A quick look at the Solarworld restructuring (XS0641270045, 6 3/8 2016)

Although I would not even touch Solarworld with a 10 foot pole, it is still interesting to see how they try to restructure their debt without going into the “ESUG” process.

Solarworld is one of the largest German manufacturers and distributors of Solar modules. In order to fund their expansion, they took on a lot of debt.

Roughly ~400 mn are loans and 550 mn are traded bonds which currently trade around 30% of nominal.

A few days ago, they announced, that some institution from Qatar will help the company plus the founder will inject as well some money.

However, this is all contingent on a proposed restructuring plan where both, the creditor banks and the bond holders of the two traded Bonds (XS0478864225, 400 mn 6 1/8% 21.01.2017 and XS0641270045, 100 mn 6 3/8, 13.07.2016) have to agree in separate meetings.

Just to make sure: This is for educational purposes only….

So let’s look into the restructuring memorandum to see how this proposal looks like:

The concept is basically to exchange the old bonds into new bonds with a lower nominal value plus some shares and a small cash component.

After the transaction, current shareholders will have only 5% of the new equity, the other 95% will be held by debt holders. Part of those new shares will be then sold to the founder and the Qataris and bondholders will get the resulting cash.

Lets look at the 2016 bond: For 1000 EUR current nominal value, bondholders will receive

57.84 EUR cash (5.78%)

7.31 “new” share

439.9 EUR nominal new bond

So here the problem starts:

1) What is the value of the new shares ?

2) What is the market value of the new bonds

1) New shares:

Here we have some possibilities to approach this. First one could use the price which is going to be paid by the founder and Qatar.

Current number of shares is 111.7 mn. After a reverse split of 150:1, this translates into 0.74 mn restructured shares for current shareholders. Then ~14.2 mn new shares will be issued, making it ~14.95 mn “new” shares in total.

The founder will buy 19.5% of the new shares for 9.75 mn EUR, Qatar pays 36.25 mn for 29%. interestingly, this translates if I have calculated correctly in different prices. 3.34 EUR per share for the founder and 8.36 EUR for Qatar.

A second possibility is to use the current share price pre dilution as a guid. However, If we look at the current price of 0.40 EUR, we can see that if I buy 150 old shares for 0.40 EUR, then I pay 60 EUR for a new share. This indicates that current shareholders do not understand how the restructuring works…

Personally, I would rather go for the lower end of the “range” between founder and Qatar. Interestingly, in one of the documents it is said, if the deal with the founder and Qatar does not happen, one would get 16.46 new shares and no cash.

So the new shares in my opinion should be valued at 7.31* 3.34= 24,45 EUR per 1000 nominal or 2.45% of current nominal.

2) New bond

So the question remains: What is the value of the new bond ? The details of the new bond can be found here.

The bond is quite complicated. The coupon is EURIBOR based, but the basis is at minimum 1% plus 5% margin. So currently this would be 6%. However, the coupons can be deferred until maturity, but then the interest rate increases.

The new bond is secured, although this is not too much different to the current bond. The current bond had “negative pledge” clauses. In some respect, the negative pledge is even stronger, because this includes all future assets as well, whereas the new “pledge” only includes current assets. Plus, they carved out the Qatar assets.

Additionally, the new bond will pay down part of the principal early. The schedule is:

1. 39.11 EUR per (new) 439 EUR principal after closing in July

2. 29.20 EUR June 2014

3. 21.43 EUR June 2015

4. 28.13 EUR June 2016

I have seen someone discounting this payments at 10% for calculating the value of the old bond, but I think this is wrong. You might do this after the restructuring happened, but before, those payments are at the same risk as the old bond.

Honestly, I find this bond too hard to value at the current stage. Based on the old bond price and the assumption for the cash and share distributions mentioned above, the implicit valuation of the new bond ~22% of the old bond or 22/44= 50% of the new bond nominal. At the current stage, with the restructuring not even implemented, this looks OK.

Comparison to Praktiker & IVG

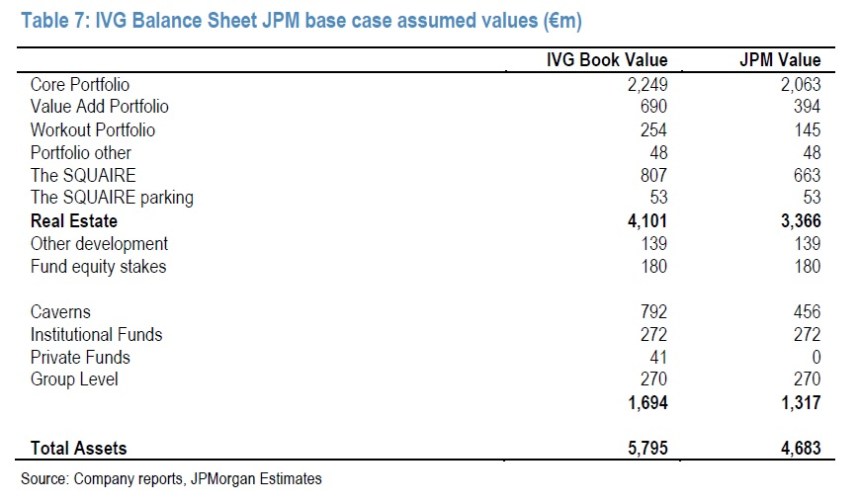

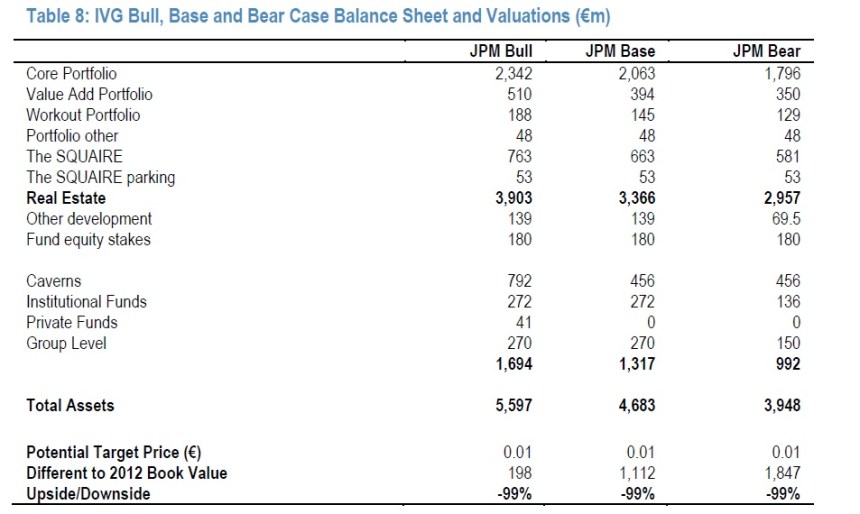

Maybe one quick note because I have covered both Praktiker and IVG as well: The big difference here is the fact, that in the current capital structure, we have only a very small amount of secured creditors in the capital structure. So Senior holders got away quite well. For IVG and Praktiker, this is not the case. Especially for Praktiker, one should assume a recovery which is much lower than what we see here.

Summary:

Solarworld will be an interesting case if and how voluntary restructurings work in Germany. The case is very different from Praktiker and IVG but nevertheless interesting.

If the restructuring is successful, I think the new bonds might be worth another look. This is due to the fact that they are very complex and to a certain extent the “fulcrum” security, i.e. the most senior part of the capital structure.

Apart from a short of the “old” the Solarworld share (which unfortunately cannot be borrowed), the current situation does not look attractive to me.