So this is part 2 of the post about Sistema, the Russian conglomerate, part 1 can be found here…

Sistema offers quite a lot of material for investors on their website, including some nice investor presentations, including a relatively recent one from November 2013. As with Koc Holdings, I found the material surprisingly good for a Russian conglomerate.

Some positive aspects (compared to other Russian companies):

+ clear financial targets in place (Cash flow to HoldCo, ROI above CoC)

+ focus on cash generation and shareholder return

+ compensation of management linked to share price development

+ clear split of corporate center financials esp. debt. Again, this is more transparent than for instance with the Belgian HoldCos I have been looking at

Interestingly they seem to follow a little bit the “Koc playbook” by teaming up with foreign companies and listing their subsidiaries. They do claim that the Sistema Holding company acts as a “private equity” investor, although some of their “Monetization strategies” (dividends) are not really private equity style. Also they can show some significant disposals, such as the Power Generation business last year or their insurance company in 2007, so “empire building” is clearly not their highest priority.

Major businesses:

Sistema has two major businesses which are both listed:

Bashneft, one of the larger Russian oil explorers and refiners active in Bashkortostan (west of the Ural, European part of Russia) & & the Arctic region.

MTS is a large Russian mobile phone company with more than 100 mn clients in Russia and neighbouring countries.

Bashneft is owned 75% by Sistema, MTS 53,4%. Now comes the interesting part: The value of the two stakes (MTS 5,5 bn EUR, Bashneft 5,4 bn EUR) is already significantly higher than Sistemas Market cap plus holding debt. With Holding debt of around 0.6 bn EUR, total Holding EV is 7,7 bn EUR vs 10,9 bn EUR market cap of those two holdings.

Their other participations include Rail cars, a toy retailer, a local power grid, a hospital chain, a retail bank, farmland,and finally a struggling Indian mobile operator. Most of the other stuff made losses at least in the first 6 months in 2013, but even if we attach zero value on that, Sistema trades at a significant discount to its sum of parts.

Most of the other businesses are relatively new, for instance the Rail car business has just been bought and combined in 2013. A very interesting subsidiary is the toy retailer Detsky Mir which seemed to have just more than doubled profits from 14,7 mn USD to 36 mn USD. This proves to a certain extent that they are able to grwo new bussinesses and create value. Assuming a 10X P/E multiple for a fast growing retailer, this would add another 250 mn EUR or so to the valuation. They initially planned to IPO Detsky Mir in March 2014, but I am not sure if they might postpone it for the time being.

The Bashneft acquisition in 2009

The EPS development of Sistema clearly correlates to a large extent with Bashneft and MTS plus any realized gains from disposals. If we look a the last couple of years, we can see that the overall increase in Sistema’s earnings per share correlates mostly with the significant increase in earnings at Bashneft. Bashneft has grown very quickly over the last years with a significant increase in output.

Much more interesting is the timing and the price paid. Sistema acquired the majority in Bashneft in March 2009 for 2,5 bn USD. Remember, this was the time when the Russian Index had lost 2/3 of his value within 15 months or so. In their 2009 annual report, one can clearly see that the transaction was a “bargain” purchase at around 50% of “tangible” book. If we look at Bashnefts financials, we can see that the timing was really good. According to the 2010 Bashneft presentation, Bashneft made around 420 mn USD profit in 2009, so Sistema was buying it around 6x P/E. Already a year later net income was around 1.4 bn, a nice 240% increase, and despite the rouble losses, Bashneft will again earn more than 1 bn USD in 2013. So clearly, this 2.5 bn USD investment has more than paid off for Sistema so far.

One interesting aspect about Bashneft: The reserve replacement ratio, which shows if an oil company is discovering more new oil than it takes out of the ground, is around 800-900% for Bashneft. To put this in perspective: Most major Oil companies have ratios slightly above 100%, BP’s for instance went down to 77% two years ago. So overall, Bashneft seems to be a pretty attractive asset for Sistema. Even Lukoil for instance, another big & cheap Russian oil company has a replacement ratio of only slightly above 100%.

Bashneft got the rights to 2 very promising oil fields in the region in 2010. According to this article, this might be part of a strategy not to allowing any Russian oil company becoming too big.

Although there are clearly risks as well. There seemed to be a rumour, that state controlled Rosneft was “interested” in Bashneft but this was denied by Sistema.

Bashneft itself last year paid significant divdends. The 220 rubles per share would be a dividend yield of more than 12% at current prices. This seems to be a confirmation of Sistema’s strategy to upstream cash into the holding. Unfortunately, Bashneft is only traded very illiquid outside Russia on the German stock exchange, with bid/ask spreads of around 10%. Otherwise, Bashneft would be a very interesting additional investment as well.

Rusneft transaction

Another example for a succesful “private Equity” style transaction ist a smaller Russian oil company, Rusneft. In 2010, Sistema bought 49% of the highly indebted company for 100 mn USD. 3 Years later in June 2013, Sistema sold the very same stake for 1,1 bn USD. An 11-bagger in three years, not that bad. One could consider this as a “proof of concept” regarding their private equity business model.

Comparison Sistema with Koc:

After investing in Koc Holding from Turkey, I think it makes sense to make a quick comparison:

Negatives:

– Sistema doesn’t have the same long-term track record as Koc (20 years against 3 generations)

– the Russian market is clearly even “more dangerous”

– Sistema is less diversified than Koc, mostly Oil and Telco

– until now no proof that they are a “value adding” HoldCo

Positives:

+ they do not have a political problem with the current local leadership

+ no fx issues (oil revenues are in USD anyway), only small exposure to financials

+ Sistema is much much cheaper, both compared to sum of parts and P/E etc.

+ from a true contrarian perspective, Russia is even more interesting than Turkey

+ they seem to be able to pull off really lucrative deals like Rusneft and Bashneft with “eye watering” ROIs

Is a Russian stock really “investible”

This is a big question for me. A couple of months ago, I wrote a post why I would not invest in Greek stocks (mistake !) or German-Chinese companies (score).

Honestly, a Russian stock is clearly in general much more a “speculation” than a German or French one. Compared to Italian stocks however, I am not so sure anymore, as the EMAK and ASTM example clearly showed that Corporate Governance for instance in Italy is not that much developed.

The two most relevant questions in my opinion are:

a) Are the managers fraudsters or thieves ?

b) Can someone else easily interfere and take away assets etc. ?

In the case of Sistema, I do not have the impression that management are explicit fraudsters or thieves. I have certainly no prove for that, but the effort they make with con-calls etc. indicates a certain interest in shareholders and a higher share price. Ron Sommer, the former CEO of Deutsche Telekom is actually the boss of the supervisory board of MTS. They never sold any new shares to the market since the IPO, so the motivation behind the German-Chinese frauds seems not to be relevant here.

The majority owner Vladimir Yevtushenkov is clearly a typical “Russian Oligarch” (but he looks like Bill Gates 😉

However, he seems to be among the more “moderate” Oligarchs, as for instance this NYT article describes.

Another factor “pro” Sisteam is the fact, that both major subsidiaries are listed as well with separate, audited statements which increases transparency a lot and makes it easier to validate the “sum of parts” valuation. On the other hand one could argue: Why don’t they pay higher dividends ? They do have a dividend policy, however they promise to pay out only a minimum of 10% of what they can stream up to the HoldCo. According to this research from Gazprombank, rising dividends can be expected, but still we are talking only about 4-5% if this turns out to be correct. Not much for a company in a country with interest rates above 10%. On the other hand, if they are able to to investments like Bashneft and Rosneft, it doesn’t make a lot of sense to pay out huge dividends but rather to reinvest the money in such “multi baggers”.

The second point is harder to answer. It looks like that Sistema is at least on neutral to good terms with Putin. In the case of the Indian Mobile subsidiary for instance, Putin put the problems of Sistema on the table when he visited India in 2012. From the NYT article linked above, I think this quote from Sistema’s owner is revealing:

And business can only prosper, he added, if the size of business is commensurate with the owner’s political influence. “We didn’t understand it” at first, he said. “Many businessmen grew their portfolios very fast but didn’t understand that one must invest time in connections, human relations, invest in human capital.”

Mr. Evtushenkov is not alone in operating along Western lines. One Russian billionaire who also did was Mikhail Khodorkovsky, the oil tycoon arrested in 2003 who has been in jail ever since.

As Mr. Evtushenkov told the Russian Web television station Dozhd recently, he knew Mr. Khodorkovsky when the latter was a young man and worked for him at a Moscow plastics factory. “He was terribly hyper, ambitious,” Mr. Evtushenkov said — and thus, he implied, forgot the rule about operating commensurate with political influence.

This sounds like a guy who knows how to maneuver (so far) within the harsh Russian political and business climate. So the risk should be a lot lower than for instance for Pharmstandard, but clearly, a dispute with government (see Rosneft/Bashneft) or a more powerful oligarch could change this real quickly.

Does Value Investing and investing in countries like Russia contradict each other ?

I want to make one thing clear here: This is no Warren BuffetT “great investment”. It is maybe an “above average” or even “quality” company in a really tough country.

On a pure stand-alone basis, there is clearly no Margin of Safety. As discussed above, certain things outside the perimeter of the company could happen which could impair the value of the stock severely. On the other hand, Value Investing is not only about Warren BuffetT style concentrated portfolio of great companies. There is another style with a more diversified “deep value” approach. I think Sistema clearly fits the “Deep Value” bucket. With this approach however it would be stupid to invest a large portion of the portfolio into a single company. The “Margin of Safety” in those cases comes from investing in a “Bucket” of extremely cheap companies where you can afford that 20-30% will actually turn out worthless, 50-60% are doing Ok and the remaining 10-30% will turn out spectacular.

Sistema in my opinion is a potential stock with a low weight for such a contrarian Emerging Market “bucket”. Yes, a lot of things can happen, but the stock is so cheap that if things turn out positive, the stock could easily tripple or quadruple.

I do have sometimes the impression that especially in the last few years the “BuffetT & Munger” approach is hailed as the ONLY way of value investing. But there are a lot of other succesful investors you had very similar track records with radically different approaches. Among them for instance were John Templeton and Mark Moebius. This ise an excerpt of the 16 investing rules from Sir John Templeton:

3. Remain flexible and open-minded about types of investment.

4. Buy low.

5. When buying stocks, search for bargains among quality stocks.

6. Buy value, not market trends or the economic outlook.

7. Diversify. In stocks and bonds, as in much else, there is safety in numbers.

This is quite different to “buy concentrated and only what you know best”. Just out of interest I have looked into the Templeton Emerging Markets funds. Mark Moebius only owns two Russian stock, Sberbank with a weight of around 3% (7th largest position) and Lukoil (2,7%). Interestingly, Mark Moebius even seems to have a blog with a recent comment to Ukraine. Personally, I would not invest in Sberbank as this could be one of the easier targets for sanctions.

Timing and other considerations

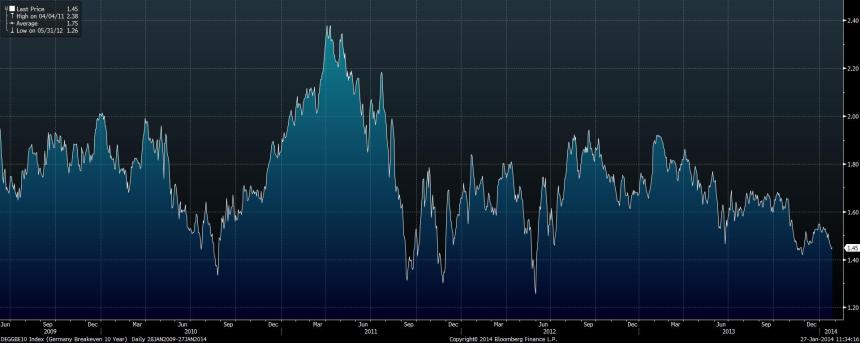

Looking at the 5 year chart one could think that Sistema would have a lot of space to fall further:

But one should not forget that from 2009 to current, Sistema turned a 2.5 bn USD investment in Bashneft into a stake currently worth 7,5 bn USD….Clearly the risk is real that I am much too early.

To give an example: In February 2010 I wrote in my home forum that Public Power Co., the Greek utility looked like a good risk/return situation at around 12 EUR per share (and a P/E of <5). I even said that it looks like that the stock is bottoming out. This is the stock chart:

Although the stock is now back at that level, the stock bottomed out -90% lower at around 1 EUR per share. Luckily I got out pretty soon before disaster struck, but this should be clearly reminder that it can always get worse.

Where is my “edge” ?

Cleary, I do not have any direct “edge” with regard to Russian stocks. I do not speak Russian, I have never been there and I have only access to published reports and research. I am as far from being an insider as one can possibly be. On the other hand, I do have one valuable advantage (as any private invetsor): I do not need to explain this to clients or bosses. I do not have to fear to loose my bonus or even my job if anything goes wrong. Ok, the readers of my blog might think of me as a gambler and my portfolio will suffer but that’s about it.

The biggest risk

A final remark on risk. I have gone through many of the risks related to a Russian stock and I am sure I obly scratched the surface. Nevertheless, I think the biggest risk is not an escalation in the Ukraine. This would be rather a buying opportunity. The biggest risk in my opinion is a hard landing in China. Russia is completely dependent on their natural resources exports. Lower prices for Oil, natural gas etc. will kill the investment case for Sistema. So this is to watch out for.

Summary and what to do

The main attraction of Sistema is clearly the valuation, comparably transparent reporting, professional management and (for a Russian company) shareholder oriented approach. The downside is, on the other hand, that Russia is dangerous for investors which explains the low valuations along the curent political turmoil.

Koc from Turkey is clearly the better company, but Sistema is only half as expensive. In building up my “basket”, I think Sistema has a place, although with a relatively small weight.

Additonally and most important to me, Sistema has shown in the past that they are able to pull of ridicoulusly succesfull deals in tough times as Bashneft and esp. Russneft have shown. So the possibility is high that Sistema again might be actually a winner from the current Russian crisis if they are able to close some more deals at “rock bottom” valuation levels.

The only thing which is really annoying to me is the fact that the spread between the GDRs and the Russian shares has now reached ~13%, a lot higher than a few weeks ago. Still, I am prepared to get my feet wet and will therefore invest into a 1% position for the portfolio as part of my “Emerging Market” basket along Ashmore and Koc holding. The low percentage reflects the (much) higher risk for Russia.