Boiron SA (ISIN FR0000061129) – Boring enough to invest ?

It’s no secret that I like French family run companies. TFF Group, G. Perrier, Installux, Dom Security are just the main examples of these kind of companies.

Boiron SA is a French company which Bloomberg lists as “Specialty Pharmaceutical” company. Although “Specialty Pharma” is not exactly what they do. in fact, Boiron SA ist the only listed company that I know that exclusively produces and sells Homeopathic “pharmaceutical” products. The call themselves “World leader” of this field.

A few words on Homeopathy

From Wikipedia:

Homeopathy is a system of alternative medicine created in 1796 by Samuel Hahnemann, based on his doctrine of like cures like (similia similibus curentur), a claim that a substance that causes the symptoms of a disease in healthy people would cure similar symptoms in sick people.[1] Homeopathy is a pseudoscience – a belief that is incorrectly presented as scientific. Homeopathic preparations are not effective for treating any condition;[2][3][4][5] large-scale studies have found homeopathy to be no more effective than a placebo, indicating that any positive effects that follow treatment are only due to the placebo effect, normal recovery from illness, or regression toward the mean.[6][7][8]

“Controversial” is maybe a good description with regard to Homeopathy. In December last year for instance, the FDA took action against some “dangerous” homeopathic “drugs”. On the other hand the article clearly states that even in the US, homeopathy seems to be a fast growing industry:

Once a niche field, homeopathy has grown into to a $3 billion industry that peddles treatments for everything from cancer to colds, FDA Commissioner Scott Gottlieb noted in a statement.

I think it is clear that Scientifically.,Homeopathy has failed to prove that it is effective on its own in scientific tests. So why has this “snake oil” survived now for over 200 years ?

I think there are at least 4 potential explanations:

- People don’t trust the “classical” Pharma industry

Just one example is what is now called the “opioid epidemic” in the US, where the pharmaceutical industry was very successful to get dangerous opioids into the hand of the average US patient which seems to have led to widespread opioid painkiller abuse.

2. There seems to be a growing market for any kind of alternative medicine

Despite Homeopathy, there are many other forms of “alternative medicine” from Ayurveda, Traditional Chinese Medicine (TCM) to newer developments. Plus there is the whole vitamin industry and the current “superfood” craze which in the end also seems to be nonsense in a lot of cases such as the current “tumeric craze”. I do think there is some connection with the first point, so fewer people belive in classic pharma and look for different ways to feel better.

3. Self healing / Placebo

Although I am not esoteric at all, I think it is not unrealistic that the body has some capacity of self healing. One theory about homeopathy says that it can activate self-healing, which might be true or not. Or it is just another version of the famous “placebo effect”.

4. More holistic approach

In Germany, Homeopathy is very popular. There is even a separate profession called “Heilpraktiker”. Estimates say that there are at least 35.000 Heilpraktiker in Germany. I haven’t been to a Heilpraktiker but people who go there tell me that among other things. a Heilpraktiker ha much more time for patients and cares more about the overall situation a person is in. When you go to a classical medical doctor, a consultation normally only lasts a few minutes and at the end you walk out with a prescription for some kind of pill.

Biggest risk: Taking it too seriously

Clearly most homeopathic substances are harmless. However there is clearly the risk that some people believe too much in homeopathy (or other alternative medicines) and rely on it even in “life or death” situations where a traditional medication would clearly help. One of the most famous examples is clearly Steve Jobs, who thought he could beat his cancer by alternative means alone, which he then seemed to have regretted very late in his life. Bur that is clearly a risk of all alternative kind of medicine, not Homeopathy alone.

Financials:

A few standard metrics (at 68 EUR per share)

Market cap: 1.36 bn

EV: 1,15 bn

P/E 2017 (est): 16,5

EV/EBITDA 7,2

Profit margin 12,1%

ROIC 18,6%

EPS growth 3 years: +0,2%

Net Cash per share 06/2017: 10,8 EUR

P/E 2017 cash adj. 13,8

We can clearly see that the company doesn’t look too expensive but it stopped growing . More on that later.

Relative profitability & relative Valuation

In order to understand how Boiron differs from other “specialty Pharma” companies, I compared them against a “peer Group” that I selected, which consists of the following companies:

- Sanofi as a typical large-scale R&D heavy pharmaceutical company

- Recordati as a typical mid-sized pharmaceutical stock which is more distribution driven

- Vetoquinol & Zoetis as specialty veterinary pharmaceutical companies

- and finally Usana, a kind of multi level marketing nutritional additives company

Although it is not easy to compare those companies due to different ways of reporting their P&Ls, a few things are striking:

- Boiron spends almost nothing on R&D

- However they need to spend a lot on marketing and distribution

- On average, Boiron is equally profitable than the peer group but signficantly cheaper

- However the pears were also growing a lot more than Boiron

The Boiron family

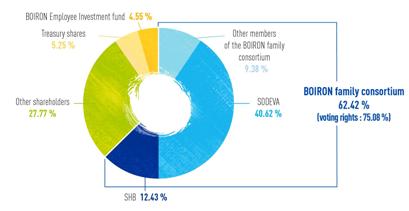

The family controls according to the official website 62,4% of the share capital and 75% of the voting rights. 4,6% are owned by the employees and another 5,2% are held as treasury shares, leaving a free float of around 27%.

The CEO Christian Boiron is 70 years old but still quite active in the company. His successor will not be someone from the family but the current Deputy CEO Valerie Poinsot.

Management philosophy

1.2.3 A DIFFERENT WAY TO WORK FOR A LIVING

Christian Boiron is convinced that a company can only be successful thanks to its employees. A source of motivation and creativity, their self-fulfillment is the key to the Company’s performance and growth.

Christian Boiron has always believed that it is possible to lead the Company and work differently by overcoming the divisions between management and staff. Therefore, in 1974, he imposed on BOIRON his unique vision of human relations based on the development of life skills as a source of motivation and innovation at the service of the economy. “Managers are at the disposal of the other employees and not the other way round.” This original approach still applies throughout the Company on an everyday basis.

The social philosophy at BOIRON grew out of the conviction that social and economic concerns are two dimensions of a company that cannot be dissociated or prioritized:

• the social dimension, because to progress the Company needs every employee to make a contribution with their know-how, their life skills, their competence, and motivation; this was the reason for a number of agreements to encourage self-fulfillment;

• the economic dimension, because any social innovation must find a sustainable source of funding.

The CEO Christian Boiron seems to be a quite “special character” and sees himself rather like an artist than a manager according to this interview.

He also modeled his company like a small “Club Med” according to this interview.

Employee Investment fund

With 4,6%, the percentage of employee shareholders is quite high. This seems to be the result of a pretty attractive share saving plan:

Employees can invest in the BOIRON employee investment fund via:

• the employee savings plan: on average, approximately 1/3 of employee savings are transferred to the BOIRON employee investment fund;

• profit sharing: on average, more than 1/3 of the funds from the profit sharing incentive are transferred into the BOIRON employee investment fund;

• voluntary contributions: Employees can also make voluntary transfers into the BOIRON employee investment fund. In 2016, 1,728 employees were paid a total of €2,510 thousand ;

• the employer contribution to voluntary payments into the BOIRON employee investment fund is based on a declining scale in three tranches providing eligibility for a maximum employer contribution of €1,500 for €3,000 of annual payments.

At December 31, 2016, the BOIRON employee investment fund’s assets amounted to more than €103 million, of which 75% was composed of BOIRON shares. About 90% of employees own a portion of the BOIRON employee investment fund.

This reminds me a little bit about Handelsbanken. In general I like companies where employees are motivated enough to put significant amounts of their own money into the company.

However: Little growth in the last few years

After strong growth some years ago, top line and bottom line have been stagnating over the past few years. However looking deeper we can see an interesting trend:

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | CAGR | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| sales | 466.71 | 526.09 | 523.2 | 533.22 | 566.29 | 617.73 | 609.75 | 607.8 | 614.4 | 617.5 | |

| – thereof int. | 202.7 | 237.27 | 231.04 | 234.01 | 240.39 | 270.77 | 265.85 | 246.04 | 243.62 | 239 | |

| – therof France | 264.01 | 288.82 | 292.16 | 299.21 | 325.9 | 346.96 | 343.9 | 361.76 | 370.78 | 378.5 | |

| yoy int. | 17.05% | -2.63% | 1.29% | 2.73% | 12.64% | -1.82% | -7.45% | -0.98% | -1.90% | 1.85% | |

| yoy. France | 9.40% | 1.16% | 2.41% | 8.92% | 6.46% | -0.88% | 5.19% | 2.49% | 2.08% | 3.16% |

The issue in the last few years clearly seem to be international markets where sales contracted now for 4 years in a row. The French core market seems to be doing OK. What I also find interesting is that sales increased most in crisis years (2009, 2012 “Euro crisis”). I think their business is quite independent of the underlying business cycle which I like very much.

Boiron’s best seller is a “drug” that is supposed to help against influenza. In 2017 there was no major influenza event in their core French market.

Pros/Cons

Time for a quick Pro/Con exercise:

The Pros:

+ High margin business, less risky than “real” pharmaceuticals (no patents)

+ family owned/run

+ low salary for CEO (only 200k)

+ very conservative balance sheet

+ business relatively independent of business cycles

+ dominant position in France

+ share count decreasing over the years (from 22 mn shares some years ago to 18.4 mn)

+ family buying shares (2016: 62,5% vs. 2011: 50,4%)

+ little analyst coverage (only 3 French analysts cover the stock)

The Cons:

– CEO already 70 years old

– international business shrinking and most likely not possible

– capital allocation not optimal (international business)

– relatively little growth in core market France

– regular “attacks” on homeopathy in general (US, Russia etc.)

The stock price:

If we look at the last 5 years, Boiron clearly has seen better days:

It is interesting to see that the stock has been rising until 2015, although growth reversed already in 2014.

Valuation:

As I try to keep things simple, a very rough valuation approach: For me, Boiron is a “low risk” stock because it is conservatively financed and its underlying business shows little or no correlation to business cycles. In such cases, I would be happy to achieve a 10% return p.a. over time.

At currently around 69 EUR and an estimated 4 EUR per share earnings, the company trades at a cash adjusted P/E of ~14 or an earnings yield of around 7,1%.

As Boiron needs little or low capital for growth (mostly variable cost like marketing), any growth should translate into an equivalent long-term increase in earnings. At the current rate of growth (0%), the stock is clearly not meeting my return requirement.

One interesting point for French shares is the proposed reduction in Corporate Taxes. This is from a Deloitte paper:

Reduction of corporate income tax rate

The corporate income tax rate would be gradually reduced to 25% by 2022. The rate reduction would be spread over the period from 2018 to 2022 but—contrary to measures included in the 2017 finance law—each annual step to achieve the 25% rate would apply to all companies and to all taxable profits (for prior coverage, see the alert dated 23 December 2016).

However, keeping in line with company expectations, the rate reduction adopted under the 2017 finance law would be maintained for 2018: a 28% rate would apply to the first EUR 500,000 of profits for all companies (with the remaining profits subject to the 33.33% standard rate). In 2019, the standard rate would drop to 31% (but the 28% rate still would be applicable on profits below EUR 500,000). The 31% rate would be reduced to 28% in 2020 (applicable on the entire amount of taxable profits), 26.5% in 2021 and finally 25% in 2022. The 3.3% social surcharge that applies in certain circumstances would continue to apply to the corporate income tax, bringing the 25% standard rate in 2022 to an effective rate of 25.8%.

Just to illustrate the effect I created this table showing the effect on a hypothetical French company with constant earnings over this period:

| 2018 | 2019 | 2020 | 2021 | 2022 | CAGR | |

|---|---|---|---|---|---|---|

| Pretax profit | 100 | 100 | 100 | 100 | 100 | |

| Tax rate | 33.30% | 31% | 28.00% | 26.50% | 25% | |

| Profit | 66.7 | 69 | 72 | 73.5 | 75 | |

| 3.45% | 4.35% | 2.08% | 2.04% | 2.98% |

So interestingly this tax effect alone creates ~3% earnings growth from 2019 to 2022.

It is fair to assume that most profit (or even all) at Boiron is made in its French home market, so the effect most likely will fully show in their after tax results until 2022.

With this tax rate driven boost, Boiron would just hit my hurdle rate of 10%. However this tax rate driven growth in my opinion is not as valuable as “real” growth. So I would at least put a 50% “haircut on that growth number.

This means that I would require a lower entry point into the stock to justify an investment or growth would need to pick up. I think I would be tempted to buy Boiron if the stock trades below 65 EUR.

Summary:

Boiron SA ticks a lot of my preferred “boxes”: It is conservatively run and owned by a family, its business seems to be not connected to economic cycles and seems to be a good example of a “Boring but beautiful” business.

However, without any underlying growth of the business, the stock is not cheap enough in my opinion to justify an investment. I will therefore stay away for the time being but watch closely and start buying if the stock goes below 65 EUR/share.

P.S.: Some links on Boiron & Homeopathy:

https://spottingstocks.com/2017/12/03/boiron-spreading-homeopathy/

http://www.echamp.eu/our-sector

https://www.deutsche-apotheker-zeitung.de/news/artikel/2017/10/11/homoeopathie-boom-flaut-ab

http://www.beweisaufnahme-homoeopathie.de/?p=844

https://www.netzwerk-homoeopathie.eu/kurz-erklaert/146-homoeopathie-zahlen-daten-fakten

http://www.igm-bosch.de/content/language1/html/12932.asp

https://www.cso.com.au/mediareleases/28592/homeopathic-medicine-products-market-on-a/

https://johnbenneth.wordpress.com/2011/10/06/worlds-fastest-growing-medicine/

http://www.health.com/mind-body/homeopathic-fda-policy

http://www.lyoncapitale.fr/Journal/Lyon/Actualite/Le-mensuel/Ces-homeopathes-qui-accusent-Boiron

One additional remark: I worte a post a time ago with the title “there is a reason for a stock being cheap”. In this case there was clearly a reason as some people might have knon about this. I didn’t. Luck.

Lucky me that I never followed up on my intention to buy the stock. My assumption was that almost all the profits come from France. It is really hard to say how severe sales will be effected.

Let’s wait and see. Back in the old days, a somehow similar situation in Germany (no payments for prescribed glasses) led to a perfect entry point for Fielmann.

Hi

this is regarding Metro, didn’t see an opporunity to post there. Basically I think they dont need to pay the same amount to both shares. If u remember the exploiding shares of VW 2008/9 because Porsche wanted to buy them, the Stammaktien (voting rights) exploded (4 times in 2 days; because they have been heavily shorted, cost some people their lives) and the preferred ones didn’t react at all.

I see a downside risk of at least 20% for Metro (bought in December for 12; but sold in Februar) They are not capable of dealing correctly with real, should have made some money there. I waited for the takeover, but was to uneasy for a collapse of the market. At his position I would wait for collapse, but probably he s not getting the capital from the banks then.

Almost halved since you first wrote about it. 1/3 of market capitalization is cash. Looks like France will no longer reimburse homeopathy.

Homeopathic treatments heal as much as prayers to some religion. Paying for either is fundamentally a loss.

Great nick name !!! Nevertheless a Lot of money is Made with stuff that does little or Nothing. Homeopathy has survived 200+ years so one should not underestimate it.

Are you considering to buy now? The stock went below 60 € a share. But the half year earnings were disappointing because there seems to be no further growth in europe – at least at the moment.

Net profit was also disappointing.

I really like Boiron. But I’m still scratching my head if it’s cheap enough.

Best regards

NF

I will need to look at them again. However the CEO also announced that he will leave.

How does homeopathy (i.e. a book of lies) fits in the ethos of a value investor?

maybe it fits in the ethos of an investor with no values

From my point of view, it is not reprehensible to distribute homeopathic medicine. The argument that the distribution of such products is fraud is inaccurate. Every buyer of homeopathic medicine knows that the effect most likely does not go beyond the placebo effect. However, the buyer feels better after taking appropriate medicine and feels encouraged to trust in a natural recovery of health. There are countless people who only go to a doctor to see if there is a serious illness. Unless severe disease is present, natural healing is often preferred by patients. Homeopathic medicine supports this healing process at least in the form of the placebo effect – according to studies even if you do not believe in it.

I can not recognize a reprehensible business model in this since every customer knows these circumstances.

I would only say that most of the products in the market have some homeopathic side. Hence the values argument is invalid. Homeopathy is 200% pure marketing… but I would say CocaCola and Gillette (which I am a consumer of), are easily 80% marketing, and so are many other products (expensive Parfums & Wines) whose pricetag is N-times the production cost … If we would truly know the prod costs, we would simply feel totally fooled by their marketing machine. As much as homeopathic.

Maybe a few points on this:

– A “value investor” as such is an investor who invests in undervalued securities. Value investing as such does not imply any moral aspect

– personally, I prefer to invest in “sustainable” businesses with honest management. Homeopathy exists since 220 years, so it looks somehow sustainable to me

– it is clear that Homeopathy is best for those who believe. But for those who believe it often works

– I do like the fact that the CEO clearly stated that homeopathy is not a replcament of classic pharamaceutical products

I agree with Cardano, that many of the most successfull businesses are pure marketing. And to be honest, Coca Cola or a Big Mac are much worse for your health than swallowing “medicine” with mostly water in it.

There are many people for instance that psychologically need to take some kind of pill when they have flu, although nothing really helps. So I see no harm for instance in sich cases to use homeopathic pills which, not by coincidence is one of the best selling “drugs” from Boiron.

However in summary, Boiron and homeopathy in principle is a marketing driven but sustainable business with a (so far) honest managment.

What is still holding me back is the quite volatile sales development in the various markets and the regulatory uncertainty in France.

Another peer group company might be Australian ‘Blackmores’, BKL:ASX. It sells vitamins, and much of it’s recent growth has come from the Chinese. I no longer own it, it’s quite expensive now. I know the Chinese have their own ‘traditional medicine’, but should they take a fancy to Western homeopathic, then maybe BOIRON’s growth would increase.

I have looked into Boiron myself in the past (also at Naturhouse & Usana Health) because of their profitability and track record. Personally I find it unethical to sell products or services that claim benefits that are not there or can’t be proven. Off course one could argue that people want to be believe in this, and these kind of companies are only fulfilling an existing need. One of the big investing ‘cons’ is regulatory risk (that’s probably what you mean by “regular attacks on homeopathy”).

For me, it looks too expensive and counting on lower taxes for future growth can prove very risky.

Because the growth is close to stagnant, it can detoriate very fast.

I’ll definitely keep this one on my watchlist as a younger and more international oriented CEO can make a large impact on what seems a dormant company for me.

Thanks as always for your analysis.

If you like cheap family owned French companies, take a look at the cheesemaker Savencia (Bongrain).

Thanks for the comment.

Re Savencia: Compared to Savencia, Boiron looks like an ultra high growth stock. 2017 earnings are expected to be below 2006 earnings. In the same period, Boiron has increased earnings by 550% !!!!!

Naturhouse from Spain could be another good peer

Thank you. Looks like it. I have never heard of them before…..

Spain is looking no better than Turkey these days. Koç Holding and Turkcell seem also look pretty good value !

Spain is looking no better than Turkey these days. Koç Holding and Turkcell also look pretty good value !

Without homeopathy you need one week to recover from flu. With homeopathy you need seven days.

That’s a pretty accurate observation.

On the other hand, a lot of money is made with stuff one doesn’t really need. Who really needs extra Vitamines, Goji Berries, 6 EUR smoothies or a Hermes hand bag ? Homeopathy is just one of them. I know a lot of people who just feel better when they can take a pill, no matter if it helps or not.

France is the biggest European market for homeopathic remedies. I don’t think that I have seen any Boiron products in Germany. Interestingly, their latest press release suggests that they diversify into “medical adjuvants” (medizinische Hilfsmittel). From your peer group, I would assume that Usana Health is the most appropriate comparison. Both homeopathy and nutritional supplement need very little R&D which is a major financial burden for a pharmaceutical company. On the other hand, consumers need to be convinced of the benefits of the products, therefore a considerable amount of money needs to go into marketing. What is also interesting about homeopathic remedies is the pricing power. A homeopathic preparation for treating the common cold will be considerably more expensive than a package of paracetamol or ibuprofen pills.

Thanks for the qualified comment 😉

I think Veterinary Pharmaceutical is also somehow similar because R&D in that area is also not a big factor.

I guess Boiron also needs to invest into “relationship management” with pharmacies…

I think there is more R&D in veterinary pharma than in homeopathy. Of course some of the drugs that are used for animals are also used for humans (and can thus be repurposed), but there are a number of drugs that are used for animals that are not suitable for humans.

The pricing power for veterinary pharma is also different than for human pharma. At the high end, I guess a 500 USD pill like Sovaldi would probably not sell for your average dog or cow. But at the lower end the pricing power is probably higher. A number of frequently used off-patent human drugs sell for fractions of an Euro because of health insurance pressure. This pressure doesn’t exist in the animal health care sector (although, to be honest, I don’t know where to find prices for veterinary drugs) and at least when considering pets people are willing to pay considerable amounts of money for their pet’s health.

I am skeptical about this ‘spontaneous healing’ solutions, and would not go for that. I find it questionable, and somehow against my principles (like I never play lottery)….

P/E of 16.5 for a company with stagnant top line in real terms and in a no-moat line of business seems quite demanding, especially in an environment of rising interest rates. Also majority of stock is in fixed hands, so what could be the trigger for higher prices?

In the period 2000 to 2013 (pre QE**2) the stock was oscillating in the 20 – 30 Euro range, so current valuation seems more likely due to the QE effect that the company’s merits.

well three comments on that:

– Cash adjusted P/E is at around 14

– Earnings per share 2000-2013 were in the 0,5 to 2 EUR per share range. P/E between 10-14x. So no real QE effect. Looking just at past stock prices is “anchoring” and should be avoided.

– Trigger: Well, i do not look for triggers. I think this is my personal “Moat” in investing that I have the patience to wait