With 200 out of 215 stocks now covered, this will be the penultimate post in this series covering single stocks. My goal is to conclude this in 2021 and it almost looks like I’ll succeed.

This time, two stocks look like worth watching further. At the very end of this series I will need to consolidate my watchlist and concentrate on the top 20 (or so) stocks to watch going forward.

191. Temenos

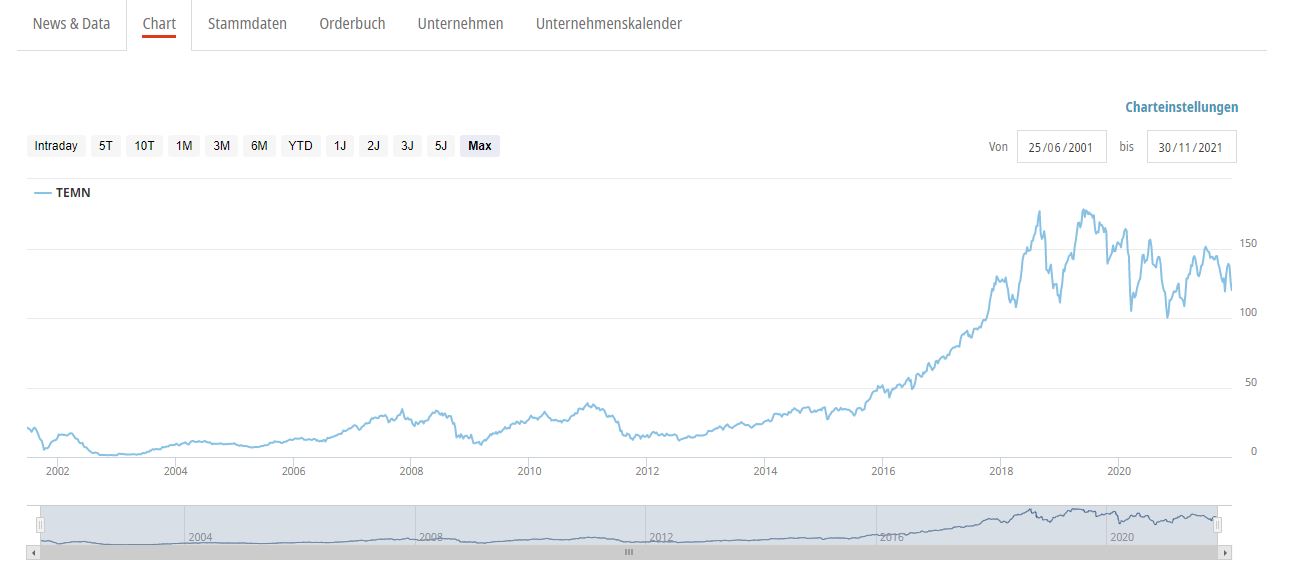

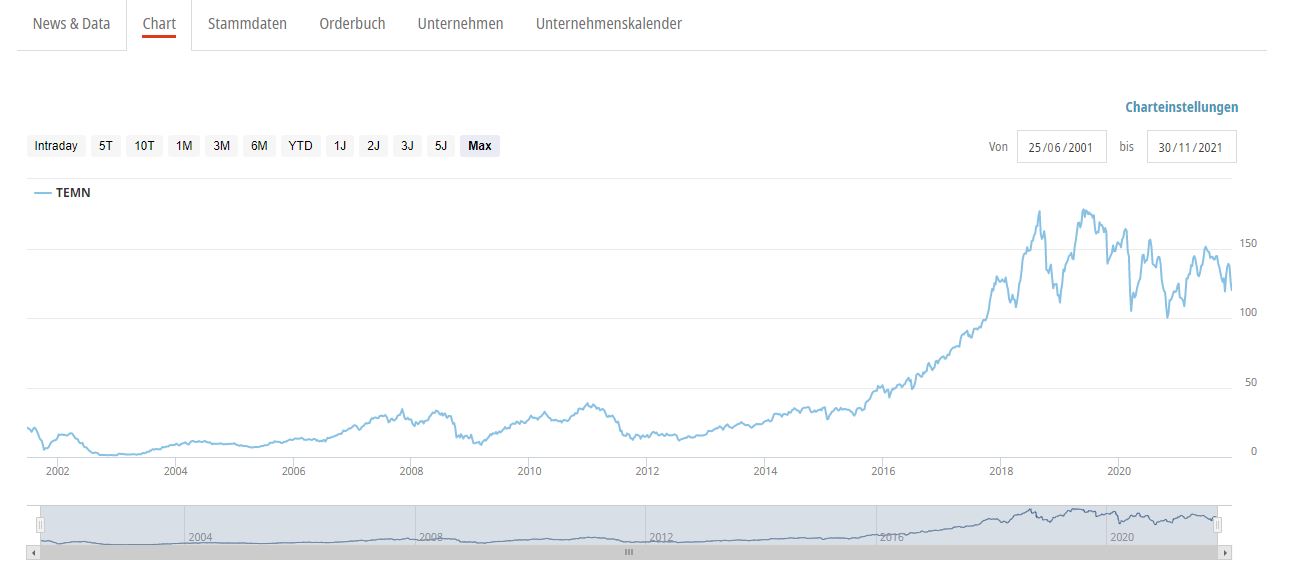

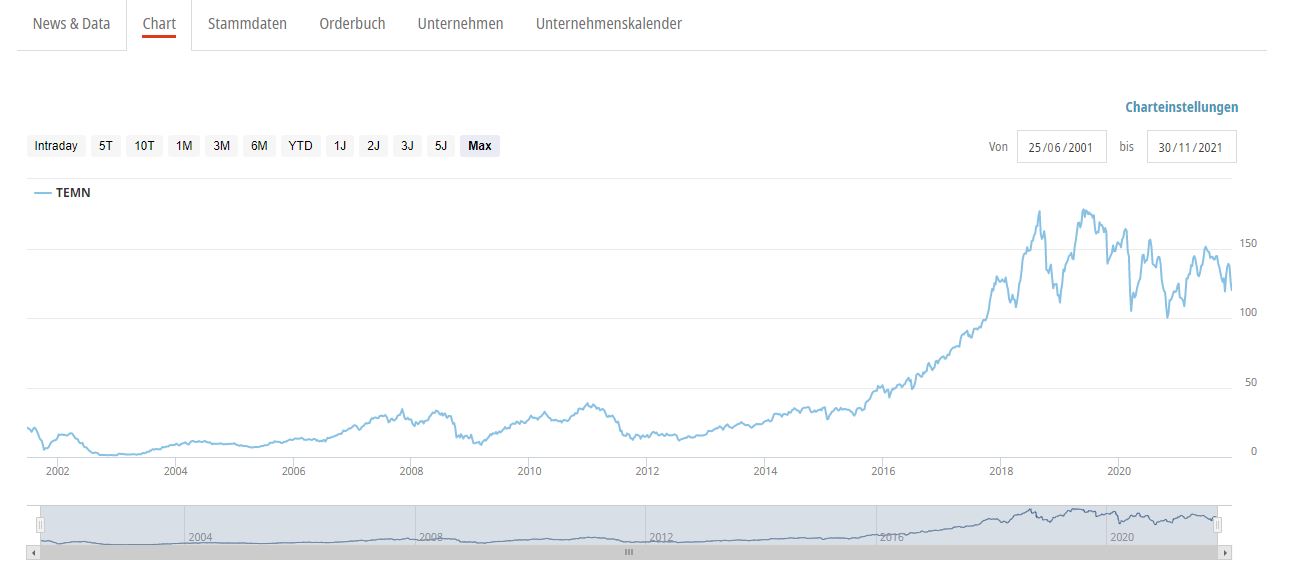

Temenos is a 9 bn CHF market cap software company that specializes on Software for banks and financial institutions. Looking at the chart one can see a very nice run up until 2018, since then the stock trades sideways under significant volatility:

The company as such is highly profitable, with EBIT margins of > 30%. In 2020, sales declined by -8%, but EPS remained more or less constant. As many other “traditional” Software companies, Temenos seems to be transitioning right now from a licence + maintenance model to a SaaS model.

Read more

With 200 out of 215 stocks now covered, this will be the penultimate post in this series covering single stocks. My goal is to conclude this in 2021 and it almost looks like I’ll succeed.

This time, two stocks look like worth watching further. At the very end of this series I will need to consolidate my watchlist and concentrate on the top 20 (or so) stocks to watch going forward.

191. Temenos

Temenos is a 9 bn CHF market cap software company that specializes on Software for banks and financial institutions. Looking at the chart one can see a very nice run up until 2018, since then the stock trades sideways under significant volatility:

The company as such is highly profitable, with EBIT margins of > 30%. In 2020, sales declined by -8%, but EPS remained more or less constant. As many other “traditional” Software companies, Temenos seems to be transitioning right now from a licence + maintenance model to a SaaS model.

Read more