Kabel Deutschland & Vodafone reloaded

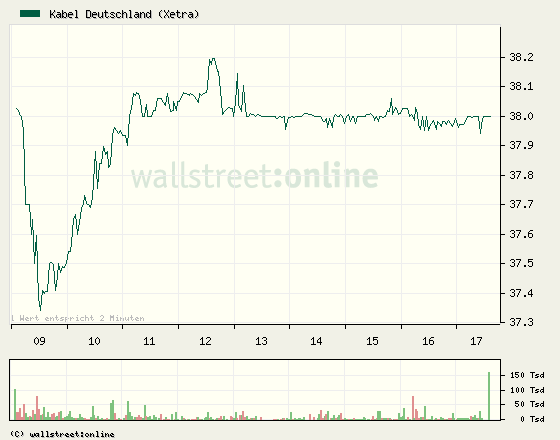

One of my two remaining short position gets “smoked” today. Kabel Deutschland is up ~7% to a new ATH:

The reason is once again the (now somehow confirmed) rumour that Vodafone wants again to take over KAbel Deutschland:

It started (again with the “rumour” as last time:

(Reuters) – Vodafone Group Plc has made an informal takeover bid within the past week for Germany’s biggest cable company, Kabel Deutschland Holding AG, Bloomberg reported, citing people with knowledge of the matter.

In the meantime, to my surprise, Vodafone confirmed the talks:

LONDON—Vodafone Group PLC said it has approached Germany’s biggest cable operator Kabel Deutschland Holding AG about a possible takeover, a move that would mark the U.K. mobile-phone company’s largest acquisition in Europe in more than a decade and add more customers to its triple-play offering of TV, mobile and broadband.

“There is no certainty that any offer will ultimately be made, nor as to the terms on which any such offer might be made,” Vodafone said in a brief statement Wednesday.

Kabel Deutschland confirmed it has received a preliminary approach from Vodafone, but also said there is no certainty an offer will be made.

So this is clearly against my expectations when I made the short. I have to admit that I don’t understand Vodafone. Why would they start such talks again with the danger of a leak again when the exact same thing happened a few months ago.

My only explanation is that they are either extremely desperate or extremely stupid. Or both.

Vodafone shareholders didn’t seem to be too enthusiastic either. So lets wait and see what happens. One first lesson is clear: Never underestimate the stupidity of others. Vodafone has done already one horrible overpriced German acquisition (Mannesmann) in the past. However, most likely most of those people who did this back then were already fired and now they make the same mistake again.

Clearly I also made a mistake here. It is definitely much more risky to short stocks with no majority shareholder in an industry which is famous for overpaying for M&A transactions.

EDIT: Real time comment for a quite “famous” Vodafone investor:

Vittorio Colao the urbane but seemingly incompetent CEO of Vodafone is the new Sir Fred Goodwin.