ingersoll-Rand.

| Name | Mkt Cap (EUR) | P/B | P/S | P/E | EV/T12M EBIT |

|---|---|---|---|---|---|

| DOM SECURITY | 89 | 1,1 | 0,5 | 13,7 | 7,5 |

| ASSA ABLOY AB-B | 20.208 | 4,5 | 2,8 | 24,7 | 17,8 |

| DORMA+KABA HOLDING AG-REG B | 2.637 | 6,9 | 1,9 | 34,3 | 13,5 |

| ALLEGION PLC | 5.897 | 88,8 | 3,1 | 25,6 | 18,5 |

So clearly the big guys are valued at multiples at least 50% higher than DOM Security. But if we look at the profitability of this Peer Group, we can also see that the others are much more profitable (based on 2015 values):

| Oper. Margin | Net Margin | ROIC | |

|---|---|---|---|

| DOM SECURITY | 7,7% | 4,0% | 9,2% |

| ASSA ABLOY AB-B | 16,3% | 11,4% | 13,1% |

| DORMA+KABA HOLDING AG-REG B | 15,2% | 9,4% | 24,8% |

| ALLEGION PLC | 19,1% | 12,2% | 17,2% |

So the issue is clearly the following: If everything stays the same and without an “exit”, I would guess that DOM’s low multiples would be more or less justified. So the question is: Is there any upside ?

The potential upside:

This is a view on the last 10 years of DOM:

| ROIC | Oper. Margin | Net Margin | |

|---|---|---|---|

| 29.12.2006 | 11,5% | 8,3% | 5,8% |

| 31.12.2007 | 15,0% | 10,1% | 7,0% |

| 31.12.2008 | 11,8% | 9,8% | 5,5% |

| 31.12.2009 | 3,2% | 6,4% | 1,4% |

| 31.12.2010 | 11,7% | 10,1% | 7,1% |

| 30.12.2011 | 12,6% | 8,8% | 5,4% |

| 31.12.2012 | 8,0% | 7,7% | 4,5% |

| 31.12.2013 | 8,0% | 7,5% | 4,0% |

| 31.12.2014 | 3,3% | 4,7% | 1,9% |

| 31.12.2015 | 7,4% | 6,3% | 4,0% |

| 10Y avg | 9,3% | 8,0% | 4,7% |

We can see that the 2015 numbers are clearly below the historical average. What I found interesting is the fact that the 2009 drop is explainable with the economic crisis, but it is not clear at first sight why 2013 to 2015 are below historical averages. Yes, the Euro crisis has an impact, as DOM is active in France, Spain and Italy, but this should have shown up earlier. So the question is: Where does the problem come from ?

The “German situation”

The German business, DOM Sicherheitstechnik GmbH is the largest subsidiary of DOM Security. They bought it in 2005 for 20 mn EUR from Black & Decker and up until 2013, the company was a cash cow and “profit machine”. This is how the stated German (local GAAP) results look like since 2009:

| Sales | Profit | Net Margin | |

|---|---|---|---|

| 2009 | 55.460 | 6.046 | 10,9% |

| 2010 | 56.839 | 8.923 | 15,7% |

| 2011 | 61.515 | 7.719 | 12,5% |

| 2012 | 59.138 | 8.359 | 14,1% |

| 2013 | 56.822 | 636 | 1,1% |

| 2014 | 62.194 | -517 | -0,8% |

| 2015 | 62.586 | 1.367 | 2,2% |

If we look at this table, we see that something “terrible” must have happened in 2013 which killed profitability completely.

And yes, in the 2013 and 2014 account, DOM gives us a little hint:

SECURIDEV a cédé à sa filiale allemande, DOM Gmbh KG, tous les droits attachés au projet européen électronique dont elle avait financé le développement. Ces frais ont été symétriquement pris dans les charges d’exploitation de la filiale allemande aucours de l’exercice.

According to my (not very good) French, this means that the German subsidiary had to bear all costs for developing a new European Electronic lock system. Although local GAAP does not fully translate into IFRS, I think it is realistic to assume that at some time in future, the German sub could earn better margins again.

I found the following German article about another medium-sized German lock company and 10% operating margins seem to be quite normal, even for a player which is smaller than DOM Germany.

Interestingly, Henri Morel personally took charge at the German subsidiary mid last year, right after Securidev was renamed in DOM Security. So I do think it is not unrealistic to expect further improvement going forward

So conservatively I would assume that the German subsidiary in the next 2-3 years will be able to earn a 10% operating margin and a 7% net margin, which would mean based on total 2015 profit of 6,7 mn, a ~2,5-3 mn profit increase all other things equal which would represent a profit increase in 40-45%.

Reorganization

In 2015, DOm started a major reorganization program, a presentation can be found here. Usually I am a little bit sceptical about reorganisation projects. Just if you reshuffle management a bit, normally not much happens. But in DOM’s case I think there is more to it.

One strong sign was that they kill all the local brands from the companies they have purchased and replace it with the “DOM” brand. I do have some experience with situations like this and I know that this is not an easy step. This costs money at first, because you have to change a lot of signs, marketing material, stationary etc. but over time such a step will pay off (more efficient marketing etc.).

Another interesting aspect of this program was the fact that the CEO of the German subsidiary left and the CEO/founder took over this role directly for the time being. For me this could be another potential catalyst for the German business to recover when the “Big boss” takes over personally.

Founder CEO/owner/ownership structure

Founder/CEO Henri Morel seems to be one of the “unexpected” self-made French entrepreneurs. He started to buy up companies right after university according to his bio at the website of the holding company.

The listed Holding company SIPF in which he holds 57% holds 69% of DOM Security, the American Value Fund International Value Advisors ~16%. 2% are Treasury shares, so the Free Float is only ~13% or 12 mn EUR.

I didn’t find much about him on the web. He seems to be active in trade associations but other than that there is not much to be found, which in my experience is a good sign.

His stake in the holding company is worth ~150 mn EUR. I haven’t looked deeply into the holding company, but it seems to be debt free, so no risk of forced sales. However I cannot reconcile the value of the holding company (~260 mn EUR) with the value of the subsidiary DOM (90 mn) ad the other subsidiaries don’t seem to be very profitable.

Acquisition history/strategy

DOM’s biggest acquisition was DOM Sicherheitstechnik, which they bought in 2005. They earned back the money on the 20 mn purchase price within 3 years or so. They buy 1 company almost every year, usually small single digit million companies in Italy, Spain or Eastern Europe.

So far they were not very succesful in turning those companies around, but hopefully, with the single brand strategy this will become easier.

In general I do think that DOM has the advantage that for them such small deals still can have an impact, whereas the big guys clearly will go for larger targets. So I do think that it is not aggressive to assume that they can grow in the next years single digit by adding a couple of smaller businesses in Europe.

Why is the company “cheap” ?

I think there are a few potential reasons:

- Free float is small, there is very little trading

- The company has no analyst coverage

- The reports are in French, which means most Non-French investors will already be turned off by this

- The “double stacking” with the listed holding looks strange

- There is a 30 mn pension liability in the German subsidiary. I am usually very critical, but in this case, with the proven cashflow generation of the business, I do not think it is a big issue, however the valuation has to be clearly adjusted (EV/EBIT goes up from around 7,5 to around 10 or so) and therefore I don’t assume any kind of multiple expansion

Valuation / Stock Price

As always, I try to keep it very simple. The case for DOM Security is not a multiple expansion case but a profit recovery case.

As discussed above, I do think that a profit increase of 40-50% (Germany plus restructuring program) is realistic over the next 3-5 years. All other things equal, this would mean an equivalent upside to the stock price. Together with the 4% dividend yield, this would translate into an expected return in the range of 12%-21% p.a. which I think is quite attractive compared to the stability of business and the solid balance sheet.

The private market value of DOM Security would be clearly higher than that. A sale to the big guys would most likely be done at 2x the current share price or more, but I don’t think that there is a high probability within my investment horizon. Justas a reference point, German Elelctronic lock specialsit SimonsVoss was bought last year at a valuation of 4x sales by Allegion.

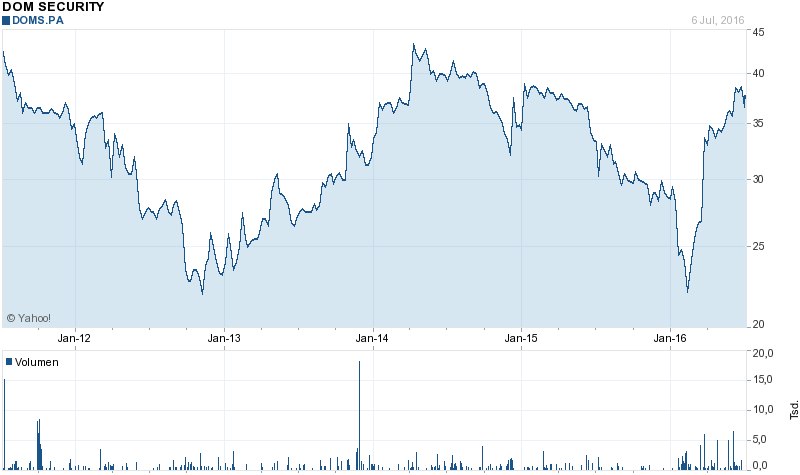

The stock price has been surprisingly volatile, especially early this year. I have no idea what triggered tha sharp decline (and rebound). Of course I would loved to buy DOM at 25 EUR. Interestingly, after the Brexit there was very little movement in the stock price.

So as a result, I have allocated a 2% position of my portfolio at an assumed price of 36,60 EUR into DOM Security for my “boring” category. If the case goes according to “plan” I might add more.

Some might ask why I buy Dom Security and not AQ Group. There are 2 major reasons: First, I do think the undelying business is better. This reduces the downside risk and justifies in my opinion a higher multiple. And secondly, I think there is a clearer profit upside at DOM Security within my investment horizon.

Hi, In the 2014 annual report, it says that the consolidated Net Result was impacted by 2,995 K€ due to two fiscal controls, in R&D credits and in transfer prices between Germany and Holland. That brings the Net result back in line with trend.

Hello

A few remarks on your excellent post, with some delay.

From a local consumer perspective, I’m not so sure about changing established brand names.

For me, a “Picard” lock (one of DOM brands http://www.picard-serrures.com/) means something and as a house owner I’m likely to pay a premium for a well known “premium” (or perceived as such) brand instead of a chinese-made one. All the locks in the company I work for (several buildings) are Picard locks.

The Ronis brand also rings a bell http://www.ronis.fr/. DOM not at all.

Regarding shareholders, a notable shareholder is the fund “Stock picking France” (http://www.jousse-morillon.fr/), with a “deep value” style.

In the last annual report, the paragraph on the “conventions réglementées” (regulated commitments and agreements with 3rd parties) seems very long…I did not have to time to dig into this and clarify the total amount of money funnelled to Mr Morel either directly or through SFPI.

The main point of your analysis, if I understand corrrectly, is that subsidiary DOM Gmbh profits will go back to someting like 10% EBIT margin. But looking at page 21 of the 2015 annual report, the EBIT margin for the North Europe sector (which includes DOM Gmbh and DOM switzeland) is already 7.7%.

The EBIT margin for the West Europe sector (France and UK) is 10 %, which is consistent with your objective

The 2015 consolidated EBIT margin is around 8 % (before restructuring costs), not so far from 2008 or 2007 consolidated 10% operating margin for instance.

I understand your point about DOM Gmbh net margin being impacted by the development costs.

But looking at it strictly from a consolidated EV/EBIT perspective :

– EV ~ 115 m€ taking into account 38.6 m€ pension liability (for a 90 m€ market cap)

– target EBIT margin ~ 10 % => around 16 m€ EBIT assuming no revenue growth

EV/EBIT ~ 7 which is not expensive, but not very cheap either ?

What am I missing ?

Thanks in advance

Thanks for the comment.

Yes, DOM is not super cheap, but in my opinion the underlying business is very high quality. As I wrote, this is not potential tenbagger but a relatively “Modest” undervaluation with relatively little downside.

And yes, if you unify brands, some clients will miss the old local brands but over time the effect should be positive.

MAybe one more remark: You might have noticed that I haven’t bought any “cheap” tocks for a long time. I do think that especially right now most “cheap” stocks really have fundamental problems. I much more like “good value for money” stocks and I think DOm could be a good one in htis respect.

Just a few thoughts if I may. Besides from the “hidden profits”. I’m not sure what do I like about Dom. We is growing a lot, and within the last ten years revenues are flat. Although they have been buying companies if I’m not mistaken. So in fact it should had increased more the revenues. I agree with your overall analysis, but I think you are overestimating the business quality, ROIC’s are crappy for the kind of company I like too, so not sure about the business quality at all.

I do think that there is a fair chance of things becoming better…..What means” We is growing a lot” ?

From DOM’s perspective you should maybe lose your keys more often 😉

Sorry, just I typo… I meant that is not growing a lot. If you look at the last 10 years, revenues are flat and the company has been active in m&a, therefore the organic business I guess is shrinking. That would justify the lower multiples for Dom to my understanding. How do you see it?, yes I think the chance that margins get better is quite high, but can’t ignore that fact.

Clearle, the lock business is not a business that is growing strongly on an organic basis because of the high barriers to entry. In DOM’s case I think the problem was(is) the base year you are comparing and the “EUR crisis”. Outside Germany, DOM is mostly active in France, Spain and Eastern Europe. 2006 was the peak of the building boom, since then there were more or like 10 years of contraction. Again, I think their decision to only use the DOM brand could improve profitability. If (and this is a big if) the “Club Med” economies improve, we could see some organic growth. The first quarter showed modest organic growth (+1 or 2%) already.

But who knows? Just to avoid any misinterpretations: DOM for me is a “Boring” stock, not a High ROIC grwoth machine. If you have read my blog for longer you will know that I am a fan of such “Boring” stocks because I think the offer decent upside by minimal downside.

Of course not every boring French stock works out. Trilogiq, Poujoulat and April didn’t really work, but the good thing is that you don’t lose a lot of money on them because they are cheap anyway.

Yeah definitely, I do really appreciate your blog. I’ve been reading for a couple of years now and it’s really one of the best blogs out there. I hope that you keep doing the same for many years, i’ve been learning a lot. Just wanted to find out more about this investment, since I really agree with the ways you view investing. As a Spaniard I can tell that the real estate business is definitely going better and there is still more money to kick in. Most of our fellow spanish businessmen don’t really know what to do with their cash but investing in real estate and I think they will keep doing it, so I see more organic growth, at least in Spain. Although prices are way lower 30-40% down from 08, I see apetite again for this market. I personally will be waiting for some good quarters ahead, as long as banks keep doing the same.

I had a look on my key. Our door locks are from DOM.

Very good quality, functioning without problems – since 1968…. 😉