Gaztransport & Technigaz (GTT) – welcome back !!

Background:

Gaztransport & Technigaz is a company that I had looked at in early 2016 and most of what I have written back then still applies:

Imagine you could invest into a company with the following characteristics:

– Global market leader with 70-90% market share (95% new built)

– Net margins after tax of 50% or more

– business protected by patents

– almost no capital requirement, negative working capital

– a potentially huge growth opportunity

– conservative balance sheet (no debt) and “OK” management

Back then, I found the stock initially too expensive at EUR 34 per share, however I invested then at around 22 EUR but sold after a quick gain at around 31 EUR.

What did happen since then ?

Looking at the chart, I was clearly underestimating the value of the stock by a wide margin as the stock more than tripled until early 2021:

Back in 2016, I actually created a model of revenues and profits going forward assuming a strong cyclicality. Let’s check how my model compared vs. reality:

| MMI Model | Reality |

Reality vs. MMI model (x)

|

||||||||||

| 2019 | 2020 | 2021 | 2019 | 2020 | 2021 | 2019 | 2020 | 2021 | avg | |||

| Sales | 92 | 69 | 109 | 288 | 396 | 315 | 3.1 | 5.8 | 2.9 | 3.9 | ||

| Net Margin | 33% | 44% | 55% | 49.7% | 50.2% | 42.6% | ||||||

| Net Profit | 30.1 | 30.3 | 60 | 143 | 199 | 134 | 4.7 | 6.6 | 2.2 | 4.5 |

So for the years 2019, 2020 and 2021, sales were around 4x my predicted value and profits 4,5x higher than I modeled back then. A good reminder that predictions are always difficult and especially if they concern the future.

Russian Gas & Germany and the potential impacts

One does not need to be a genius to understand, that Germany (and other Eastern European countries) moving permanently from pipeline gas to LNG will create opportunity for GTT

And I do think that will happen independently from what will happen in the next few days or weeks in Ukraine. The big question is what kind of impact this will have on the LNG market and how will this impact GTT ?

Based on a McK report, in 2020, the global LNG market was around 360 mn tons p.a., thereof Europe accounted for around 85 mn tons p.a.

Europe currently imports 340 bn cubic metres of Gas, thereof 50% or 170 bn cubic metres from Russia. According to this site, the way to transform cubic metres into LNG tons is as follows:

1 billion cubic meters NG = .73 million metric tons LNG

So replacing 170 bn Cubic metres pipeline gas would translate into 124 mn tons LNG p.a. or an increase of the global required capacity by 1/3 on top of a projected doubling of the LNG market until 2040.

As GTT’s products are required for all stages of the value chain (Liquification, transport and regasification), this should have very positive impacts on future orders and future sales and profits.

As LNG carriers are still the main business for GTT, this could lead to significantly more orders for GTT. There seem to be around 600 LNG carriers available.GTT assumed that in the next 4 years, around 60 vessels would need to be replaced:

To be honest, I do not know how quickly LNG volumes could be ramped up, but I think it is pretty clear that another 200 vessels or so would be required to replace Russian gas in Europe plus a maybe a few dozens additional Liquefaction and Regasification installments.

If we compare this with GTT’s current outlook, we can see that this extra demand will hit an already quite bullish outlook especially from 2023 onwards:

Other developments

LNG for shipping

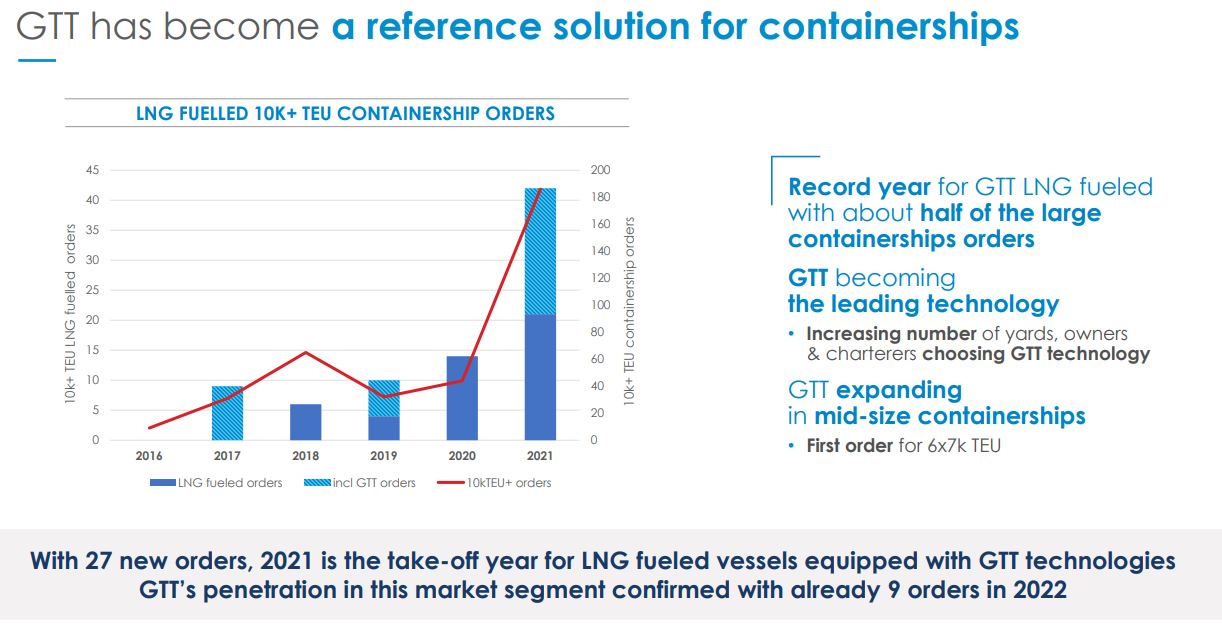

In 2016, the topic of LNG as shipping fuel was the “bird in the bush”. Looking at this chart from GTT’s investor presentations seems to indicate that this segment is taking off and GTT is able to play a significant role in that market as well:

Other business initiatives

I was surprised that GTT also created two additional business lines:

- Digital solutions for carbon efficient shipping

- PEM electrolyzers, where they acquired a french company

At this point, I would not put a big value on these initiatives but it shows that they may have regained some entrepreneurial spirit which is quite an achievement for such a monopoly player.

Current valuation:

GTT currently trades at 25x 2022 earnings and around 19,5x EV/EBIT. This is clearly not cheap. However to me it is quite obvious that there is a high probability of significant additional growth over the next 5-10 years.

The business is very capital light, order books are full (and getting even bigger) and they pay a decent dividend.

I abstain this time from doing a model and just assume that based on the current dividend yield of ~4%, an expected return of 14% (Dividend yield +10% growth p.a.) would be my base case for the next 3-5 years.

Therefore, as mentioned already in the comments, I allocated 3% portfolio weight into GTT at prices of 84 EUR/share on Monday and another 1% today, making it a 4% position.

However, GTT is clearly not a “forever” stock as Natural Gas/LNG will not have an indefinite life or at least not indefinite growth.

Summary:

Overall, GTT has performed a lot better than I thought in 2016. Although the stock is not as cheap any more as it was back then, I still think that it offers good return/risk at the current price considering the very likely “extra growth” from the forces transition of Europe to LNG from Russian gas.

On top, there seems to be further tailwind from the shipping industry as such and the new initiatives could add further upside.

There might be “spicier ways” to benefit from that move towards LNG, like LNG tanker plays, or Cheniere Energy, another stock had reviewed a few years ago, but I prefer GTT because I know the company, I understand the business model and think that it is a relatively “safe” play.

As Gaztransport reached my price target within 2 months, I started to take some profits by selling 1/10 of the initial position at 128 EUR.

Looks to me like that new orders are unavoidable:

https://www.ft.com/content/bc5f79a6-729e-47ff-bf46-cb23c460fa6f

with significant amounts of lng coming out of russia they will probably have significant exposure to russia too (topline / sanction risk), but I do understand your thesis – nice work

Russia currentl, has around 10% market share in the lng market. Not sure if and how many lng ships run under russian flags and if they use gtt technology.

Sure, GTT works together with Russian shipyards.

https://gtt.fr/news/gtt-and-zvezda-shipbuilding-complex-sign-cooperation-agreement-relating-membrane-containment

SO I guess some of those contracts are at risk. However, they might be replaced by others….

The “bear” case paradoxically is the regime imploding (which looks like the highest probability outcome), where Europe might want to take back Russian gas to help consolidate a new friendly regime.

What about next country series being on Polish stocks? They may get discounted more than the situation warrants, and it’s an interesting market in any case.

I could live with that “bear case” very well….however, even if Putin would be gone, Gernany will diversify its gas supplies. Polish stocks: no. Not my cup of tea.

Sorry to bear “bad” news, but that’s not how the lng market works. Russia could deliver gas to other countries, eg China. China in return would import less, which would be taken on by European countries. Not only does it take 7-10 years to build meaningful capacity, but best guess global capacity will not increase more than a couple percentage points.

And how exactly would they deliver the gas to China or other countries? Through new pipelines that materialize out of nowhere instantly ? Happy to learn more about this 😉

Not instantly, but they are there and more are coming.

https://intellinews.com/gazprom-starts-designing-20bn-gas-pipeline-to-china-183569/

Nice.

I looked at flex LNG (FLNG NO) for a short time some months ago, but dismissed it due to, in general historically, bad shipping industry

I love it when you compare your past predictions with the actual development. One has to do that in order to learn and see if one was on the wrong track. Just feeling right is not enough 😉

Thanks. Next time I multiply my estimates times four 😉

Cool find. It’s had a big run from the mid-60s to mid-80s so it feels like some of these prospects are already reflected. I suspect it will keep going up but I’m going to just put it on the watch list for now.

Thank you for the thoughts. Was wondering, if the sanctions shouldn’t impact their top line significantly? How cyclical was the business during the GFC?

Revenue halved in 2009 and then halved again in 2010 and then fell so more.

I did mention that it was cyclical if that is what you wanted to express. If LNG transporters stop ordering, sales go down pretty quickly with a time lag of 1-2 years.

That was why I initially only got to a fair value of 25 EUR/share. However over the last years there seems to have been a less cyclical development.