Siemens Energy AG Spin-OFF – ANother Interesting Member of the “Ugly duckling Spin-off Family” ?

Disclaimer: This is not investment advice !!! PLEASE DO YOUR OWN RESEARCH.

At first a big “health warning”: My track record with Spin-offs is awful although I dedicated significant efforts into this area. Over the last years, I missed out on several good ones (Uniper, Trisura, Osram) and I unfortunately invested in a few bad ones (Cars.com, Metro). My best spin-off investment so far was Italgas.

Siemens Spin-off history

Siemens itself is an interesting case, as under (soon to be former) CEO Joe Kaeser, and even before, they are one of the few German companies that use spin-offs more or less frequently. Over the years, Siemens has spun off for instance Quimonda (bankrupt), Infineon (has recovered quite well), Osram (taken over by AMS) and Siemens-Gamesa (very volatile but strong performance lately). Overall I would say that on average the Siemens Spin-offs did very well despite being mostly “ugly ducks” at the time of spinning off. Siemens Healthineers in comparison was not an ugly duck (despite the stupid name) and that’s why they actually IPOed it.

Siemens Energy AG Spin-off

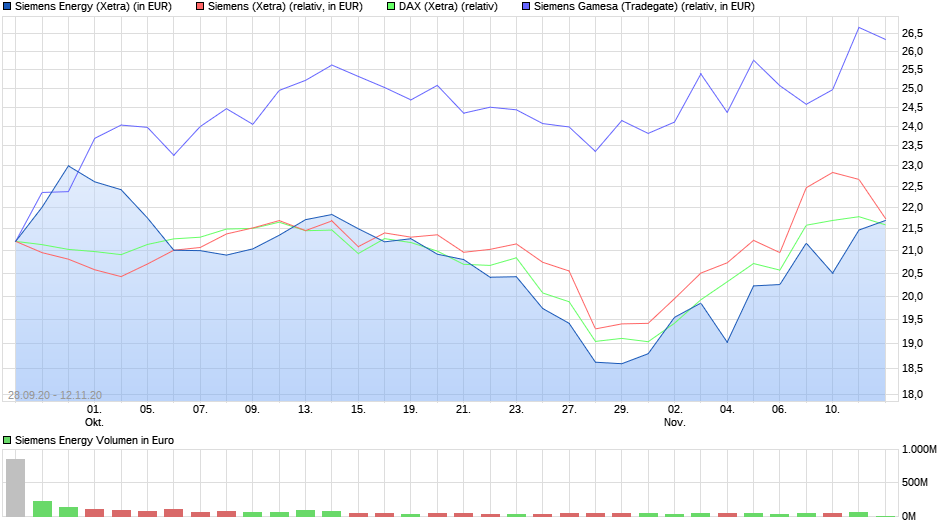

This is the latest spin-off from Siemens, spun-off on September 28th with a first price of around 22 EUR, a lot lower than initially expected. As we can see in the chart, the shares dropped at first but now recovered to the initial level in line with Siemens AG and the DAX:

So what exactly is Siemens Energy ?

The new company consists of:

- the traditional Power & Gas business that among other things builds and maintains Gas Turbines (as well as legacy coal power plants) but is also active in building power transmission facilities and industrial power applications

- the 67% stake in the listed Siemens-Gamesa subsidiary

- a 25% stake in Siemens India

- around 2.4 bn cash

- around 1 bn pension liabilities

The company just released 2019/2020 results (FY as Siemens ends on September 2020). The reason why Siemens wanted to spin-off Siemens Energy so badly is clearly the fact that Siemens Energy reported a loss of ~2 bn EUR which, thanks to the spin-off Siemens now doesn’t have to show fully in their accounts. interestingly, Siemens Gamesa contributed significantly to the loss.

Sum of parts

At the time of writing, using the public listed stakes plus cash minus pension we get to the following result:

|

Sum of parts ex Legacy business

|

||

| 67% of Siemens Gamesa | 12,874.02 | |

| 25% of Siemens India | 1,420.07 | |

| Net cash 30.9. | 2,366.00 | |

| Pension liability | -1,057.00 | |

| Sum: | 15,603.09 | |

| Per share | 21.47 |

So these stakes cover almost all of Siemens Energy’s current market cap and the legacy business is “for free”. The next question of course is: What is the value of the legacy business ?

Using the outlook given in the investor presentation, I would come up with the following potential valuation in 3 years time:

| Legacy business | ||

| 2020 sales | 18.100 | |

|

3 year EBITA margin target (midpoint)

|

7% | |

| Tax rate | 30% | |

|

Net income margin est. 3 years (midpoint):

|

5% | |

|

2023 estimated net income (sales flat)

|

886.9 | |

| Value at 10x PE | 8,869.00 | |

| Value at 15x PE | 13,303.50 | |

| mid point | 11,086.25 | |

| mid point valuation per share | 15.26 |

So using their own projections own projections, the legacy business at a P/E of 12,5 would add another 15,26 EUR per share in value in 2023.

Aggregating these two building blocks, we get to the following total sum of parts value:

| Total sum of parts 2023: | ||

|

Gamesa, india, net cash pension:

|

15,603.09 | |

| Legacy business | 11,086.25 | |

| Total sum of parts 2023: | 26,689.34 | |

| Per share | 36.73 | |

| Upside | 65.82% |

So based at a share price of currently 22,15 ER/per share, I would expect a potential upside of ~66% within 3 years which I think is a very attractive discount.

Additional considerations:

Decarbonization – Hype or long term mega trend

We are currently clearly seeing a big hype in anything related to renewable energy and other decarbonization efforts (Hydrogen, Carbon Capture etc.). We all know that we have seen this already once and the hype quickly died away. The question is: Is it different this time ? Personally I do think that there is a high probability that we are indeed at the first step of a very long lasting and deep transformation of the energy sector. Solar (in the right location) is now the cheapest source of energy and wind becomes more competitive every day. Siemens Energy has clearly exposure to the legacy but I think especially Gas Turbines are needed for quite some time and via Gamesa they will benefit form a potentially big push into wind. Of course there will be potentially big up and downs along the way.

I think as a bonus one gets also a leading player in large scale hydrogen generation which over the long term could be the most interesting part of the legacy business

Why is Siemens Energy cheap ?

CEO vanity

Joe Kaeser, the long term CEO and life log “Siemensianer” will retire latest after the AGM in February 2021. As with many long term CEOs before him, he wants to go out “at the top” with the core Siemens showing a great ste of numbers. That’s in my opinion one of the reasons why Siemens “pushed out” Siemens Energy two days before the end of their fiscal years in order de-consolidate the loss making subs for Joe Kaeser’s last AGM. It sounds silly, but I have seen this several times already.

Another point is that Joe Kaeser became Chair of the supervisory board of Siemens Energy right away and will stay so after retiring at Siemens. For the Siemens AG supervisory board itself, he would have required a 2 year cool off period. So maybe he wanted to make sure that he has an interesting job after retirement. I would however not consider his as only negative. Kaeser was a decent CEO at Siemens, taking shareholder interests into account and has many important global contacts that could help the company.

It’s a difficult stock for the growing herd of ESG investors

ESG investing is BIG right now and in my opinion will be in the future. Siemens Energy however is a difficult case: One the one hand you have the 67% stake in Gamesa, a potentially very interesting play on wind plus you have their Hydrogen capabilities. If you would “SPAC their hydrogen business”, one could easily dream of a 5-10 bn valuation in the current environment.

However they also said that they will still service their existing coal plant portfolio which is a big issue for many “Pure play” ESG investors which have a “no coal” policy. I think this also explains the much better performance of Gamesa since spin-off. However I think at some point in the future, they could solve this issue by selling or spinning out the coal division or transform it into a “decarbonization” play somehow.

Turbine businesses in general have a bad reputation & Goodwill

For decades, the typical turbine businesses with large upfront capital requirements but long term recurring revenues via maintenance contracts have been considered as super attractive. However sicne the problems at GE, Rolls Royce and others, investors have detected that a lot of past profits were just on paper as these companies “adjusted” the long term expectations to consistently show profits whereas the underlying economics significantly deteriorated. There is clearly a risk that we see some more write downs at Siemens Energy. With around 9,4 bn Goodwill and another 3.9 bn of Intangible assets, the balance sheet contains a lot of “soft” assets, however luckily, Siemens spun them off with no debt which mitigates most of that risk as long as cash flows remain OK.

Stock “Overhang” from Siemens AG

In the first step, Siemens only spun off ~55% of the shares. 10% were transferred into a Siemens Pension Trust where in doubt, Siemens still has some control. Unfortunately they announced that they want to sell down more share going forward within the “next 12-18 months”. This clearly creates a structural “stock overhang”.

Potential catalysts

Apart from an operational improvement especially for the Legacy business, I could imagine the folowing “soft” catalysts:

- With ~10 bn free float, Siemens Energy could be a potential DAX candidate especially if the DAX gets expanded to 40 stocks

- further portfolio management (i.e. spinning off out coal and or hydrogen). With Kaeser being Chairman, I think further spin-offs could always be on the table

- Similar to Uniper (Fortum), another big player could start building a position. A few years ago, Chinese companies would have been the natural candidates, but these days not so much. But maybe the Japanese ?

Pros/Cons Investment case

+ attractive upside

+ high portion of listed parts makes tracking easier

+ several identifiable reasons why undervaluation exist

+ long term attractive business dynamics (Energy transformation)

+ good competitive position in underlying businesses (#1 global offshore wind trubine company etc.)

+ relatively solid financials (net cash)

– potential underlying volatility

– high intangible position subject to impairment risk

– continuing influence from Siemens (stock overhang etc.)

– part of the legacy business could simply disappear

– ugly duck spin-off often need some time before they shine and the share overhang doesn’t help

Summary:

At a first glance, the stock looks like a pretty ugly duck: Gas turbines, coal plant maintenance a a 2 bn ER loss published just weeks after the spin-off paint a pretty bad picture. The Balance sheet contains ~13 bn of intangibles and Siemens clearly wanted to get rid off them despite burdening the stock with a significant “stock overhang”.

A friend of mine already mentioned that the “Union of Ugly Ducks” might want to distance themselves from this one.

At a second glance however, I do think that there is an interesting mid- to long term opportunity as described above and a sum of part analyses shows a clear upside.

Therefore I allocated ~3% of the portfolio into Siemens Energy at around 22 EUR/share as a Spin-off special situation. My target would be a +50% to +60% total return over the next 3 years.

they have not been doing good lately, worth a new look imo! together with this whole sector (the bubble effect seems to be over)

Siemens Holding was smart to get rid those ugly value destroyers.

As mentioned in the JustEat post, I reduced the position by 0,5% in a first step when establishing the JET position.

Today I further decreased the position by 1% to finance the increase in the JET position. In total, I have sold now 1/3 of the initial position at around 33 EUR/share at a profit of +50%.

Ich denke der Zeitraum von Deinem Target sollte von “years” umgeändert werden in “months” 🙂

Glückwunsch

“My target would be a +50% to +60% total return over the next 3 years.”

he he he, ja, im aktuellen Markt werden Kursziele schnell erreicht wenn die Aktie “heiss” ist….

Was macht man dann in so einem Umfeld ?

Behalten , verkaufen oder die Welle mitschwimmen?

Schwierige Entscheidung denke ich.

Nach meinem “Modell” ist immer noch 30% Upside da die Gamesa Aktien stark gestiegen sind. Ich müsste mir Gamesa mal genauer anschauen…

Following your blog for a few months now, many thanks for the great work!

Went through your considerations regarding Siemens Energy today. I have only one problem concerning the liabilities connected with the legacy business.

Siemens Energy reports liabilities of EUR 27.6 bn.

Siemens Gamesa reports liabilities of EUR 11.4 bn,

i.e. 67% = EUR 7.6 bn of that liabilities should be shown in Siemens Energy on a consolidated basis.

Liabilities of EUR 0.2 bn can be connected with Siemens India (25% stake)

Here is now my problem, 27.6bn – 7.6bn – 0.2bn = EUR 19.8 bn liabilities that must be mainly connected with the legacy business.

If I am right the legacy business is highly indebted. Although the market value paid for the legacy business is quite small, the enterprise value = market value + liabilities is quite significant; i estimate the enterprise value ~ EUR 23 bn

If we assume an EBITA ~ EUR 1.3 bn, I get an EV/EBITA multiple of around 17 in current valuation (based on your profit estimations). A Multiple of 17 doesn’t sound that great, consequently, i would see the company fairly priced, maybe even slightly overvalued.

Maybe I am missing something in my considerations, would be great to hear your feedback on my thoughts!

Not sure if I can follow your calculations and what you consider as EV.

First, as Siemens Energy fully consolidates Siemens Gamesa, you will find 100% of these liabiilities in Siemens Energy’ balance sheet.

Second, not any liability should be included into an EV calculation. if you search the blog you’ll find an article from a few years ago outlining how to calculate a meaningful EV.

Siemens Energy liabilities are mostly what one would put under “woking capital” and not add to EV.

Please don’t get me wrong, but my recommendation to you would be to learn a little bit more on accounting principles and calculation of EV.

MMI

Thanks for your feedback and on your hint, I see that i missed a couple of points here, will have to invest some time on this 🙂

For the record, Siemens-Gamesa Press release for 2019/2020. Sound pretty upceat to me:

https://www.siemensgamesa.com/newsroom/2020/11/201105-siemens-gamesa-press-release-results-presentation-q4-fy2020

For illustration: Borrell, one of the capos of Spanish mafia, was in the Board of Abengoa just before the company went bust. And did illegal stocks trading. To add insult to injury, EU nominated this capo to the post of EU Foreign Affairs. Spaniards peeing on all EU citizens, and tell the it is rain.

https://www.politico.eu/article/borrell-forced-to-resign-over-energy-interests/

Well, some foreign investors might think the same about Germany after Wirecard. Perosnally, I have similar issues with Greece and China, but for me Spain so far is OK.

You should then at least concede you know little and only superficially about Spain… (….and much worse, you don’t want to know!)

You got me. I actually know very little of anything. I have looked at some Spanish companies (search function). The point i wanted to make is: the deeper you Look into things the more bad things you discover. The german stock market for instance comprises a significant number of fraudulent companies and actors. The same most likely applies to any other stock market. So far however there is no indication that siemens-gamesa is fraudulent. If you have some facts on siemens-gamesa, i am happy to check them out.

Unsurprisingly, spanish (sick) influence strikes again. Now in SiemensEnergy exGamesa.

Appologies for being spot on, concerning worst in class standards from that country

Shouldn’t make too much difference to your conclusions but exit multiples 3 years ahead should be discounted back to present value..

Well, you can either discount to today or calculate expected returns forward towards the “exit multiple”.

For the legacy business, what’s the difference if you discount the 3 years forward multiple valuation to present value?

I would discount it with maybe 8-10% p.a. But then you should add any free F going forward to the expected return.

From my point of view, one would need to assess the value of Siemens-Gamesa, isn’t it?

For the value of Siemens Energy depends vastly on the value of Siemens-Gamesa. Should I really trust in the fair market value of the latter? I doubt so. Just the stock price tells me that it is not a contrarian investment, but also the price-to-everything.

Nevertheless, it is an interesting observation that you made.

Well, a market value is a market value. However, my underlying assumption is that we will see a long term, massive build up of offshore Wind capacity and Siemens Gamesa is in a very good position to benefit from this.

If one doesn’t believe in Siemens Gamesa, on could hedge the value with a corresponding short position to bet only on the legacy valuation

I’ve had my share of duds here.

On Thu, Nov 12, 2020 at 12:52 PM value and opportunity wrote:

> memyselfandi007 posted: ” Disclaimer: This is not investment advice !!! > PLEASE DO YOUR OWN RESEARCH. At first a big “health warning”: My track > record with Spin-offs is awful although I dedicated significant efforts > into this area. Over the last years, I missed out on several goo” >

I will never touch any (i)Spain-related stock even with a 10 m pole. Business in that corrupt country of cronies can’t proper. Is like making a deal with the mafia* and expecting to be on the winning side. Basically Spain is all about mafia.

KRLS, from your nick I deduct you are a Catalan Independentist. I´ve seen you quite often commenting on this incredible blog, with the sole purpose of talking sh*t about Spain with usually no context. I know you probably hate Spain, but your life has to be a bit sad If you are on a friday night spreading hate to Spain in a german blog. Let us enjoy the content and go to twitter for that purpose.

Sorry for the rambling, but as a great fan of the blog I got a bit tired of this. Keep it up with the good work, you´ve built one of the best European investing blogs.

Nice nick name 😉