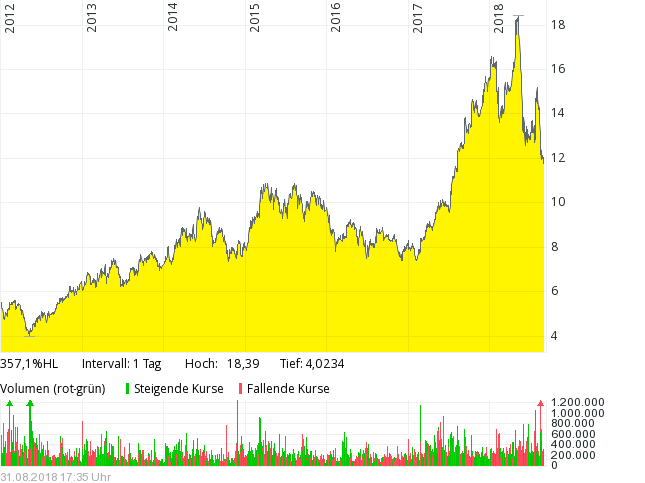

Tesla / Elon Musk

Elon Musk’s “Tesla is somehow going private” Tweet has triggered a lot of comments and discussions (good coverage on FT Alphaville).

For me the main take-away of this story is two fold:

One the one hand, listed equity markets are not the best place to raise equity capital once you are listed. It is OK to raise equity once when you IPO but after that, a company should only pay dividends and buy back stock. Part of the reason that Tesla is shorted so much is the expectation that they will need to raise equity which clearly shows the dilemma of public equity markets these days. Personally, I do think we will see more “Softbank style” large private vehicles which will specialize in providing capital to growing companies and save them the troubles of public equity markets until the company is mature enough. Unfortunately this will lead to the shift of a large part of value creation away from public markets and out of the reach of many “Normal” investors.

Read more