After having introduced the “Boss Score” in a series of posts, I have now build up a database of around 1000+ companies. o it’s time to look at results !!!

As I am looking for some UK exposure to add to the portfolio, I concentrate on UK companies first.

One of the best scores is achieved by a company called Dart Group Plc, a UK company which operates

1) a budget airline (Jet2)

2) a tour operator

3) a distribution / ground transport company (Fowler Welch)

The great thing about about potential UK value small caps is the fact that you find many great blog posts among the excellent UK based value logs about Dart Group.

So please read the following post on Dart Group at:

Kelpie Capital (very good blog by the way)

Expecting Value

Interactive Investor

Value Stock inquisition

Valuhunteruk

I would try to summarize the pros and cons for the company out of the blogs as follows:

+ cheap, asset rich company with a conservative (and improving) balance sheet

+ entrepreneurial management, founder holds 40% of company

+ competitive and regionally focused business model, profits from demise of competitors

+ business is growing

– unloved airline sector

– low margin business, exposed to oil price and consumer behaviour

– low dividend payout

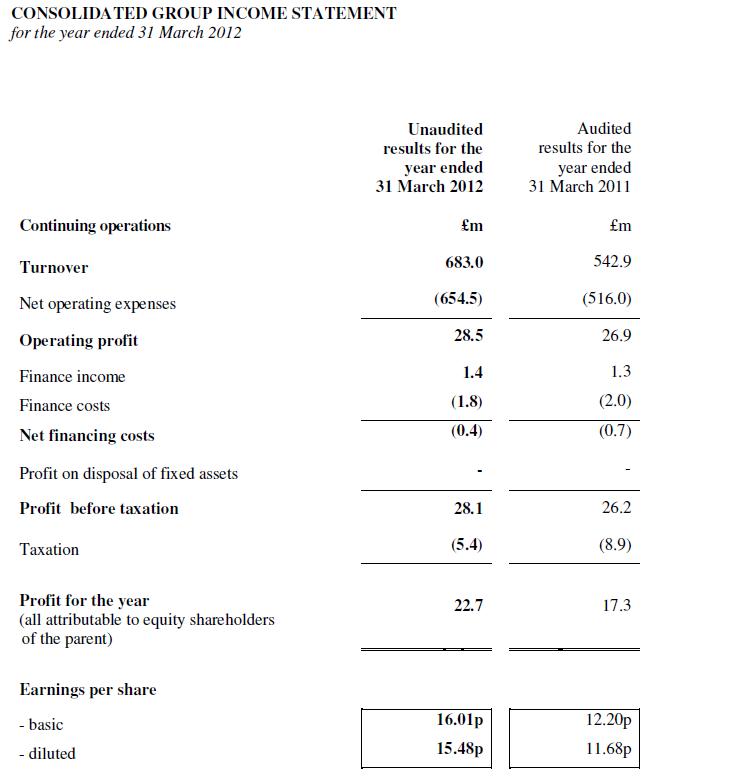

Let’s have a quick look at the traditional valuation indicators of Dart Group at the current price of 0.67 GBP:

P/E: 4.7

P/B: 0.6

P/S: 0.1

Div. Yield 2%

Market Cap 97 mn GBP

Debt/Assets 2%

EV/EBITDA 0.02 (!!!!)

EV/EBITDA is tricky for Dart Group. Dart group has a lot of cash on its balance sheet but a lot of that cash is “restricted”. In one of the blogs someone said it is restricted because of the deferred income on prepaid airline tickets.

If we look into the 2010/2011 annual report, it says however the following:

16. Money market deposits and cash and cash equivalents

2011 2010

£m £m

Money market deposits (maturity more than three months after the balance sheet date) 8.5 —

Cash at bank and in hand 98.3 52.2

Included within cash is £81.1m (2010: £38.1m) of cash paid over to various counterparts as collateral against

relevant risk exposures. These balances are considered to be restricted and collateral is returned either on the

maturity of the exposure or if the exposure reduces prior to this date.

This is something to be explored further, but I assume this has to do more with fuel hedging than prepaid airline tickets.

Historical volatility

Dart Group is a prime example how the Boss Score works in practice. Let’s look quickly at historical EPS vs. historical “comprehensive income”

|

EPS |

BV p. Share |

Dvd p.sh |

CI p. SH |

| 2000 |

|

0.22 |

|

|

| 2001 |

0.046 |

0.25 |

1.67 |

0.047 |

| 2002 |

0.036 |

0.27 |

1.70 |

0.038 |

| 2003 |

0.056 |

0.33 |

1.70 |

0.071 |

| 2004 |

0.037 |

0.36 |

1.75 |

0.054 |

| 2005 |

0.052 |

0.43 |

1.93 |

0.083 |

| 2006 |

-0.013 |

0.42 |

2.16 |

0.015 |

| 2007 |

0.062 |

0.53 |

2.31 |

0.132 |

| 2008 |

0.193 |

0.66 |

0.72 |

0.142 |

| 2009 |

0.111 |

0.82 |

1.19 |

0.168 |

| 2010 |

0.122 |

1.04 |

0.83 |

0.233 |

| |

|

|

|

|

| Total |

0.70 |

|

|

0.98 |

We can see 2 important points here:

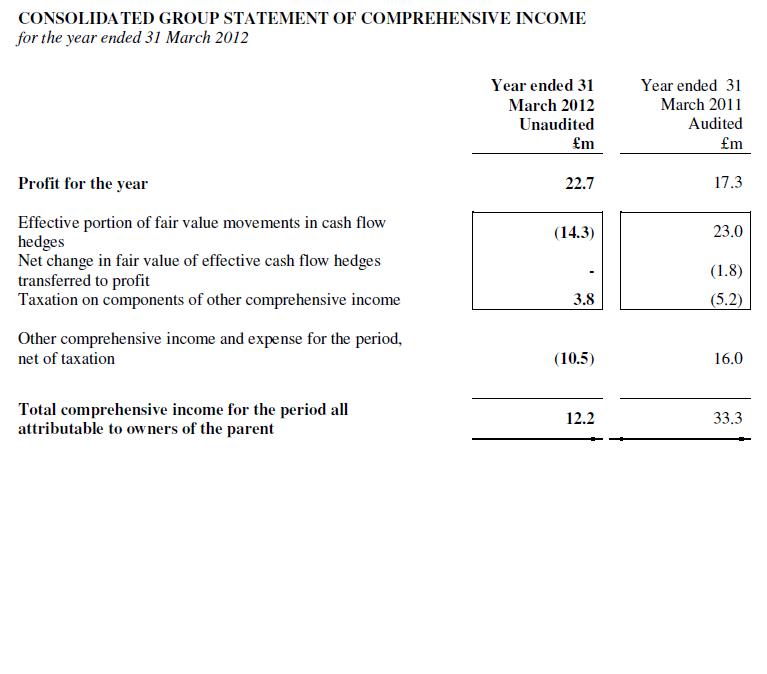

A) The comprehensive income over this 10 year period is significantly higher than the stated EPS (by almost a third !!)

B) the volatility of the comprehensive income is much lower than stated EPS, even in the loss year 2006, total comprehensive income was positive

Why is that ? The answer is relatively simple: Fuel hedges !!!!

In the annual report they state the following:

Aviation fuel price risk

The Group’s policy is to forward cover future fuel requirements up to 100% and up to three years in advance. The magnitude of the aviation fuel swaps

held is given in note 22 to the Consolidated financial statements. As at 31 March 2011 the Group had substantially hedged its forecasted fuel requirements for the 2011/12 year and a proportion of its requirements for the subsequent two years in line with the Board’s policy

So what happens is the following: If fuel prices move up like in 2010/2011, margins go down, because the cost increases. However an off setting effect takes place in Dart’s balance sheet because the hedges increase in value and increase equity. The effect is not perfectly correlated as they are hedging partly future years as well but nevertheless, on a combined basis, the total P&L is a lot less volatile than if one just looks at EPS.

Banks for example do exactly the opposite. A bank will always try everything to smooth earnings but to book everything unpleasant into comprehensive income.

If we look at the corresponding P&L lines we can clearly see the effect:

Fuel costs increased significantly from 95 mn GBP or 23.1% of total cost in 2009/2010 to 128 mn GBP or 23.8% of total cost in 2010/2011. Gains from hedging in 2010/2011 were 23 mn GBP. If we just deduct this gain from fuel costs, we would end up at 105 mn fuel cost or 20.3%. As they have mentioned before, they have “overhedged” for one period, but in general I would say that Dart’s results including the hedges are a lot less volatile than simple EPS would indicate.

Chart, relative strength and momentum

A comparison with the FTSE all share shows at least, that the stock doesn’t have a real negative momentum.

Compared to Halford’s, which is still in its free fall phase, the stock looks surprisingly strong

Also relative performance with the last 6 months or so is neutral or positive:

|

REL_5D |

REL_1M |

REL_3M |

REL_6M |

REL_1YR |

| dtg ln equity |

1.2% |

-6.1% |

-0.3% |

1.2% |

-16.8% |

Current developements

In april 2012, Dart issued a cautious trading statement saying:

The Group continues to develop and grow its business base across its operations, although in the current challenging trading environment, limited profit growth is expected in the current financial year.

Based on the current valuation one might think that the market expects a significant profit drop, so for me that is actually good news.

Management / Founder

Philipp Meeson is a 63 year old trained RAF pilot

The CEO seems to be very hands on but also sometimes quite rude to his employees like this article from 2009 shows:

Philip Meeson, boss of budget airline Jet2.com, was warned by police after flying into a rage at his own staff after becoming annoyed at the length of time it was taking them to deal with a long queue of passengers.

Officers had to be called as the airline’s chief executive berated check-in workers during an early morning ‘spot-check’ visit to Manchester airport.

Police had to warn the millionaire about his conduct and behaviour after he used a string of four-letter words – even though his outburst was applauded by many of the 200 passengers.

Could be that clients like him better than employees….

A nice quote from the same article is that one:

But it’s not the first time Mr Meeson has attracted controversy.

Three years ago he condemned strike action by French air traffic controllers by writing an article on his company’s website which called for “lazy frogs to get back to work”.

Shareholders

Founder Philip Meeson holds around 39.6% of the shares, followed by Schroders (according to Bloomberg either 25% or 22%), Jo Hambro with 6.3% and Norges Bank with 3%.

For some strange reasons, no real “value shop” is invested, which might be a good thing after all after having read Nate’s blog post about shareholder structure at Oddball.

Interestingly, Bill Ackman form Pershing seems to have established a new position of ~0.4%, whereas Standard Life seems to have sold down more than 1% in the last few months.

EDIT: Bill Ackman was nonsense. I mixed upPershing Llc with Ackman’s Pershing Square.

Business model

There is an interesting discussion about the business model to be found here.

In essence within the airline business, their main competitive advantages seem to be

– regional focus (not fighting on the crowded London market)

– buying cheaper used airplanes for cash instead of leasing new ones (used aircraft buying seems to be one of the special abilities of the CEO..)

– higher flexibility due to ownership and contracts with Royal Mail

– differentiation with slightly better services as a “family budget” airline

I am not able to judge how this holds against Ryanair and Easyjet going forward, but so far the strategy seems to have worked OK and better than many of the smaller competitors.

Valuation

A few simple thoughts about valuation:

Dart Group will never be a P/E 15 company, but it could easily be a P/B 1 company. At the moment, you get a company which increases shareholder equity by something close to 20% p.a. at 0.6 times equity. If we assume for instance they manage to generate 15% ROE in the next 3 years and the company would trade at book at that time, we would have a fair value of 1.7 GBP per share or an upside of 150% over 3 years. More than enough for me.

Summary

After reading all the blogs and going through annual reports, the company grew on me. In the beginning I thought: Airlines – keep away. But the more I looked at the company the better I liked it.

The reason why its cheap is relatively clear, no one likes airlines, especially when fuel prices are increasing. On the other hand I think the market is exaggerating the implied volatility and is not giving credit to the hedging program, which I think is one of the “hidden stories” of the stock.

So to summarize the stock I would pick out the following aspects:

+ stock is really cheap and unloved and in an extremely tough sector (so no “feel good” value investment)

+ company is led and owned by an entrepreneurial founder which has proven that he can grow the business ( no “cigar butt” either)

+ underlying returns on equity are really good despite asset intensity and low margins

I will add Dart Group with a limit of 0.7 GBP to the portfolio as a “half position” (2.5%) under the usual rules (max 25% of daily VWAP). After the final 2011/2012 numbers in July I wull then decide if I increase it to a full position.