Installux

Installux released 2015 results a couple of days ago. EPS went down slightly from 28,12 to 26,63. With 31,7 mn EUR or 104 EUR per share, at the current share price of 271 Installux trades at an adjusted P/E of 6,3x.

The decrease in profit seems to be attributable to a reserve for a legal dispute in the Roche Habitat subsidiary. Roche Habitat is still the “problem child” and the only subsidiary making losses. The annual report states however that the restructuring is well on track and that sales at the division increased by 13% in 2015. If that division turns around, this could easily add 1-2 EUR per shar in profits in 2016.

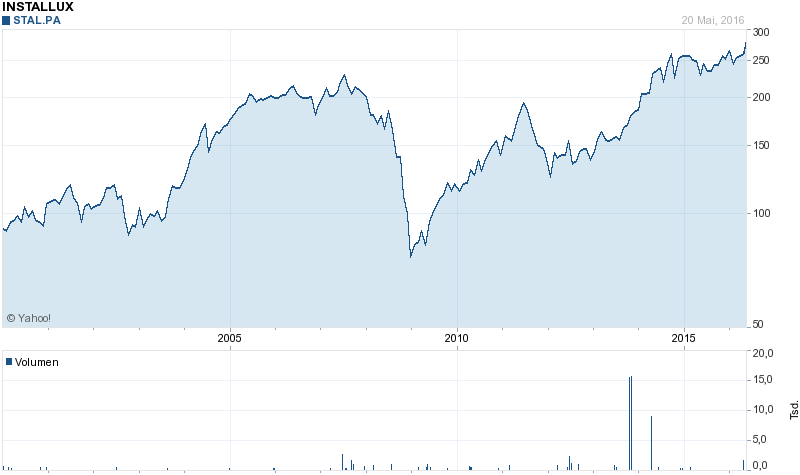

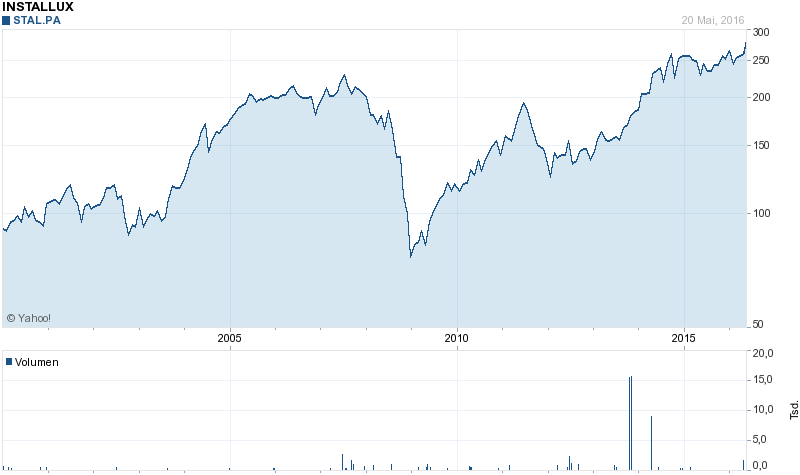

Installux is maybe not a great company but a solid and very resilient company and at the current valuation still a very good “hold” in my opinion. Interestingly enough, Installux trades near its all time high:

G. Perrier

G. Perrier released its annual report 2015 some days ago.

2015 EPS was 2,65 EUR per share vs. 2,50 EUR. Cashflow generation was exceptionally good so that they now have 38,8 mn EUR or ~10 EUR per share in Cash. At a current share price of 35 EUR per share, this means that adjusted for cash the P/E is below 10.

The first quarter looks pretty Ok as well. Overall, this quality (boring) company is still very reasonable priced and will remain a core position of my portfolio.

Thermador

Thermador released 2015 numbers and the 2015 annual report already some weeks ago. Stated EPS were 4,55 EUR vs. 4,47 in 2014. This includes two companies (Mecafer and Nuair France) that Thermador acquired in 2015. Without the acquisitions, EPS would have gone down by a low single digit percentage.

As Thermador is highly geared towardsFrench construction activity, the performance itself is quite good, the business seems to be very resilient.

Adjusting for around 4,50 EUR cash per share, the trailing P/E is now around 15,5 which clearly is not that cheap anymore. The current share price clearly implies EPS growth in the next few years (Bloomberg estimates are ~10% EPS growth for 2016 and 2017). This is something one will need to watch. 2015 earnings were still below the 2007/2008 level despite higher sales. If they actually grow earnings like estimated, the price is pretty OK, if not, the stock would be more or less fully priced in my opinion.