Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!

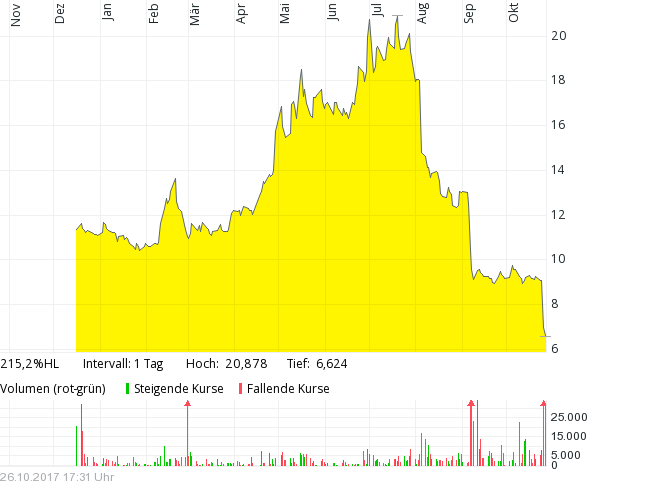

Cars.com is a recent (May 31st) spin-off from publishing company Tegna, which itself is a spin-off of the Gannet publishing Group. Interestingly, Gannet/Tegna only bought control of cars.com in 2014 for a total value of 1,8 bn USD.

Cars.com – The business & Market

Cars.com is a typical “Online classified” business, meaning that it collects offers of merchandise (in this case cars), aggregates and sorts them and then shows it to as many potential customers as possible.

The economic value of such a “service” is relatively easy to explain: For a potential customer, it saves time because he can look at and compare different offers at one place. For the sellers, such a service is basically an advertising and/or sales channel which ideally reaches many potential customers.

Read more