Compagnie Du Bois Sauvage (BE0005576476])- See’s Candy in a Belgian wrapper ?

While researching Ackermans & Van Haaren, I stumbled over another smaller diversified Belgian holding company called Compagnie Du Bois Sauvage (CBS).

The company doesn’t look too exciting with the following “standard” metrics:

P/B 0.92

P/E 16.6 (mostly meaningless for Holdcos)

Div. Yield 3.3%

Market Cap 340 mn EUR

The company presents itself as a holding company, active in Real estate and strategic participation plus a so-called “treasury” division.

The strange name of the company (wild forest) is explained on the website as well as the origins.

However it is much more interesting what they are doing now, especially the strategic holdings. The company divides the participations into the following pillars:

-financial

-industrial

-food

-other

Financial:

This segment consists only out of 2 investments:

1) A 26.41 stake in a tiny Belgian Credit insurance company and

2) much more interesting a 12% stake in one of Germany’s oldest and most succesful private banks, Berenberg .

According to the CBS report, Berenberg has around 300 mn EUR equity and earned on average around 20% return on equity over the last 3 years, which is very very good. They seemed to have bought the stake in 2002 from an US shareholder.

I tried to reconcile the numbers in CBS annual report with the official annual report of Berenberg but it did not match. I think Berenberg reports only their bank, not the complete Group

Nevertheless a very interesting and high quality asset

Industrial

CBS discloses the following stakes:

– a 1.56% stake in listed Belgian metal group Umicore

– a 29% stake in listed Belgian automotive supplier Recticel

– 29% in an unlisted US plastics company called Noel

Nothing special here, very diversified but in my opinion without a clear focus or strategy.

Food – Neuhaus Chocolate & Pralines

This is in my opinion the “highlight” . The main company in this segment is Neuhaus, a famous Belgian chocolate manufacturer where CBS owns 100% of the company . According to Wikpedia, Neuhaus has actually invented the “praliné” as we know it.

Neuhaus was actually a separate listed company until 2006 and then taken private by CBS.

Out of curiosity, I did not follow my normal “Armchair investing” approach but did some real research. Neuhaus positions itself at the very high end of Chocolate and praline manufacturers. When i went into one of the biggest downtown department store in Munich, i was surprised that they actually charge 5 EUR for a 100 g chocolate bar and up to 75 EUR for a 1 Kilo representative praline selection. I bought myself a 250 gram pack for 17 EUR which looked like this:

I am not an expert chocolate, but someone else is, Warren Buffet. That is what he said about See’s Candy: (from 1998):

It is a good business. Think about it a little. Most people do not buy boxed chocolate to consume themselves, they buy them as gifts— somebody’s birthday or more likely it is a holiday. Valentine’s Day is the single biggest day of the year. Christmas is the biggest season by far. Women buy for Christmas and they plan ahead and buy over a two or three week period. Men buy on Valentine’s Day. They are driving home; we run ads on the Radio. Guilt, guilt, guilt—guys are veering off the highway right and left. They won’t dare go home without a box of Chocolates by the time we get through with them on our radio ads. So that Valentine’s Day is the biggest day.

Can you imagine going home on Valentine’s Day—our See’s Candy is now $11 a pound thanks to my brilliance. And let’s say there is candy available at $6 a pound. Do you really want to walk in on Valentine’s Day and hand—she has all these positive images of See’s Candy over the years—and say, “Honey, this year I took the low bid.” And hand her a box of candy. It just isn’t going to work. So in a sense, there is untapped pricing power—it is not price dependent.

Neuhaus is doing pretty much the same but with a twist: Their increase in sales seems to come to a large extent from Airport duty free stores. So instead of the Californian car driver you have the European business man or tourist but the principle is the same.

The biggest difference in my opinion is only the price. While See’s currently charges 18 USD per pound, Neuhaus actually gets away charging more than twice with 33 EUR (~40 USD).

It seems to be that for one, “Belgian Chocolate” allows them to charge premium prices. On a recent inland flight I quickly checked an Airport store in Munich, and indeed, Neuhaus together with Lindt was sold at very high prices at a premium location. The third brand was Feodora, the premium brand from Hachez, a privately owned German chocolate manufacturer.

Out of fun, I created a table of the developement of Neuhaus from the CBS annual report. The turn around and growth since acquisition is impressive:

| Neuhaus | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|

| Sales | 64.52 | 70.88 | 83.9 | 96.25 | 102.25 | 105.7 | 119.9 | 133.47 | 149.27 | |

| Net | 0.505 | 1.34 | 3.33 | 6.95 | 8.94 | 10.31 | 10.95 | 11.63 | 12.02 | |

| Equity | 25.98 | 26.5 | 29.55 | 36.37 | 45.18 | 50.89 | 57.6 | 53.24 | 58.79 | |

| Net margin | 0.78% | 1.89% | 3.97% | 7.22% | 8.74% | 9.75% | 9.13% | 8.71% | 8.05% | |

| ROE | 5.1% | 11.9% | 21.1% | 21.9% | 21.5% | 20.2% | 21.0% | 21.5% | ||

| CAGR Sales | 9.9% | 18.4% | 14.7% | 6.2% | 3.4% | 13.4% | 11.3% | 11.8% | ||

| CAGR Earnings | 165.3% | 148.5% | 108.7% | 28.6% | 15.3% | 6.2% | 6.2% | 3.4% |

Not only did they achieve a great turnaround, but Sales doubled and ROEs have been constantly at 21-22% p.a.since 2007. This resulted in a 10 times increase in earnings over this period.

If we look for instance to market leader Lindt from Switzerland, we can see that Lindt has a slight advantage in margins, but Neuhaus in growing more and has a better (and more stable) ROEs .

| Lindt | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|

| Sales p.s. | 9,151 | 10,255 | 11,721 | 13,210 | 11,389 | 11,126 | 11,309 | 10,944 | 11,765 | |

| Net incom p.s. | 684 | 788 | 947 | 1,123 | 1,158 | 851 | 1,061 | 1,084 | 1,198 | |

| Equity | 3,638 | 4,421 | 5,224 | 6,195 | 6,519 | 7,168 | 7,410 | 7,095 | 7,695 | |

| Net margin | 7.47% | 7.69% | 8.08% | 8.50% | 10.16% | 7.65% | 9.38% | 9.91% | 10.19% | |

| ROE | 19.6% | 19.6% | 19.7% | 18.2% | 12.4% | 14.6% | 14.9% | 16.2% | ||

| CAGR Sales | 12.1% | 14.3% | 12.7% | -13.8% | -2.3% | 1.6% | -3.2% | 7.5% | ||

| CAGR Earnings | 15.3% | 20.2% | 18.6% | 3.1% | -26.5% | 24.6% | 2.2% | 10.5% |

Don’t forget that the market is valuing Lindt at a 30x P/E, I think a 25x P/E for Neuhaus would not be unrealistic, as the business looks like a nice high ROE compounder.

In a M&A transaction, I could imagine even a higher multiple for such a premium brand from a strategic buyer.

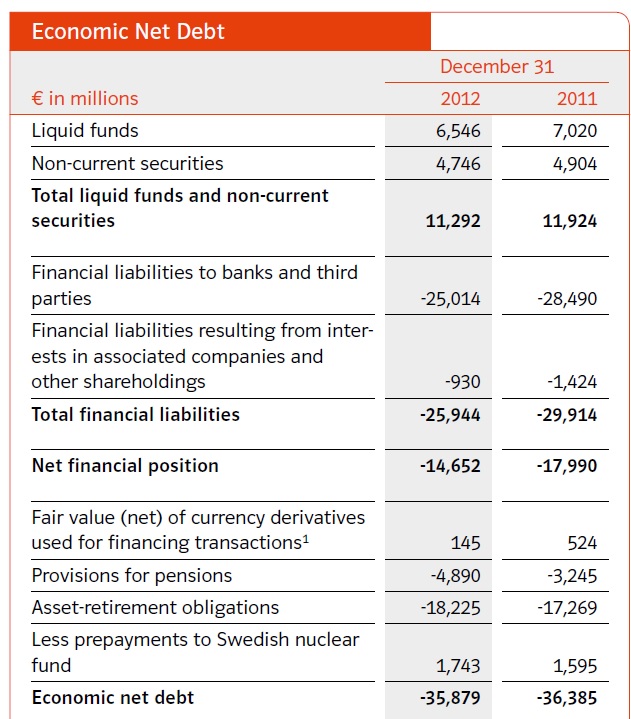

Valuation:

Interestingly, CBS discloses NAVs on bi-annual basis, the last value being 270 EUR per share at June 30th 2013.

So we can easily use the template from the annual report and plug in own values:

What about a Holding Discount ?

I have written about how I look at Holding Comanies. In CBS case, I am neutral. I like that they are able to strike really good deals (Neuhaus, Behrenberg) and hold them for the long term. On the other hand, some of the activities look like trying to kill time. Positive: transparent and conservative NAV calculation. Overall I would not necessarily require a big discount here, maybe 10-15% or so.

Compared to GBL/Pargesa for instance we do not have a double holding structure and the main assets cannot be invested directly. So definitely a lower discount here. Compared to CIR, there is also only little leverage in the company.

SO let’s look at the sum of part valuation now:

| % | Value | Comment | |

|---|---|---|---|

| Neuhaus Chocolate | 100.00% | 300.00 | PE 25(2012) |

| Behrenberg | 12.00% | 54.00 | at 1.5 times book |

| Umicore | 1.56% | 60.53 | At market |

| Recticel | 28.89% | 47.67 | at market |

| Noel Group | 29.37% | 4.64 | PE 10 |

| Other | 20.00 | as disclosed | |

| Codic Real Estate | 23.81% | 24.52 | at book |

| other reals estate | 60 | as disclosed | |

| cash etc. | 20 | ||

| Sum | 591.36 | ||

| Net debt | -80 | ||

| NAV | 511.36 | ||

| shares our | 1.6 | ||

| NAV per share | 319.60 | ||

| Holding Discount | 271.66 | -15% | |

| Upside | 25.19% | at EUR 217 |

What we see is that before applying the holding discount, the stock would have an upside of around 50% which would be OK for me. After applying the discount, the potential upside shrinks to 25%.

Other Info:

The guy behind CBS is Guy Paquot, a well-known Belgian investor. He owns close ~47% of the company.

According to this article, he comes from a rich family and was knighted in 2000 by the Belgian King. He stepped down in 2010 and is no official director anymore, but I guess he still influences the company to a large extent as the dominating shareholder

The Fortis situation

There is one dark chapter in CBOs history: As part of their activities they also invest into Belgian stocks. In 2008 however, they seemed to have received insider information about the upcoming nationalization of Fortis and were able to sell the stock before.

Because of this episode, the CEO actually was imprisoned for a few days and Guy Paquot came back from “retirement”.

It seems to be that one member of the supervisory board of CBS was also in the supervisory board of Fortis and passed the information. In 2008, it was speculated that the fine might be 40 mn or more.

The company settled the dispute finally in last November for a 8.5 mn EUR payment without committing to any wrong doing.

Stock price

Interestingly, the November settlement seems to have been some sort of catalyst, as the stock gained almost 30% in the aftermath.

The stock seems to have bounced off from the 2011 level of 230 EUR but overall I would say the chart looks ok.

Summary:

Compagnie du Bois Sauvage is an quite unusual stock. Among a strange combination of businesses, there is a prime asset hidden which I think is comparable to Buffet’s famous “See’s Candy” which accounts currently for 60% of the value of the company under my assumptions. If Neuhaus keeps growing at this pace for 2-3 more years, the percentage of Neuhaus could be even bigger.

My own valuation shows an upside of around 25% from current prices after a 15% holding discount which is too low for me to buy . So although I like the company and the two great assets (Neuhaus, Behrenberg), the current price is not attractive enough for me +. For me, A stock price of 185 UR would be required or maybe profits (and valuations) of the two prime assets increase enough to justify an investment.

P.S: I started looking at the company and writing this post already in November 2013, when the stock was around 190 EUR. This is the reason why the post is so long despite the missing upside.