Imagine you could invest into a company with the following characteristics:

– Global market leader with 70-90% market share (95% new built)

– Net margins after tax of 50% or more

– business protected by patents

– almost no capital requirement, negative working capital

– a potentially huge growth opportunity

– conservative balance sheet (no debt) and “OK” management

– at a very reasonable price (11x P/E, 7,8% dividend yield)

At a first glance, Gaztransport et Technigaz (GTT) from France seems to be the ideal cheap “moat company”. What do they do ?

Gaztransport is the global leader for “LNG containment systems”. LNG is liquified natural gas and is the predominant method to transport natural gas over long distances. In order to become liquid, natural gas has to be really cold,at least -162 degrees celsius. GTT’s technolgy is required to safely store and transport LNG on ships.

Problem Number 1

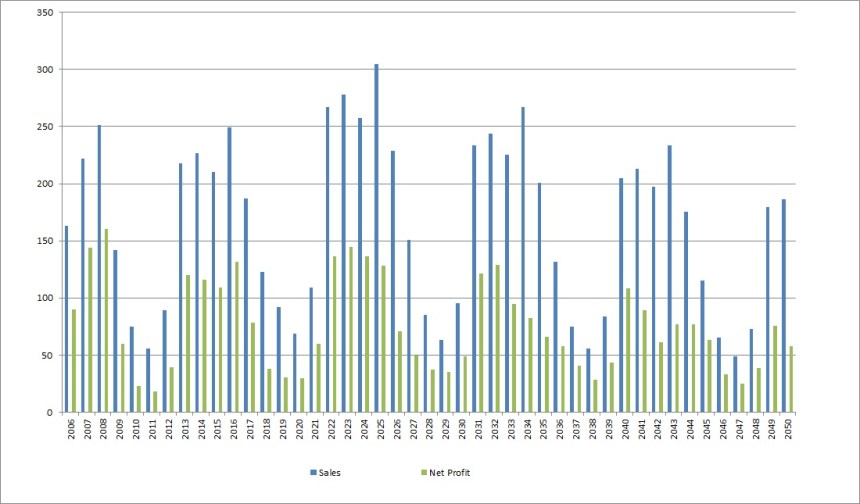

Before going into more details, it is pretty clear that GTT is an energy related company. But looking at this chart from their investor presentation we can clearly see what the real problem for GTT is:

Ultracyclical sales. We can see that within 4 years sales dropped -75% only to quadruple again in the next 4 years. Although the overall strength of the business model clearly shows in the fact that even after a -75% drop in sales, they still earned a 30% net margin.

So what do they actually do (The Moat) ?

Gaztransport has been IPOed in 2014 in France (although it was technically more a “carve out” as the company itself did not need any money. They have extremely good English language investor material, for instance the Q3 2015 report.

I try to summarize their businessin my own words:

– if you want to build ship to transport LNG, there are effectively only 2 technologies available to ensure that the LNG is contained safely, one of them is owned and patented by GTT. From inside it looks like this:

– there is a relatively large moat with regard to technology. GTT has developed that technology over the last 50 years or so and it is superior to the only competitor (“Moss”), both in price (for the total ship) as well as in utility (ships are lighter, easier to maneuver, overall cost is cheaper)

– GTT charges royalties, both, for the technology and “consulting” during the building of the ship. After the ship is finished, there are no royalties. Service is currently only a single digit percentage of sales

– Sales therefore directly depend on the number of LNG tankers being build

So the future of GTT clearly depends on the future of LNG. More LNG means more ships and more money for GTT and vice versa.

The Moat vs. new competitors

There are potential new competitors, mostly the handful of Korean companies who actually build the ships. The Koreans for some time now try to develop or copy their own version of the technology. I assume that they clearly know how much money GTT makes with the patent and that they woul love to cut GTT out of the process.

GTT themselves think that the threat is not so big in the near future. The ship certification companies would need to approve first as well as the oil companies who are finally responsible for the LNG tankers and the administrators of any harbour or docking station.

So far in the 50 year history both, Moss and GTT have a 100% safety record with no accidents. The cost for GTT technology within the overall price of a LNG tanker is around 4-5% of the total constructon price. So the question is really why should any energy company take on the risk for a new unproved technology when the potential cost savings are pretty low ? LNG Tankers do carry the equivalent “firepower” of dozens of nuclear bombs, so risk aversion is pretty high especially in developed world harbours.

The LNG market

There is a lot of material on LNG but most of them are very optimistic, some links:

BG LNG Global market outlook

McKinsey LNG study

Again in my own words my thoughts on LNG:

– LNG is considered “clean fuel” compared to oil and coal and should benefit from climate issues

– Natural gas is abundant and in many cases cannot be transported via pipelines

– A lot of the natural gas comes from “stable” countries like Australia and the US and is therefore strategically interesting

But clearly, low energy prices take a toll on LNG as the liquification, transport and regsification are expensive. A year ago I looked at Seth Klarman’s investment Cheniere Energy and I was not convinced. However a lot of money has been now invested into liquification facilities especially in the US and Autralia, so it is not unlikely that the amount of LNG to be transported might rise as projected and the need for transport and storage increases.

So just some rosy LNG projections alone would not be enough to make GTT interesting for me.

The “carrot on the stick”: Bunker fuel

Big Ocean going ships burn a fuel called “bunker” which is extremely filthy:

As ships get bigger, the pollution is getting worse. The most staggering statistic of all is that just 16 of the world’s largest ships can produce as much lung-clogging sulphur pollution as all the world’s cars.

Because of their colossal engines, each as heavy as a small ship, these super-vessels use as much fuel as small power stations.

But, unlike power stations or cars, they can burn the cheapest, filthiest, high-sulphur fuel: the thick residues left behind in refineries after the lighter liquids have been taken. The stuff nobody on land is allowed to use.

In the meantime however, stricter requirements for ship fuel have been installed. Current caps are mostly effective in Europe and North America, but starting 2020, globally much tighter rules will come into effect.

There are several possible solutions to the problem:

– using cleaner fuel which is however more expensive and limited

– cleaning the exhaust with expensive technology

– use LNG as alternativ fuel

If LNG would become popular in the future, GTT’s technology would suddenly be required everywhwere, from every port and every big ship, which would mean much more steady business than in the past and a strong structural growth over many years.

However, at current prices this is far from a sure thing, so in any case as an investor I would not want to pay for this at the moment.

Click to access 213-35922_LR_bunkering_study_Final_for_web_tcm155-243482.pdf

Stock Price

For an energy stock, GTT has held up quite well since their IPO until late 2015 but then got hammered, howevr as we can see less than TGS for instance:

How to value GTT ?

The problem is the following: GTT is a cyclical company and we are most likely at or near the top of the cycle with regard to the “core” business. One could argue that with an overall size increase of the LNG tanker fleet, the replacement requirement increases but with an expected life of around 40 years, the replacement cycle for the current fleet is a long way off in the future.

So using current profits and saying” Wow the stock is cheap” clearly doesn’t help. Comparing it for instance with a less cyclical stock like G. Perrier and saying: 11x PE is better than G. Perriers 15x PE is nonsense.

As I said before, I would not be willing to pay for the “Option” of LNG powered shipping so I need to come up with a way to value the company based on the cyclicality of earnings.

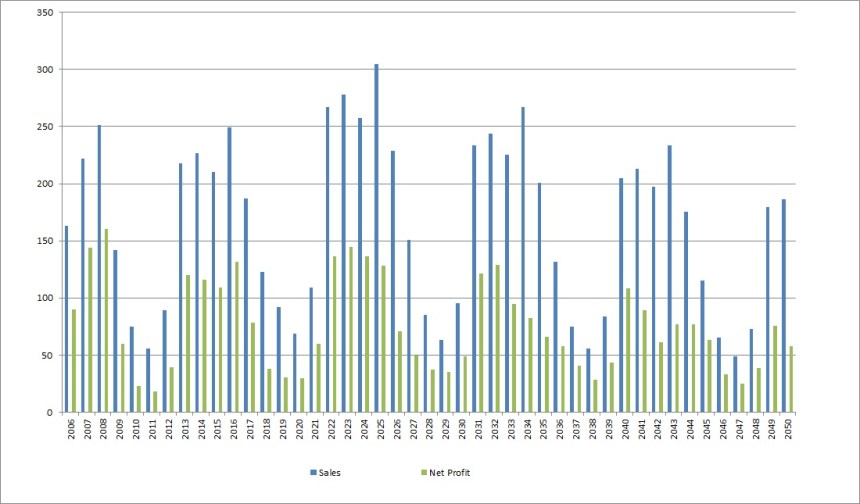

So what I did is that I tried to “simulate” future earnings with roughly the same kind of cyclicality that we have seen in the past 10 years. This is the resulting “Model” for the next 35 years:

I have “modelled” somehow similar cycles as the current one, with the peaks increassing first and then trailing of somewhat in the future.

We can then discount this cyclical earnings stream by our “required rate of return” to see if GTT is a real bargain or not.

Under those assumptions my results were the following:

10% discount rate: 20,80 EUR per share

15% discount rate: 14,26 EUR per share

So now one could clearly challenge my “model” and tweak it somehow, but in general it looks like that GTT is not a bargain at current prices (34 EUR). To me it rather looks like that the current valuation already implies a certain value for the LNG ship fuel “option”. Therefore GTT at current prices is not interesting to me as an investment.

One important learning experience for me is that I guess one should value all cyclical stocks like this, i.e. really model the cycles and discount those cashflows instead of just looking at current multiples and say “wow that’s cheap”. I think I made that mistake to a certain extent with TGS Nopec.

Summary:

Overall, GTT is a very interesting, unique company. It combines a “wide moat” with regard to technology and patents with a very cyclical business.

Although the company looks cheap at current multiples, over the cycle there is more downside than upside at current prices in my opinion.

If LNG will become the dominant fuel for ships in general, than the investment case might change significantly to the upside but for me this is not given at current energy prices.

In the future, I will need to analyse and value cyclical companies the same way as I did here: With actually modelling cycles instead of (implicit) constant growth assumptions.