Home Capital Group (HCG) – Contrarian Opportunity in Canada after being rescued by Buffett ?

Background:

Home Capital Group is a Canadian bank/mortgage lending company founded in 1986 and run by the same CEO for 30 years, which came into the spotlight over the past few months. It ran into trouble, almost imploded and then got saved by no one other than Warren Buffett (and Ted Weschler).

There is good coverage following this link. The story in short:

Home Capital wanted to aggressively expand into insured mortgages. However at least one underwriter collaborated with mortgage brokers to get mortgages approved without proper documentation. At some point regulators reigned in but management did not tell shareholders about it. Then the regulator got tough and management had to go. In the meantime, short-term financing was pulled and the company got into real liquidity troubles.

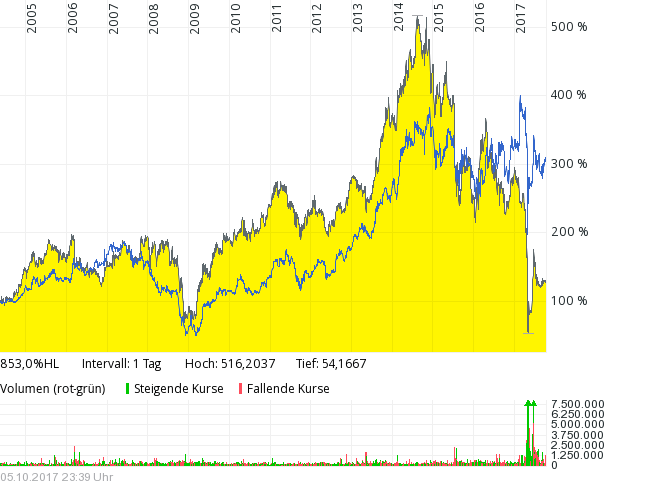

This is the graphical timeline of those events:

Home Capital Group was a popular target for short sellers before. John Hempton from Bronte was short as well as Marc Cohodes who followed “Big Short” Steve Eismann:

Marc Cohodes didn’t have a clue about the income fluffing. As a veteran short-seller he listens to the calls of other short sellers, and when famed short-seller Steve Eisman presented Home Capital as a “short idea” at a New York investor conference in the spring of 2013, Cohodes started paying attention.

According to one account, Eisman defined Home Capital to the crowd as the largest non-prime mortgage originator in Canada that could have serious problems “if housing rolls over.”

Buffett to the rescue

So it came clearly as a little surprise that no one other than Warren Buffett “bailed out” Home Capital Group in June 2017. The deal looked like this:

The brief on the deal:

Home Capital Group Inc (HCG.TO: Quote) said billionaire Warren Buffett’s Berkshire Hathaway Inc (BRKa.N: Quote) will provide a new C$2 billion ($1.50 billion) line of credit to its unit Home Trust Co, ending the Canadian lender’s strategic review process.

Berkshire will also indirectly buy C$400 million of Home Capital’s common shares in a private placement through its unit Columbia Insurance Co, Home Capital said on Wednesday.

So, through Colombia, an insurance subsidiary of Berkshire Hathaway, Buffett will be buying stock and also lending money. It’s the details of the deal that are particularly juicy:

Provided shareholders back the two-tranche deal, Berkshire will buy shares equivalent to about 38 per cent of the enlarged company at an average $10 a share — a 33 per cent discount to Wednesday’s closing price. Meanwhile, the credit line carries an interest rate of 9.5 per cent on outstanding balances, compared with 10 per cent currently, dropping to 9 per cent over time.

A bail out by Warren is clearly a big plus and it is clearly not by chance that Home Capital features this prominently on its homepage.

What happened since then ?

A lot of stuff happened since then at Home Capital. First, they were able to repay Warren’s credit line 4 weeks after they struck the deal.

Second, most of Home Capitals management now has been replaced. The founder of Home Capital, Gerald Soloway has been replaced by industry veteran Youssry Bissada.

And thirdly and quite surprisingly, Warren actually wasn’t able to invest the full 400 mn as shareholders rejected the second tranche of the bail out. It seems that one half of the equity injection was subject to shareholder approval and shareholders thought that Warren got his shares too cheap. The first tranche got executed at 9,55 CAD/share, the second tranche should have happened at 10,30 CAD, well below the then prevailing share price of around 13-14 CAD.

So for Buffett, with the credit line repaid and only a 200 mn CAD stake this looks like a really small fish investment. According to Bloomberg, Buffett did in principal anticipate this outcome:

Buffett indicated last month that a rejection by shareholders of his plan to take a larger stake in Home Capital would not be cause for him to walk away from the investment.

“We knew that could go either way,” he said on Bloomberg Television. “We’d like to buy the stock but if they vote it down, if the shareholders vote it down, we’ll be fine.”

Why did Buffett invest ?

The question is clearly: what did Buffett see in Home Capital Group ? It is known that the initiative came from Don Johnson. No, not the Miami Vice guy but a retired 82 year old Canadian banker who seems to have met Buffett some time ago and left an impression.

Interestingly enough, Buffett sent Ted Weschler to Canada to look at Home Capital:

Mr. Buffett “did some thinking on it” with one of his lieutenants, Ted Weschler, and on June 12, they made their move. They sent a formal, no conditions offer on June 13, and Mr. Weschler was dispatched to Toronto to discuss it. He reported back to Mr. Buffett that he was impressed with Home Capital’s directors

Buffett is also quoted to be bullish on Canada in general after meeting Justin Trudeau.

If we look at the short seller’s arguments, they boiled down to basically 2 arguments:

- there was fraudulent underwriting

- the Canadian real estate market is overheated and will need to correct at some point in time

In combination, the short sellers are sure that Home Capital will show huge losses, similar to the US players 10 years ago (Indymac, Countrywide etc.).

My take on this

I am not an expert on Canadian Real Estate and mortgages, but what I found interesting was the following:

First of all, even for the guys who have been fired due to missing information, there seem to have been no losses:

Elavia was one of the underwriters who left the company. A credit review cited in the KPMG report found that his mortgages had a lower error rate than those of the other high volume producers on the unit, and there has been no accusation of wrongdoing on his part. He later found a job with mortgage financing company MCAP Corp.

Also on an aggregated basis, the loan book itself looks still good or even better than last year:

Finally, the company’s mortgage book is actually doing quite well. Its non-performing loan ratio is only 0.23%, which is 10 basis points lower than a year prior. These loans, which are 90 days late, account for such a small percentage of the book that I’m not particularly concerned in the short-term.

So although the applications seem to have been “light on information”, it doesn’t look like outright fraud so far.

However maybe the most important difference to the US is that in Canada most mortgages are full-recourse mortgages. The big issues in the US came from the fact that especially in California, mortgages were non-recourse. So as an underwater borrower, you could just stop paying and send the keys to the bank (“jingle mail”) without paying anything more. In Canada (as in most European countries) you would need to get through a rather unpleasant personal bankruptcy.

Is there a real housing bubble in Canada ?

Just typing “Housing Bubble Canada” into Google gives billions of hits. The truth is: I have absolutely no idea. When commodity prices started to drop several years ago, I thought that Canada must get into trouble soon but similar to Australia, the economy seems to do quite well.

Also from a political side: Where will the bright and aspiring young people of the world go to ? So far the went to the US but I guess with Trump a lot of young people might think twice and go to Canada, where qualified immigrants are still welcome. But nevertheless, at the moment I have zero knowledge about the Canadian Housing market.

This is a comparison of the stock price with local competitor Equitable:

Equitable didn’t have any scandals but the stock hasn’t moved for the last 3 years and looks very cheap. So either investors are stupid (unlikely) or there is some real risk in the Canadian mortgage market.

Summary:

I think I can follow Buffett’s logic to invest to a certain extent: He seems to be relatively bullish on Canada and he judged the problems of Home Capital Group as a liquidity and reputation problem which he could heal with short-term money and his name. So far there doesn’t seem to be a fraud/underwriting problem and the issue that killed US banks (non-recourse loans) seems to be a much smaller problem in Canada.

However at this stage I would not feel comfortable with investing into the Canadian mortgage market as I know next to nothing about it. So I need to dig deeper. Competitor Equitable would be a logical next target for an analysis.

I used to do a lot of trading but now shifting more to value investing. Your blog looks great and I will check back here often. Keep up the good work!

The US short-selling guys fail to understand that Canadians are not as crazy in chasing the real estate market like they did back then.

Perhaps you should read the KPMG a report that describes just how bad the problems at HCG were/are.

Contact Cohodes directly if you can’t find it.

Then perhaps you may want to revise your opinion.

hmm, I am not aware of stating a stron opinion in my blog post ??

Click to access HCG-internal-fraud-report-KPMG.pdf

SO I read the report (Did you ?). There is no “smoking gun”. Not nice but also not a total disaster.

If you don’t see a problem there, then you have no understanding of consumer credit.

Your blog is normally good, so my advice would be stick to non-financials were you add a lot of value.

Thanks for the compliment on the good blog. And yes, I am clearly not an expert of consumer credit although Home Capital is clearly not Consumer Credit but Mortgage Lending which is VERY different from consumer credit. Which you know of course 😉

However I have read a lot of Audit Reports in my life and I have been audited myself quite often, so I think I can judge the tone and the content of financial audit reports to a certain extent.

So if you are the Financial super expert: Which stocks are the best in the financial sector ?

I think MMI knows more about financials than we commentators all together. Especially what things to consider critically and how to conservatively evaluate the business from a long term perspective.

Any possibility to get your email, so I can respond directly ( you can then maybe summarise anything that you think is worthwhile here later).

“Those who will seek me will find me” Hint: Try “contact & disclaimer” as a starter.

Perhaps you should read the KPMG a report that describes just how bad the problems at HCG were/are.

Contact Cohodes directly if you can’t find it.

Then perhaps you may want to revise your opinion.

https://www.institutionalinvestor.com/article/b1579dbtsg1bbq/warren-buffetts-mosquito

Entertaining!

Great read. If you’re looking at distressed Canadian lenders, Callidus Capital (TSE:CBL) might also be worth a look – but definitely at the “fruity” end of the lending spectrum!

In reality, investors are pretty stupid.

Thanks for the insult!

The reality is often very stupid itself. Hence, how would you label those who think they can predict the future reality ?