Frosta AG – Defining their own Category the Hard Way

Disclaimer: This is not Investment advice. The stock discussed is very illiquid and trades at the unregulated market (Freiverkehr). If you want to buy this stock, work very carefully with strict limits. The author owns the stock and might buy/sell it without giving prior notice. And as always: PLEASE DO YOUR OWN RESEARCH !!

After having two (relatively) exciting stocks in the last two weeks with Rocket Internet and Innoscripta, I decided to tune down the exitement a little bit and focus on a very boring, family run German small cap this time. In order to not fall asleep, you might want to listen to the Soundtrack while reading:

Elevator Pitch:

This write-up is special in two ways. For one, I have privately bought the stock already a few months ago. Secondly, I base this write-up on another write-up from my friend Jon from abilitato.de. So please read that one before you read my “mini-writeup” where I only focus on a few specific aspects.

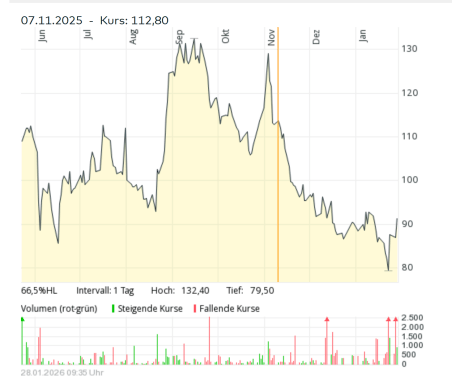

In a nutshell, Frosta is a boring, under-the-rader German family owned and run frozen Food company that does not do a lot of investor relations but runs a very convincing strategy focusing on additive-free ready made frozen meals. Inventing this category more than 20 years ago, the main Frosta brand is now growing with solid “mid teens” percentage rates p.a., has succesfully managed to enter and grow in neighbouring countries and with profitability that is steadily increasing. For the quality of the company and the potential growth prospects, the stock is still relatively cheap in my opinion at around 12×2025 P/E (ex net cash).

Here ist the write-up. Best read it after having a decent “Chicken Paella” from Frosta 😉