All Swiss Shares Part 11 – Nr. 101-110

Again 10 randomly selected Swiss stocks with 2 watch candidates. As I am still on holidays, please do not expect quick reactions from me on any comments.

101. Bank Cantonale Vaudoise

BC Vaudoise is with around 7 bn CHF market cap one of the bigger regional banks. As the other regional banks, business is stagnating since a couple of years, however with an ROE of 9-10% they achive one of the highest ROE’s in the industry.

However I am not interested in the shares of such a bank, therefore I’ll “pass”.

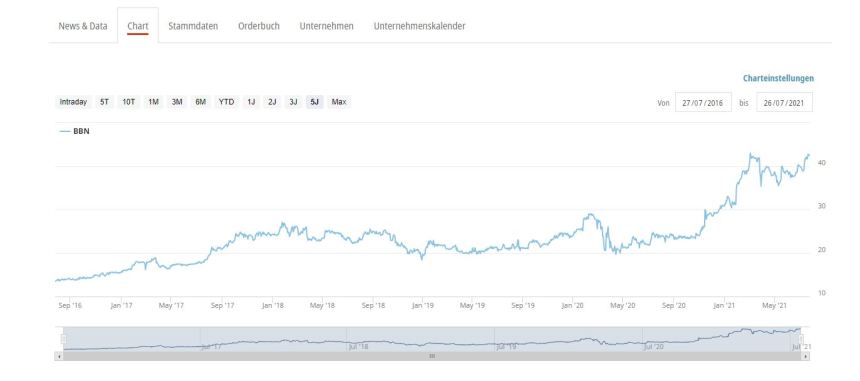

102. Stadler Rail AG

Stadler Rail is a 4 bn market cap company that manufactures “rolling stock” railcars and went public in 2019. Currently the stock price is pretty much where the stock started: