Metro Bank Plc – “The Apple of Banking” or “One-trick Pony” ?

Readers of my blog know that I do like “outsider” like financial companies and that I do like UK banking (Handelsbanken Lloyds).

Therefore it was highly interesting to read about Metro Bank, a recently listed “UK Challenger bank” in a letter of an investor I greatly respect. I had a look at “online only” UK challenger Bank Aldermore but didn’t like it too much, but as Metro Bank runs a “Branch strategy”, I decided to look into them.

I do have to confess that as a reader of FT Alphaville, I have a lot of doubts about Metro Bank. They have dedicated a complete series on those guys.

The Bull case for Metro Bank

I will summarize the bullish case in my own words:

- The founder of Metro Bank has a great track record from the US where he founded a retail bank called “Commerce Bank” from scratch and sold it 30 years later for 8 bn USD

- the concept is “fanatic” customer service. They focus on branches and easy access including, among others, much longer opening hours than normal banks and a “dog friendly” atmosphere

- they use word of mouth marketing instead of expensive advertising or high deposit rates

Creating a simple and great customer experience is clearly something which is in short supply in financial services.

The UK banking market

Fundamentally, UK Banking is vulnerable to challengers as I have written back in my Handelsbanken post. RBS, Barclays, HSBC and Lloyds (and Santander) clearly run some kind of oligopoly and their reputation hasn’t improved since the financial crisis. RBS, Barclyas and HSBC have a lot of other problems and could be considered clear “market share donators”. Lloyds in my opinion is better, but so far my investment doesn’t look good either.

However, Metro Bank is not the only “Challenger Bank”. Svenska Handelsbanken is one challenger, others are Aldermore, Virgin Money and Shawbrook just to name a few. On top of that, you have many non-bank financing companies in the UK competing for loans.

The founder Vernon Hill – Controversial

Vernon Hill successfully founded Commerce Bank in New Jersey in the 1980ies. The business case was pretty much the same like the one he tries with Metro Bank in the UK now. The branches were much more like stores open 7 days a week.

However, he actually got fired in 2007 from the bank that he founded. There seem to have been several incidents where his integrity seemed to have been at least questionable:

For all his success, Hill left himself vulnerable on ethical questions in a highly regulated business. For many years Commerce had been paying big fees to Shirley Hill to design the branches and to her husband’s partnerships for leases under more than a dozen branches. In 2007 the regulators demanded that Hill end those arrangements. They also banned Commerce from opening new branches, the lifeblood of his business, unless Hill resigned. After Hill stepped down he signed a consent order requiring that any bank in which he’s a major shareholder conduct an independent review before approving contracts with companies owned by Hill or members of his family.

This was not Commerce Bank’s first brush with the law. In 2004, a federal grand jury indicted two Commerce executives, Glenn K. Holck and Stephen M. Umbrell, on charges of giving loans to the Philadelphia city treasurer in exchange for the city’s financial business. In 2005, the two executives were convicted of conspiracy and the treasurer was found guilty of fraud and conspiracy. Although investigators disclosed that they had taped Mr. Hill talking about business with the treasurer, Mr. Hill was never charged.

Hill himself is quite excentric to put it mildly. He usually appears in public with a dog on his arm:

And he lives in a “house” which resembles a French palace. And of course, his wife Shirley gets paid nicely for designing the Metro Bank branches as back then at Commerce Bank.

What is actually their business mdoel ?

When I read through the listing prospectus, I stumbled over the following passage:

Metro Bank relies on its network of intermediaries, having derived approximately 84% of its mortgage portfolio and 61% and 75%, respectively, of its invoice and asset finance portfolios from intermediaries in 2015, with the top 10 brokers accounting for approximately 80% of all intermediary-originated loans in the same year. Metro Bank has limited oversight of intermediaries’ interactions with prospective customers, and intermediaries violate applicable regulations or standards when selling Metro Bank’s products, Metro Bank’s reputation could be harmed.

So 3/4 of all loans ar not made by Metro bank but come via brokers. If one looks further into the current balance sheet, then only ~50% of the assets are loans, the rest are securities bought at the market.

This clearly leads to the question: What is actually the business model of Metro Bank, how do they want to earn money ? For the time being it seems at least that the only “real” business they are doing is attracting deposits and they seem to have “outsourced” almost all of their asset origination.

Now the question is clearly: How much value are you creating with all those fancy branches and long opening hours when interest rates are (close) to zero percent anyway ?

I would argue: Not much. In the EUR zone, deposits have actually already become a real “liability” as it is very difficult to charge retail customers for their money, whereas in the money market one actually can get money at negative rates. The branch network, if it is used mainly for deposit gathering in my opinion is a very expensive way of borrowing money which you get almost for free anyway in these days of ultra-expansive monetary policy. The UK pre-Brexit was somehow isolated from that but following the Brexit it seems that interest will move more towards the level of the EUR zone.

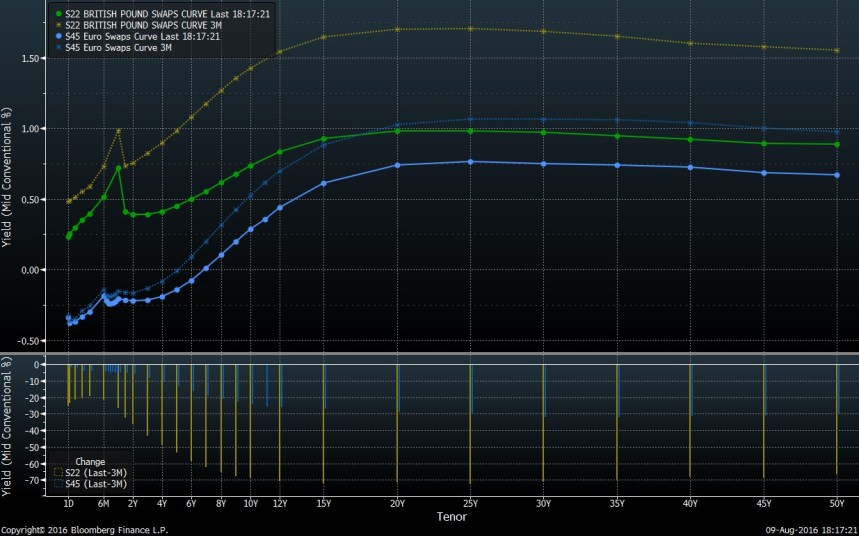

This is a chart how the UK Swap curve has moved over the last 3 months compared to the EUR curve:

The upper two curves ar the UK curves, the lower one the EUR rates. We can see that in the short end the move was lest drastic than in the long end. The UK curves are quite strange at the moment, especially the “humpback” at the 12 month spot is hard to explain. In any case the tendency clearly goes into the direction of “EUR scenario” and a flatter and lower yield curve makes it much harder to earn money for ANY bank.

Secondly, I would be very cautious about the credit quality they get when sourcing loans from brokers. Handelsbanken in comparison has a completely different business model. Their “edge” is loan underwriting. They fund themselves to a large extent in the institutional market but are very cautious and diligent to whom and how the lend their money.

Personally I think the Commerce Bank/Metro Bank business model worked very well back in the 1980ies/1990ies in the US with sky-high interest rates. There, cheap “float” in the form of deposits or even no-interest current accounts was very valuable. These days however, the value of deposits in my opinion is very questionable.

Interestingly, FT Alphaville came to the very same conclusion:

The problem is that securities, or bonds, don’t make their owners a lot of money these days. Unlike the years during which Hill built up Commerce Bank in the US, across the world today central bank interest rates are zero, barely above zero, or even negative. That has dragged down bond yields (or inflated bond prices if you want to look at it that way) and so unless you’re willing to wade into the riskier end of the market, there isn’t much income to be had owning securities.

Maybe they manage to increase their loan origination capabilities, but I think this is not within the “DNA” of the founder.

Someone now could say “Wait, but you like Admiral which is also outsourcing its investments”. However the 2 big differences in the Admiral case is the following:

- They do create a sustainable competitive cost advantage on the technical side which I don’t see at Metro

- They also pass the risk of the assets to someone else. Metrobank actually keeps all the asset risks but does not really control the asset selection.

In general: Caution with fast growing financial services companies

Having said this, there is still the chance that Metro Bank will show growing profit for some time to come. How is that ? Well, in financial services, growing quickly (which is not that difficult if you compromise) can leads to nice results for some time due to time lags. The main reason is that if you lend money, very few people default on the first day. Rather defaults cluster towards the end of the maturity. An extreme example for this was the late Subprime crisis where People even didn’t pay interest any more in the first few years and then the wall of defaults hit hard when the interest payments kicked int. For the first few years however everything looked brilliant.

As long as you grow quickly, the tail doesn’t catch up. But once growth rates decrease, defaults start to rise and often wipe out the previous perceived profitability.

One pretty remarkable detail is the fact that Metro only shows 8 mn GBP loan loss allowances against 4,6 bn of (brokered) loans. I don’t think that this is a sustainable level.

Other observations.

Metro Bank’s “float” was not a classical IPO, as no shares were actually sold. Interestingly, since the float, altogether ~13 mn stocks have been traded, representing around 16% of the market cap. Based on Bloomberg information, several investors have initiated significant position, but strangely enough, no one of the pre flowat investors has filed a decrease of his positions.

Summary:

At this stage I can already wrap up my “analysis” of Metro Bank. In my opinion, the two big issues are:

- The founder is very controversial (I would not lend him my wallet), which especially for a bank, is a problem in my opinion

- Although the business model has worked well in the US starting in the 1980ies, the “deposit gathering machine” does not create a lot of value these days with interest rates at or below zero.

As the stock is promoted well (“The Apple of banking”) and headline growth looks impressive, there could be clearly more short-term upside to the stock price, especially when the show a profit in one of the next quarters. So for anyone who likes to “surf the wave” it could be interesting.

Fundamentally, I do think that at the current share pRIce the stock is already very “richly” valued as I don’t see a sustainable business model to earn the required returns on equity in the long run.I see a large risk that Metro Bank is rather a “one-trick pony” which worked well once but most likely not a second time.

At some point in time in the future this could even turn out to be an interesting short opportunity when growth is slowing and defaults start catching up.

Metro Bank failed to issue a bond:

https://ftalphaville.ft.com/2019/09/24/1569316020000/Another-blow-for-Metro-bank-/

I guess the Matro Bank story will not last that much longer…

Der Apfel beim „Apple of Banking“ war faul oder hatte eine wurm drin 🙂

„Kunden der britischen Metro Bank fürchten um ihre Einlagen

Seit einem Bilanzierungsfehler gibt es Zweifel an der Finanzlage der britischen Metro Bank. Nun wollten besorgte Kunden sogar ihre Schließfächer leeren.“

https://www.handelsblatt.com/finanzen/banken-versicherungen/challenger-banken-kunden-der-britischen-metro-bank-fuerchten-um-ihre-einlagen/24337072.html

You nailed that one. I urge you to go back to shorting stocks.

Well, im between this would have gone significantly against me. Unfortunately, i don’t have so much time These days.

https://www.ft.com/content/cf8db3de-495f-11e8-8ee8-cae73aab7ccb

I would find it better that guy hold a hogg rather than a dog…

A quick explanation of the bump in the interest rate curve: The reason is a technical one and depends on your setup in Bloomberg (though the default often looks like yours). Traditionally yield curves are built using Libor/Euribor rates until 12 months and swap rates after that. But in reality this combines apples (deposit rates) and oranges (swap rates), because deposit rates incorporate credit risk and swap rates involve a collateral agreement (they are daily cash secured at the current market value). Before the financial crisis none of this really mattered much. Since 2007 it does. To get rid of the bump you’d have to include FRAs or futures in the curve construction (about 1-3 months up to 2 years maturity). Then the curve looks much smoother.

yes you are right. Swap rates are “unfunded”. Interestingly however the “Bump” currently sonly Shows in GBOP, not so much in EUR.

The GBP curve (S22) in your screenshot shows Libor rates up to 12M. The EUR curve (S45) shows Euribor rates only up to 6M. On Bloomberg page both curves seem to ignore their settings from , which correctly use FRAs/futures.

The GBP curve (S22) in your screenshot shows Libor rates up to 12M. The EUR curve (S45) shows Euribor rates only up to 6M. On Bloomberg CRVF page both curves seem to ignore their settings from SWDF, which correctly use FRAs/futures.

Sorry, the page names in the “greater-than” and “less-than”-signs were swallowed by WordPress.

The only time I’ve visited a bank branch in the last three years was to collect a passcode device for online banking (that was in the days before I could create a passcode using a smartphone app). Take a look at Avanza Bank or Fineco Bank.

Re Handelsbanken: They have some troubles coming their way too in my opinion due to the uniqueness of the swedish housing market system where the prices have risen dramatically mostly because of the ultra long loan periods provided by their banks (over 100 years).

Recently the max loan term permitted from the banks was cut to 105(!) years, before that the average term for new loans was reported at 140 years meaning their clients are essentially renting from the banks and this has enabled the housing prices to soar for decades.

I think this is frightening and unsustainable and i have sold my shares of SHB since,imo they are the best nordic bank by a distance with a great business model but the bubbly swedish housing market affects them all.