Some thoughts on discounts for Holding structures (Porsche SE, Pargesa, Autostrade Torino)

In my post about Porsche SE, I concluded the following:

However on a relative basis I don’t think that there is a lot of upside in the Porsche shares, as I don’t see a quick “real” catalyst and a certain structural discount (20-30%) is justified due to holding structure and non-voting status of the traded shares.

Geoff Gannon used this summary to come up with his view on holding company discounts:

I do know something about holding companies that trade at a discount to their parts. And I don’t agree with that part of the post. If the underlying assets are compounding nicely – you shouldn’t assume a holding company discount is correct just because the market applies one to the stock.

So he is basically saying one should ignore the holding structure and look at the underlying only.

Interestingly, we had such a discussion on the blog about the same topic in the Bouygues post. Reader Martin commented that “one usually applies a 20-30% holding/conglomerate discount” which I didn’t apply in my sum-of-parts valuation.

So far this seems to be quite inconsistent from my side, isn’t it ?

I have to confess that especially for Porsche, I did not mention all my thoughts about why I applied a discount there. However maybe I can shed some light on how I look at “holding structures” and when and how to discount them.

For myself, I distinguish between 3 forms of holding companies:

A) Value adding HoldCos

B) Value neutral HoldCos

C) Value destroying HoldCos

A) Value adding HoldCos

This is in my opinion the rarest breed of HoldCos. Clearly, Berkshire Hathaway is an example or Leucadia. Those HoldCo’s add value through superior capital allocation capabilities of their management. In those cases I would not apply any discount on the underlying assets, however I would be hesitant to pay extra.

B) Value neutral HoldCos

Those are holding structures which exist for some reason, but most importantly are transparent and do nothing stupid or evil to hurt the shareholder. Ideally, they are passing returns from underlying assets to shareholders.

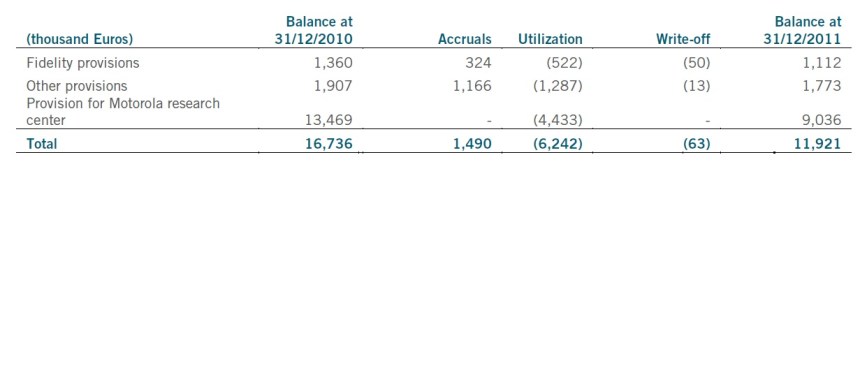

A typical example of such a company would be Pargesa, the Swiss HoldCo of Belgian Billionaire Albert Frère. They are quite transparent and even report their economic NAV on a weekly basisandpass most of the dividends received to the shareholders. Nevertheless, the share trades at significant discount to NAV as their own chart shows:

At the moment, we see a 30% discount for Pargessa. So one should ask oneself, why such a discount exists for such a transparent “fair” holding co ? I can think of maybe 3 reasons:

– The stock is less liquid than the underlying shares

– people do not really trust Albert Frere despite being treated Ok so far

– no one wants to invest into this specific basket of stocks

Nevertheless, one has to notice that even for such a transparent company like Pargesa, a 30% discount does not seem to be the exception.

C) Value destroying HoldCos

Here I have the privilege to have documented such a case in quite some detail, Autostrada Torina, the Italian Holding company for toll road operator SIAS SpA.

As I liked the underlying business, I thought buying at a discount, following Geoff Gannon thoughts that a nice compounding business at a discount is an ever nicer business.

However, I had then to find out the hard way that the discount of the holding company was clearly a risk premium. In this case, the controlling Gavio family “abused” the holding to buy an interest in another company (Imprgilo far above the market price. They couldn’t do this in the operating subsidiary, as the sub was subject to regulation. The Holding co stock recovered to a certain extent but in this case the underlying OpCo was clearly the better and safer investment

My lesson in this was the following: Stay away as far as possible from such “value destroying” HoldCos. They are totally unpredictable and doe not have any margin of safety.

So going back to our Porsche example, what kind of Holding company is Porsche ?

Well, it is definitely not a “value adding” holding. The question now would be if it is a “neutral” or potentially even “value destroying” hold co ?

In my opinion there are already some warning signs:

– Porsche SE already communicated that they will not distribute the cash, but build up an additional portfolio of “strategic participations”

– Porsche only issues detailed reports twice a year, accounting is rather “opaque”

– in my opinion, Volkswagen has a lot of incentives to achieve a weak Porsche SE share price in order to then acquire their own shares at a discount (and swap them into VW pref shares if possible) at a later stage. Common shareholders (Porsche & Piech family might get a better deal. Under German law it is possible to treat pref holders differently

Compared to Pargesa for example, I would definitely prefer Pargesa with a 30% discount to a Porsche pref share at 35% discount.

So to summarize the whole post:

– With holding companies, it is very important to determine the intention and risks of the holding structure

– neglecting or even “evil” holding management can quickly turn a “discount” into a real loss

– better err on the safe side in such situations

– in doubt, assume there is a reason for the discount if you cannot prove the opposite

– however for skilled activist investors, those situations might create potential. So maybe Chris Hohn has a different game plan.But don’t forget that a lot of famous Hedgefund managers (incl. David Einhorn lost a lot of money with Porsche/Volkswagen already in the past.