Looking at Berkshire’s portfolio is clealry a “must” for any value investor. Whenever they disclose a new stake it makes clearly a lot of sense to look at least briefly at what they are buying. Berkshire disclosed the John Deere position in late February this year. I assume this is a “Ted & Todd” stock. Looking at the track record of Berkshire’s public holdings, this is actually a good sign as Ted&Todd have beaten the “master” now several years in a row.

Looking quickly at Deere, it is not difficult to see some of the attractions:

+ relatively cheap (trailing P/E of 12,6, Stated EV/EBITDA of 5,5, EV EBIT 7)

+ organic growth, low Goodwill, good profitability in the past

+ good strategy /incentives in place

+ solid business model, significance of dealer network (quick repairs during harvest season…)

+ “Cannibal”, is massively buying back stocks

Especially the massive share buy backs are clearly a common theme for “Ted&Todd stocks”. Starting in 2014, Deer has reduced the sharecount constantly from around 495 mn shares to now ~344 mn shares.

However we can also see quickly a few “not so nice” things at Deere:

– pension /health liabilities (health – how to value ? 6bn uncovered. Very critical, healthcare sunk GM, not pension (EV multiples need to be adjusted for this)

– they do not cancel shares, held as “treasury”, why ?

– Financing business –> receivables & ROA most likely not “true”..

– lower sales but higher financing receivables ? Channel stuffing ?

– comprehensive income to net income volatility

– cyclical business. current profit margins still above historical average

Financing business

One of the most interesting aspects of John Deere is clearly the financing business. As other companies they offer financing, here mostly to dealers and not to the ultimate clients. A financing business is nothing else than an “in-house bank”, sharing much more characteristics with a financial than a corporate business, for instance requirement of continuous capital market access, default risk etc.

What I found especially interesting is the following: looking at Bloomberg, they already strip out automatically all the debt from the financing business when they show EV multiples. This could be OK if the debt is fully non-recourse however I am not so sure with Deere. Although they not explicitly guarantee the debt, there seems to be some “net worth maintenance” agreement in place which acts as a defacto guarantee for the debt.

An additional important point is the following: Deere shows very good profitability on capital in its “core” business. However, this is partly due to the fact that they show almost no receivables in the core segment. the receivables are indirectly shown in the financing business. To have the “true” ROIC or ROCE, one would need to add back several months of receivables to the core segment in my opinion.

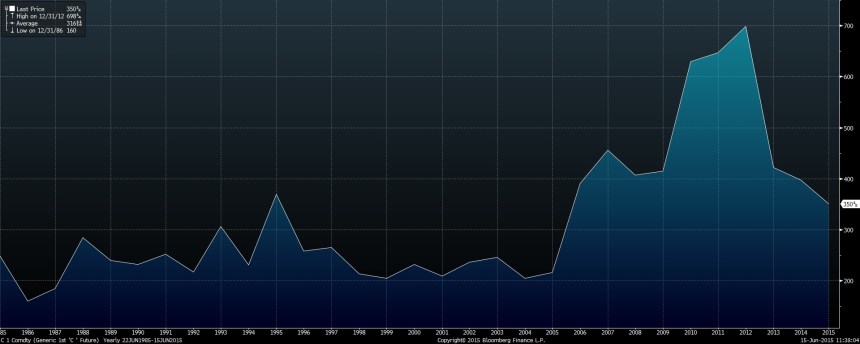

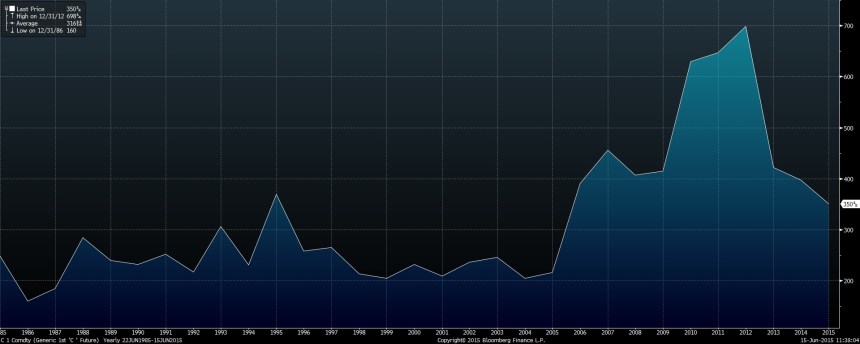

Cyclical aspect: Corn prices

This is a 35 year chart of annual corn prices:

We can clearly see that corn prices went up dramatically in around 2006 but are dropping since 2013 back to their historical levels. Demand for farm equipment is pretty easy to explain: If you make a lot of money on your harvest, you have money to spent for a new tractor (with a small time lag).

This is the 17 year history of Deere’s net margins:

|

Net margin |

| 31.12.1998 |

7,52% |

| 31.12.1999 |

2,08% |

| 29.12.2000 |

3,76% |

| 31.12.2001 |

-0,49% |

| 31.12.2002 |

2,32% |

| 31.12.2003 |

4,17% |

| 31.12.2004 |

7,04% |

| 30.12.2005 |

6,89% |

| 29.12.2006 |

7,82% |

| 31.12.2007 |

7,68% |

| 31.12.2008 |

7,32% |

| 31.12.2009 |

3,78% |

| 31.12.2010 |

7,17% |

| 30.12.2011 |

8,75% |

| 31.12.2012 |

8,48% |

| 31.12.2013 |

9,36% |

| 31.12.2014 |

8,77% |

|

|

|

|

| Avg total |

6,02% |

| Avg 2006-2014 |

7,68% |

| Avg. 1998-2005 |

4,16% |

So it is quite interesting to see, that in the 7 years before the “price explosion” of corn, margins were quite volatile and around 4,2% on average. In the last 9 years however, the average jumped to 7,7% with 2014 being still above that “high price period” average.

Clearly, Deere doesn’t only sell to corn farmers, but many other agricultural prices have faced similar declines.

To be honest: I do not know enough if Deer can maybe keep the high margins they are enjoying currently, but to me at least the risk of margin mean reversion is pretty high for such a cyclical business.

Even if we assume mean reversion only to the overall average of ~6%, this would mean around 6 USD profit per share which seems to be currently also the analyst consensus.

Summary:

For me, despite a lot of positive aspects, John Deere is not an attractive investment at the moment. Despite being well run, the business is cyclical and has profited from high crop prices in the past. The balance sheet is not as clean as I like it and the valuation is not that cheap if we factor in pensions and the financing arm. Clearly the stock looks relatively cheap to other US stocks but the risks are significant. Maybe there is more if one diggs deeper (network moats via dealers etc.) but for the time being I will look at other stuff. At an estimated 2015 P/E of 16-17, there are many opportunities which look relatively speaking more attractive and where I can maybe gain a better “informational advantage” than for such a widely researched stock.

Edit: By the way, if someone has a view on the moat / brand value of John Deere I would be highly interested……