All Swiss Shares Part 15 – Nr. 141-150

Moving forward with another 10 almost randomly selected Swiss stocks. This time, only one stock looked interesting but in that case so interesting that I initiated a 1% starter position.

141. ASMALLWORLD AG

ASMALLWORLD is a 36.4 mn CHF market cap company that was IPOed in 2018 at 9,75 CHF per share, climbed to over 20 CHF and then dropped big time even pre Covid. According to their web site their are some sort of travel community, whatever that means. Life is too short and there is a big world full of more interesting stocks. “Pass”.

142. Schaffner AG

Schaffner is a 176 mn CHF small cap that seems to be active as a specialist automobile supplier and produces components for electrical systems. A third division active in “Power Magnetics” was just sold to Swedish AQ Group, a company that I covered several years ago.

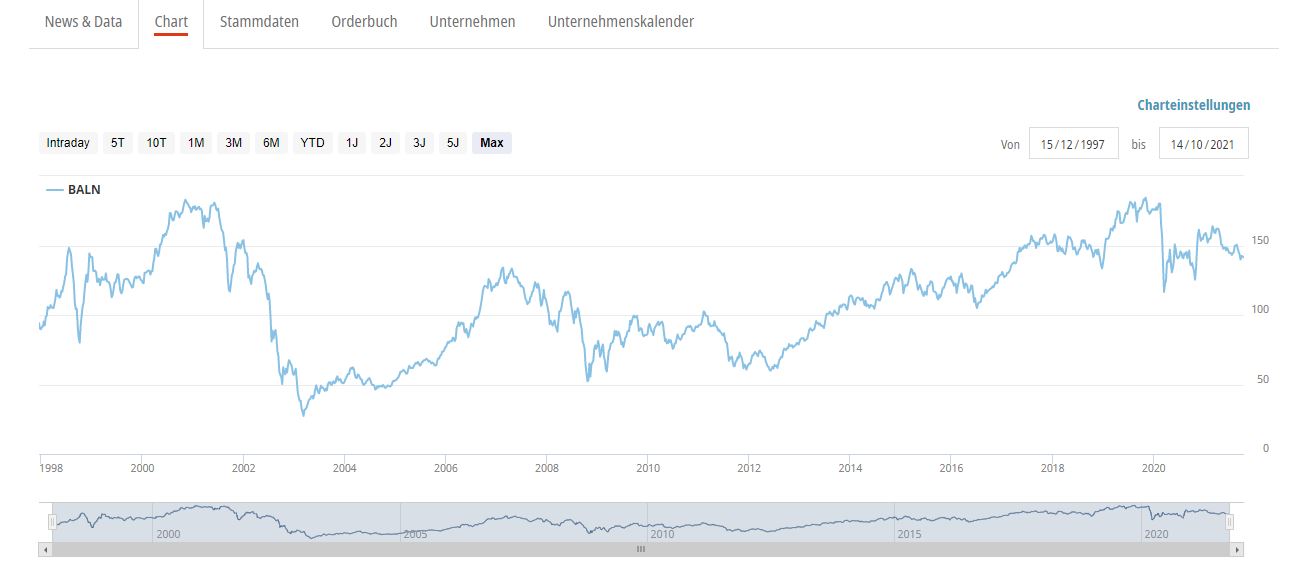

Schaffner’s share price looks extremely uninspiring:

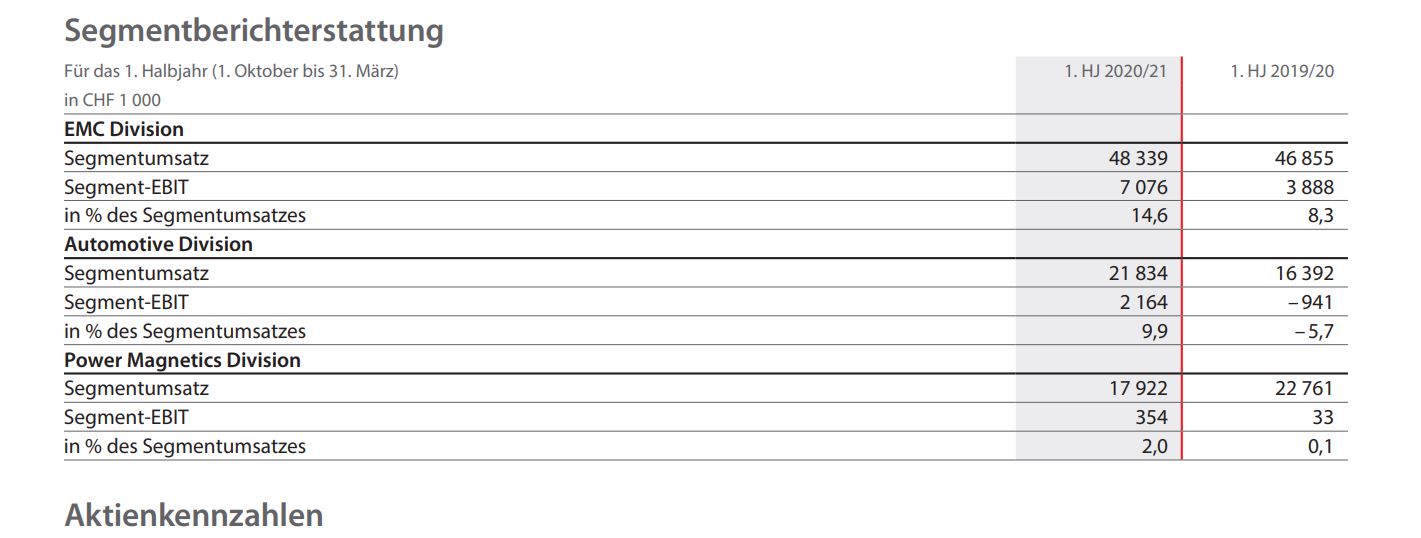

However I do like the combination of a pretty bad business that got sold (The magnetics division shrank by -18% in the first 6M of 2020/2021) and two rather attractive ones with good growth and good profitability.

This screenshot from the 6M report shows how different the segments are and how different Schaffner might look after the sale:

Just doubling the 6M numbers would give us 14 mn EBIT (ex HoldCo) and including the sales Price an EV/EBIT of a round 12x for a double digit EBIT margin business that seems to grow.

The main product, EMV filters in my understanding is a very important component to shield electronic circuits from high voltage electricity. To my understanding, this should be in high demand if my electrification scenario realizes.

This looks really interesting, therefore “watch” and I even added a 1% position into my Electrification basket.

142. Mobimo Holding AG

Mobimo is a 2,1 bn CHF market cap real estate company. The both, own and rent out real estate as well as develop new projects. The portfolio is a mix of commercial and residential real estate in Switzerland. As with all the real estate companies before, I’ll happily “pass”.

143. Edisun Power Europe AG

Edisun is a 133 mn CHF market cap solar company that owns solar park across Europe. During my German Stock series I didn’t really look at renewable companies, but my approach has changed. The company had been IPOed in 2008 and as one can se in the chart, IPO buyers were unhappy for a long time:

Half year results were very good as they ramped up a Solar plant in Portugal. “Watch”.

144. Landis & Gyr

Landis & Gyr is a 1,73 bn CHF company that offers “Energy management” solutions which are mostly meters. I have looked at the company back in early 2018 when the company was spun-off via IPO from Hitachis in what I thought was a distressed situation.

My final conclusion back then was as follows:

So all in all, Landis & Gyr for the time being doesn’t look like a very attractive investment and Toshiba seemed to have gotten a quite good price despite their distressed situation.

Looking at the chart, the assessment back then seems to have been spot on:

Growth has been very disappointing and Covid 19 led to a big loss for the company, also the years 2018 and 2019 were not that great. Overall this doesn’t seem like a great business. “Pass”.

145. Evolva Holding AG

Evolva is a 3 mn CHF market cap Nanocap that is active in Biotech and is burning money like crazy. “Pass”.

146. Polyphor AG

Polyphor is a 22 mn CHF market cap Biotech company that was IPOed in 2018 and went downhill since then.

From a quick glance into a Swiss forum, the main issue seems to have been that their best candidate had shown severe side effects (Kidney failures) and has been burning money like crazy since then. “Pass”.

147. Swatch AG

Swatch AG is one of the leading Swiss watchmakers with a market cap of 12,9 bn CHF. Long term readers of the blog might remember that I covered Swatch in a two part mini series almost 6 Years ago (Part 1, Part 2) plus a book review.

Back then, at a level of around 370 CHF, I was not that much interested in the stock:

I think the key issue for me is that for the moment, there are clear risks to parts of the business which in my opinion are not fully reflected in the price of the shares. If the shares become cheaper, maybe because of a bad 2015 Christmas season, then of course it could become more interesting. Other than Fossil, I don’t think that Swatch has an existential problem as I believe that expensive Swiss watches are here to stay.

For me, the stock would be interesting at a level of 300 CHF, roughly 20% lower where it is today.

Looking at the chart, this was a good decision to stay away:

Comparing it to Richemont, it is interesting to see that Richemont, into which I invested last year started to outperform Swatch already before Covid-19:

Looking at the latest 6M report, it is interesting to see that Swatch sales have recovered from 2020, but net margins are only around 50% of what they had achieved when I looked at them 6 years ago.

Just doubling 6M numbers, the PE of Swatch would be around 24x or an EV/EBIT of 14x. Not extremely expensive but also not really cheap. Overall, Richemont seems to have the better business model, mainly driven by its “mega brand” Cartier to which Swatch doesn’t have anything comparable. “Pass” (again).

148. Fundementa Real Estate AG

Fundamenta is a 594 mn CHF market cap real estate company that mainly holds residential real estate focusing on the German Speaking part of Switzerland. “Pass”.

149. Baloise AG

Baloise AG is a 6,5 bn CHF market cap Insurance company that is active mainly in Switzerland but also Germany, Luxemburg and Belgium. As many similar insurance companies, the share price shows that the industry has been struggling, mostly due to ever decreasing interest rates:

Baloise trades slightly below book value and returns are relatively OK. 6M results were very good, however as with all insurers having a signifcant life insurance business, results are not easy to understand.

All in all I am not convinced that Baloise will be able to generate a lot of value going forward, therefore I’ll “pass”.

150. V-ZUG Holding AG

V-Zug is a 830 mn CHF market cap company that produces household appliances. The company is a spin-off from Metall-Zug (which I owned a very long time ago) and listed in 2020. The stock performed quite well after the spin-off and is clearly one of the better spin-offs in the last few years.

The 6M numbers look great, with 12% EBIT margin and decent growth yoy. With ~5 CHF EPS for the first 6 months, the stock doesn’t look that expensive either (PE 13 if one just doubles the 6M numbers).

Long term, growth expectations are lower as this snip shows from the 6M presentation:

The company mostly sells in Switzerland but tries to also go more international. To be honest, I do not fully understand how they can be so profitable as an appliance maker. Overall this is not really my area of expertise, therefore I’ll “pass”.

Pingback: Schaffner Team AG (ISIN CH0009062099) – Is that this “Meier & Tobler 2.0” ? - Future Wealth Investors

I#Ll put it here: very interesting Investor Day presentation from Schaffner.

Very good numbers from Schaffner (again). Maybe I am overoptimistic here, but I added to (almost) a half position.

https://www.dgap.de/dgap/News/adhoc/realigned-schaffner-significantly-improves-profitability/?newsID=1491770

Good news from Schaffner

https://www.dgap.de/dgap/News/adhocall/schaffner-gruppe-erwartet-deutliche-profitabilitaetsverbesserung/?companyID=387214&newsID=1484458

I have added 1% to make it a 2% position

Thank you for the explanation !!!

Wow, thanks for the great update. Short comment to EMC/EMV filters: They are not used to shield electronic circuits from ‚overvoltage‘ but these are used to shield high frequencies superimposed on the actual voltage. Interference or unwanted switching operations can be triggered there. It is quite triky to remove such superimposed frequencies without much power loss and without triggering new disturbances due to the installed filters.