Mikron Group AG – Super Cheap (EV/EBIT ~4) and +33% EBIt 6M 2023- what is not to like ?

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!

Spoiler: If you are short on time: I did not buy a position here. No need to read everything.

Mikron is a company that I had on my (passive) radar since my “All Swiss shares” series some years ago (since I passed on it, it made around +100%, so keep this in mind for the rest of the post). It is a Swiss based machinery manufacturer with a market cap of 200 mn CHF and has some connection to SFS (SFS is a client, same Chairman in the past).

These were the main items that motivated me to looks deeper into Mikron this time:

+ currently very (very !!) cheap (P/E 7,5, EV/EBIT 3,5)

+ currently VERY good business momentum (6M 2023: Sales +22%, EBIT +33%)

+ better customer/product mix than in the past

+ Rock solid balance sheet (100 mn CHF cash vs 200 mn CHF market cap)

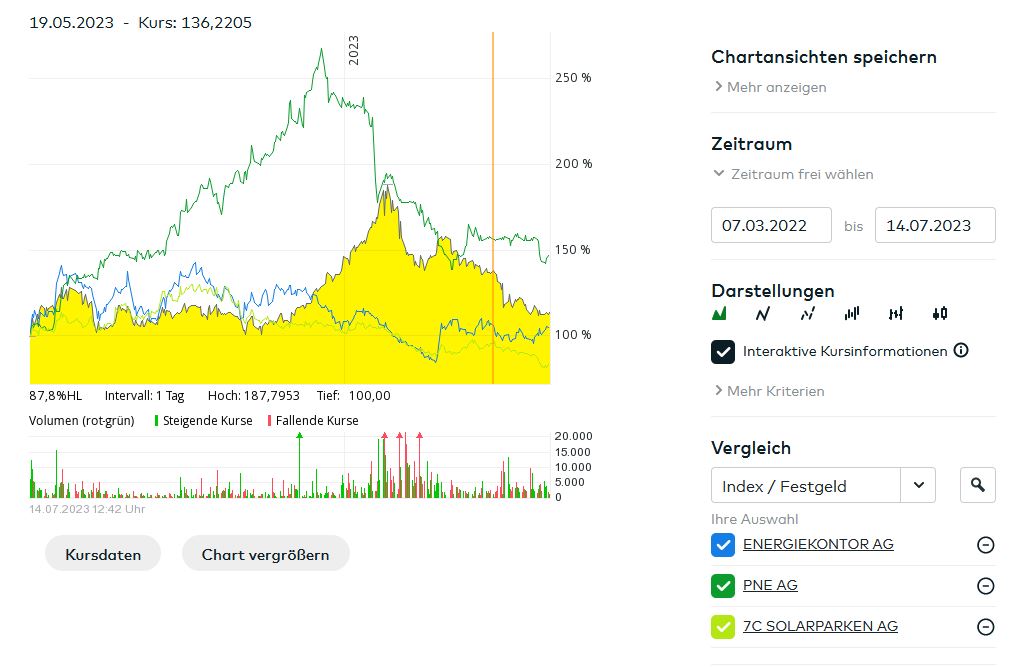

+ good share price momentum