Some thoughts on utility stocks (Fortum, EVN)

In my portfolio, I have 2 utility stocks, Fortum OY from Finland and EVN AG from Austria. Both are part of the portfolio since the beginning.

The idea behind those two investments were the following:

1. utility stocks in general looked cheap and relatively save at that point in time

2. both, EVN and Fortum had a large share of non-carbon electricity generation capacity. “Fossil fuel” burners were expected to suffer as they need to pay more for the carbon emissions in the future

3. both companies are located in countries which are not directly impacted from the EUR crisis, so the risk of special taxes etc. should have been low

So far the investment thesis didn’t really work out.

First, the utility index underperformed with -8% the corresponding full index (Stoxx Europe 600) by a whopping 11%.

Second, both EVN and Fortum managed to underperform the utility index. EVN by -3.7%, Fortum by a dramatic 30.4% (including dividends)

If we look at the index constituents, we can see some interesting things:

| Perf. 12/2010 – | |

|---|---|

| DRAX GROUP PLC | 41.2% |

| NATIONAL GRID PL | 37.8% |

| UNITED UTILITIES | 36.1% |

| SEVERN TRENT | 34.5% |

| PENNON GRP PLC | 28.7% |

| SSE PLC | 18.2% |

| CENTRICA PLC | 5.7% |

| ENAGAS SA | -3.5% |

| RED ELECTRICA | -11.6% |

| SNAM SPA | -12.4% |

| TERNA SPA | -12.8% |

| GAS NATURAL SDG | -13.9% |

| ENEL GREEN POWER | -20.7% |

| EDP | -22.6% |

| E.ON AG | -22.8% |

| GDF SUEZ | -27.3% |

| ENDESA | -29.8% |

| RWE AG | -34.2% |

| ENEL SPA | -34.3% |

| FORTUM OYJ | -37.1% |

| VERBUND AG | -42.2% |

| SUEZ ENVIRONNEME | -42.6% |

| EDF | -46.3% |

| IBERDROLA SA | -47.0% |

| VEOLIA ENVIRONNE | -62.8% |

Frist thing to notice: “Renewables” really did badly, Mostly Iberdrola, Verbund and Fortum but also Enel Green Power. UK utilities did best. At least peripheral utilities did underperform as well, however French utilities were the worst (EDF, Suez, Veolia).

If we exclude UK and go for “EURO” utilities, the picture looks relatively speaking better, with a total return of -23.82%, this index performed really badly, EVN here (although not in the index) looks like a clear outperformer. Fortum still doesn’t look that good…

| Perf. 12/2010- | |

|---|---|

| ENAGAS SA | -3.45% |

| RED ELECTRICA | -11.56% |

| SNAM SPA | -12.37% |

| TERNA SPA | -12.85% |

| GAS NATURAL SDG | -13.85% |

| ENEL GREEN POWER | -20.37% |

| EDP | -22.64% |

| E.ON AG | -22.93% |

| GDF SUEZ | -27.49% |

| ENDESA | -29.75% |

| RWE AG | -34.24% |

| ENEL SPA | -34.39% |

| FORTUM OYJ | -37.06% |

| VERBUND AG | -42.23% |

| SUEZ ENVIRONNEME | -42.67% |

| EDF | -46.34% |

| IBERDROLA SA | -46.95% |

| VEOLIA ENVIRONNE | -62.76% |

So looking back, what happened, especially to Fortum ?

– first of all, the Finish government introduced a special tax for Fortum although they didn’t need to. Bad luck

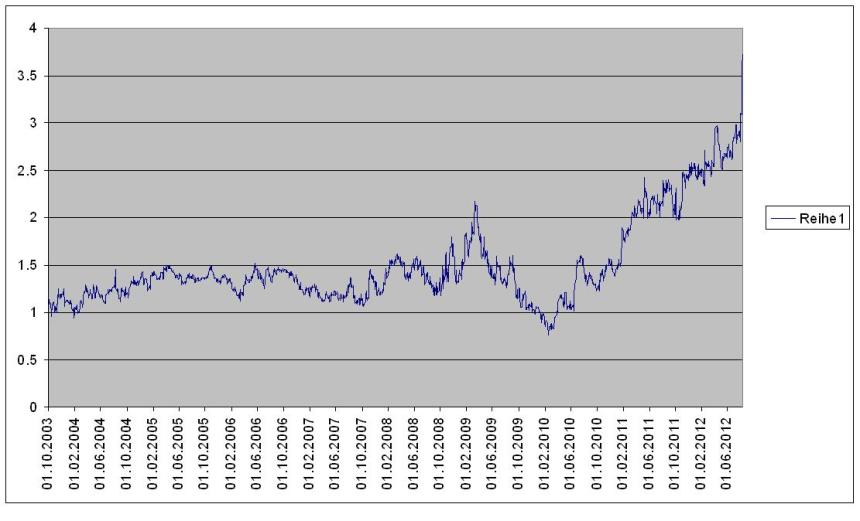

– secondly and more importantly, the price for carbon emission rights fell dramatically. As the following chart shows, CER prices fell a dramatic -75% from mid 2011 until now.

So the “Built in” (and as we know now “priced in”) competitive advantage of renewable power generators against “conventional” generators seems to have narrowed. Interestingly, the big divergence between Index and renewables opened up only in the last few months.

Additionally, the business model of electricity genrators in general seems to have eroded somehow, as it seems to be that they are on the worng side of the current political debates. Maybe not without their own fault.

If we look at the performance numbers above, we can see a second interesting detail:

Gas utilities (apart from the French) and grid operators do a lot better than electricity generators. The top 5 performers are either gas utilities (Enagas, Gas Natural) or Grid operators (Red, Snam, Terna).

A quick look on relative valuation shows that Fortum is still relatively expensive, as well as EVN, although EVN should be treated differently:

| Name | BEst P/E | EV/BE EBITDA Curr Yr | |

|---|---|---|---|

| RWE AG | 8.11 | 4.37 | 6.40% |

| EDF | 8.07 | 4.80 | 6.28% |

| HERA SPA | 10.49 | 5.16 | 2.12% |

| ENBW ENERGIE BADEN-WUERTTEMB | 15.98 | 5.54 | 3.27% |

| GAS NATURAL SDG SA | 7.68 | 5.67 | 2.58% |

| IBERDROLA SA | 6.76 | 6.02 | 3.45% |

| GDF SUEZ | 12.15 | 6.10 | 4.18% |

| E.ON AG | 8.82 | 6.21 | 7.19% |

| REDES ENERGETICAS NACIONAIS | 7.29 | 6.55 | 10.11% |

| A2A SPA | 6.65 | 6.75 | 7.00% |

| ENAGAS SA | 9.28 | 7.27 | 7.48% |

| ROMANDE ENERGIE HOLDING-REG | 14.26 | 7.44 | 8.93% |

| ENERGIEDIENST HOLDING AG-REG | 15.36 | 7.91 | 7.66% |

| FLUXYS BELGIUM | 18.23 | 8.34 | 8.95% |

| FORTUM OYJ | 10.16 | 8.36 | 6.21% |

| EVN AG | 9.01 | 8.60 | 8.44% |

| SNAM SPA | 11.73 | 8.74 | 7.75% |

| VERBUND AG | 13.66 | 8.87 | 8.29% |

So looking back, it was not a good idea to buy the “Carbon story” although I was lucky to a certain extent with EVN. However going forward I still have to find out what I am going to do. At the moment, Gas Natural does look quite attractive.

I think the Carbon Emission Right (CERs) might also be an interesting area to look at.

more to come…..