So after my first look into David Einhorn’s long pick AerCap last week, I want to follow up with some more detailed analyis in a second step.

By the way, a big “thank you” for all the qualified comments and Emails I got already after the first post, that’s the best return on investment on a blog post I can get !!!

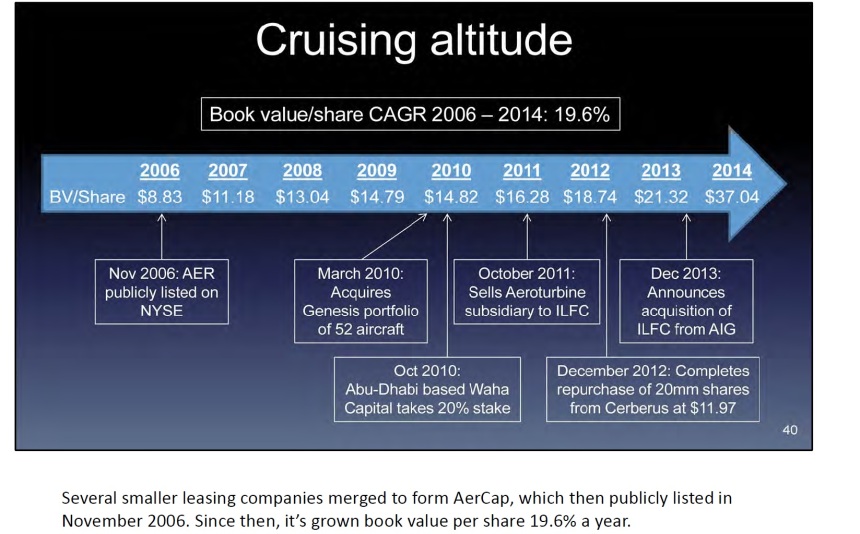

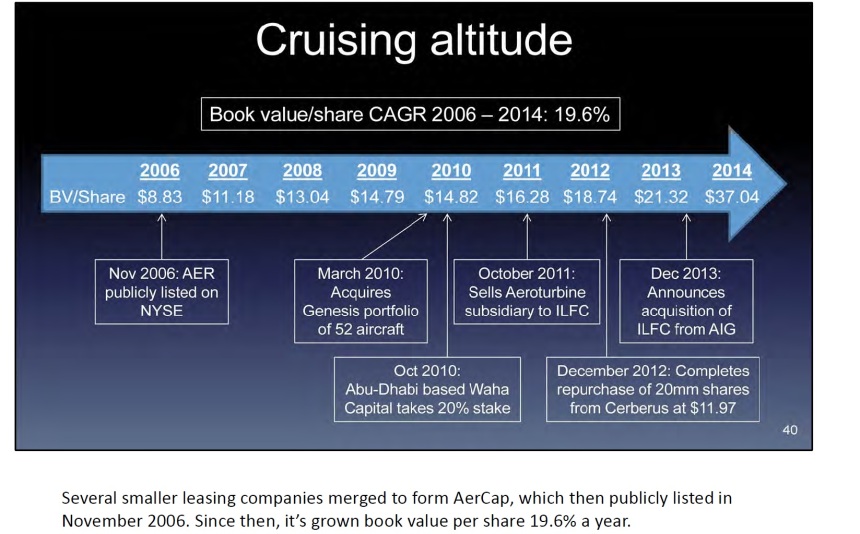

The book value story growth

This was for me one of the core slides of Einhorn’s deck:

I mean you don’t have to be a genius to understand this: A company which trades near book value and compounds 20% p.a. is pretty much a no brainer. However, if I look at the developement of book values for financial companies, I always look at both, stated and tangible book value per share.

In AerCap’s case, the comparison looks interesting:

|

BV per share |

TBV share |

| 2006 |

8,83 |

8,3493 |

| 2007 |

11,18 |

10,6041 |

| 2008 |

13,04 |

12,4083 |

| 2009 |

14,79 |

14,3448 |

| 2010 |

14,82 |

14,3798 |

| 2011 |

15,26 |

15,0608 |

| 2012 |

18,72 |

18,5592 |

| 2013 |

21,32 |

21,2334 |

| 2014 |

37,04 |

16,174 |

| |

|

|

| CAGR |

19,6% |

8,6% |

| CAGR 2006-2013 |

13,4% |

14,3% |

This table shows two things: Before the ILFC transaction, stated book values and tangible book values were pretty much the same and compounding around 13% p.a. Still pretty good but clearly not 20%. In 2014 however, with the ILFC deal something interesting happened: The book value per share doubled but tangible book value dropped.

The ILFC deal

So this is the right time to look into the ILFC deal. The two main questions for me are:

a) why did the book value per share increase so much ?

b) why did tangible book value per share actually decrease ?

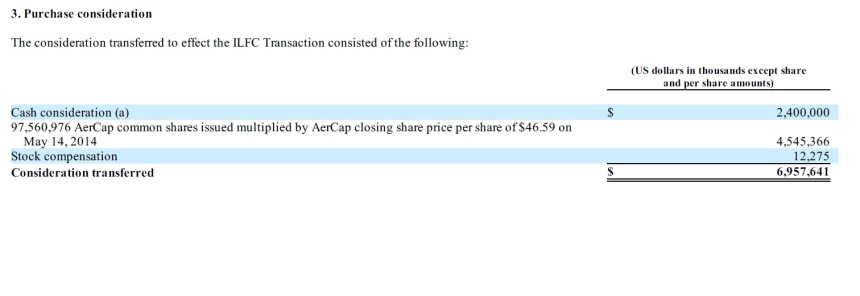

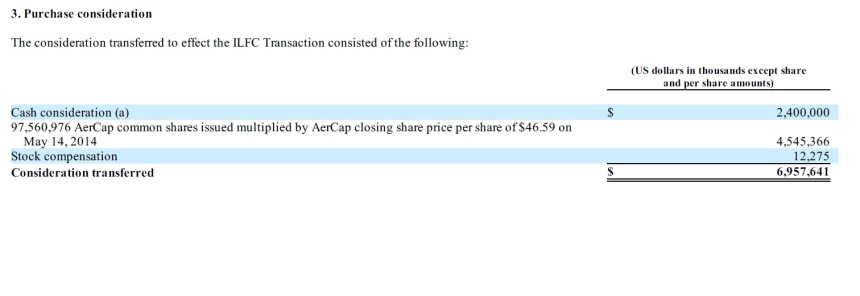

This is how AerCap presents what and how they paid for ILFC:

So AerCap paid the majority of the purchase with own shares, 97,56 mn shares valued at 46,49 USD. Issuing new shares always has an impact on book value per share if the issue price is different from the book value. Let’s look at an example:

We have a company which has issued 100 Shares at 50 EUR book value per share and 100 EUR market value (P/B =2). So the total market value is 10.000, total book value is 5000. If the company now issues another 100 Shares at 100 EUR market value, we have 200 shares outstanding and 5000+10000 = 15.000 EUR total book value. Divided by 200 stocks we now have 75 EUR book value per share or a 50% increase in book value per share for the old shareholders. So issuing shares above book value increases book value per share automatically.

In AerCap’s case, it worked more or less the same way: AerCap had ~113 mn shares outstanding with a book value of around 21,30 USD per share. So issuing 97,56 mn share at a steep premium at 46,49 of course increased book value per share dramatically. The transaction alone would have increased the book value to ((113*21,30)+(97,56*46,49))/(113+97,56)= 32,97 USD per share or an increase of ~50%.

So how is this to be interpreted ? Well, clearly it was a smart move from AerCaps management to pay with its owns shares at such a nice price. On the other hand, one should clearly not mistake this a a recurring kind of thing. I would not use the historic 20% p.a. increase in ROE as expectation for the future but rather something like 13% or so in the past.

Intangibles

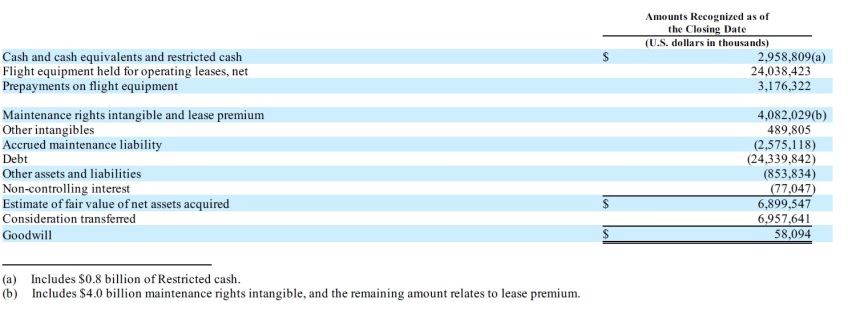

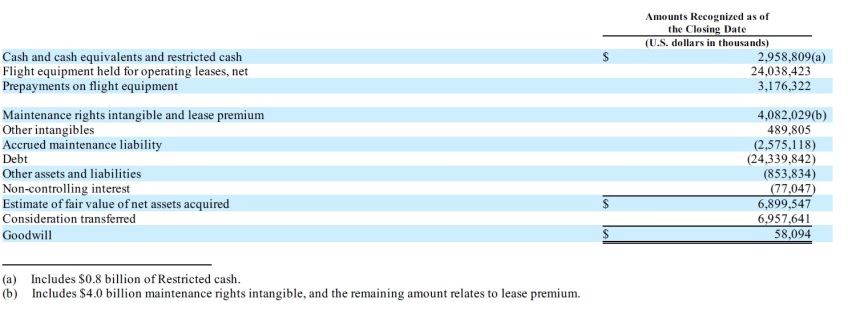

After looking into how much and in what form AerCap was paying, let’s look now what they actually got:

Yes, they got a lot of planes and debt. Interestingly they assumed more debt than book value of the planes. Altogether they did get a lot of intangible assets. All in, AerCap bought 4,6 bn intangibles which is around 80 mn more than equity created through the new shares. So at the end of the day, one could argue that the new shares have been exchanged more or less 1:1 against intangible assets.

The largest part of this is a 4 bn USD position called “Maintenance rights intangible” which for me is something new. This is what they say in their 20-F filing:

Maintenance rights intangible and lease premium, net

The maintenance rights intangible asset arose from the application of the acquisition method of accounting to aircraft and leases which were acquired in the ILFC Transaction, and represented the fair value of our contractual aircraft return rights under our leases at the Closing Date. The maintenance rights intangible asset represents the fair value of our contractual aircraft return right under our leases to receive the aircraft in a specified maintenance condition at the end of the lease (EOL contracts) or our right to an aircraft in better maintenance condition by virtue of our obligation to contribute towards the cost of the

maintenance events performed by the lessee either through reimbursement of maintenance deposit rents held (MR contracts), or through a lessor contribution to the lessee. The maintenance rights intangible arose from the application of the acquisition method of accounting to aircraft and leases which were acquired in the ILFC Transaction, and represented the fair value of our contractual aircraft return rights under our leases at the Closing Date. The maintenance rights represented the difference between the specified maintenance return condition in our leases and the actual physical condition of our aircraft at the Closing Date.

For EOL contracts, maintenance rights expense is recognized upon lease termination, to the extent the lease end cash compensation paid to us is less than the maintenance rights intangible asset. Maintenance rights expense is included in Leasing expenses in our Consolidated Income Statement. To the extent the lease end cash compensation paid to us is more than the maintenance rights intangible asset, revenue is recognized in Lease revenue in our Consolidated Income Statement, upon lease termination. For MR contracts, maintenance rights expense is recognized at the time the lessee provides us with an invoice for reimbursement relating to the cost of a qualifying maintenance event that relates to pre-acquisition usage.

The lease premium represents the value of an acquired lease where the contractual rent payments are above the market rate. We amortize the lease premium on a straight-line bases over the term of the lease as a reduction of Lease revenue.

This sounds quite complicated and for some reason part of the sentences seem to have been duplicated. If I understand correctly, they assume that the underlying value of the aircraft is higher than the book value of the acquired planes. To be honest: I do not have any clue if this is justified or not.

However, as those intangibles are significant (more than 50% of book value), the case gets a lot less interesting for me. Intangibles created via M&A activity are in my experience always difficult, especially if it is esoteric stuff like this. It’s also a big change to the past of AerCap. Historically, they were carrying very little intangibles.

Funding cost & ROE

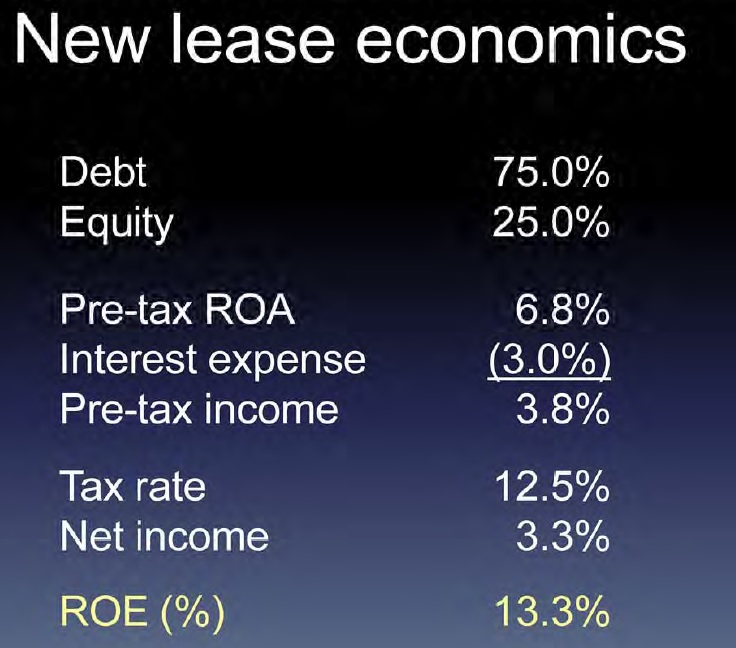

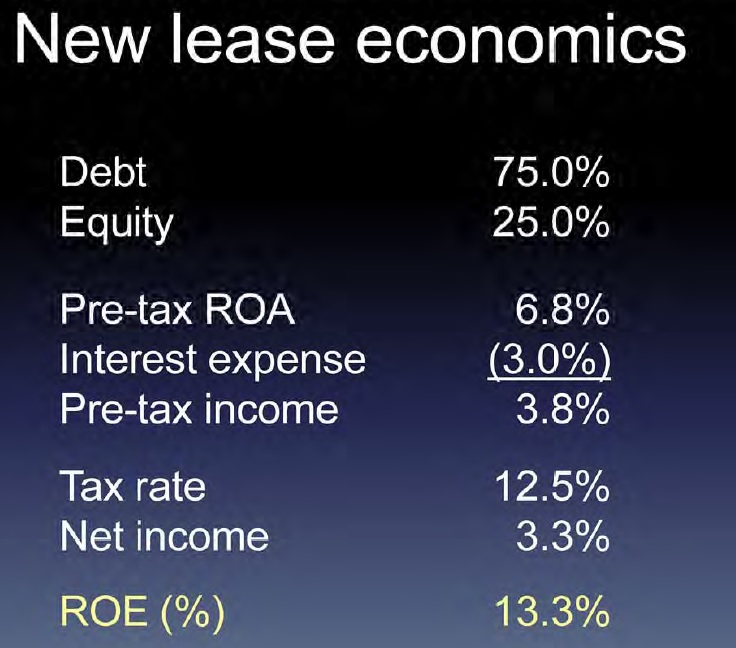

This was Einhorn’s prospective ROE calculation:

One of the key assumptions is a 3% funding cost. So let’s do a reality check and look at the expected pricing of AerCaps new bond issue. This is from Bloomberg:

Aercap $750m TLB Talk L+275, 99.75, 0.75%; Due April 30

By Krista Giovacco

(Bloomberg) — Commits due April 30 by 12pm ET.

Borrower: Flying Fortress Holdings LLC, a subsidiary of AerCap Holdings and International Lease Finance Corp., largest independent aircraft lessor

$750m TLB due 2020 (5 yr extended)

Price Talk: L+275

OID: 99.75

Libor Floor: 0.75%

Call: 101 SC (6 mos)

Fin. Covenants: Max LTV test

Existing Ratings: Ba2/BB+ (corp.); Ba1/BBB-, RR2 (TLB)

So AerCap is funding at a spread of 2,75% vs. LIBOR. With the 10 year USD LIBOR at 2,00%, funding would be way more expensive than the 3% assumed by Einhorn. Maybe the fund floating rate, but then the whole company would rather be a bet against rising interest rates than anything else. On a “like for like” basis without structural interest rate risk, I don’t think AerCap will generate a double-digit ROE at current spreads.

Business case & competitive environment

Within the comments of the first post, some people argued that the company is not a financing company but that the access to Aircraft is the value driver. Buying cheap aircraft from manufacturers and then selling (or leasing) them with a mark-up to clients then looks like some kind of Aircraft trading business.

For me however there is one big problem with such a business model. Retailing or wholesaling any merchandise is then most attractive as a business when 3 criteria are met:

– there are a lot of suppliers

– there are a lot of clients

– you can create a competitive advantage via physical distribution networks

In AerCap’s case, the biggest problem is clearly that there are not that many suppliers but only 2, Boeing and Airbus. Both don’t have much incentive to let any intermediary become too large so they will most likely encourage competition between Aircraft buyers.

Secondly, as far as I understand, there is no physical distribution network etc. behind AerCap’s business. So entering the market and competing with AerCap in the future doesn’t look so difficult for anyone with access to cheap capital.

Clearly, as in any opaque trading business, an extremely smart trader can always make money but it is important to understand that at least in my understanding there are no LONG TERM competitive advantages besides the purchase order flow from ILFC.

That the barrier to entry the business is not that high is proven by no other than Steven Udvar-Hazy the initial founder of ILFC and his new company Air Lease.

IPO’ed in 2010 and now the company is already a 4 bn USD market company 5 years later. Interestingly, AIG sued Air Lease in 2012 because they

were able “to effectively steal a business,” and reap a windfall at the expense of ILFC, the world’s second-largest aircraft lessor by fleet size. It described how some employees, while still working at ILFC, downloaded confidential files and allegedly diverted deals with certain ILFC customers to Air Lease, before leaving to join that firm. The companies are in the business of buying aircraft and leasing them to commercial airlines all over the world.

So to me it’s not clear what AerCap actually bought. It seems the “secret sauce” of ILFC seems to have been transferred to competitor Air Lease already. Interestingly, the lawsuit was settled a few days ago at a sum of 72 mn USD. I found that quote from Udvar-Hazy interesting:

“I want to make it clear that there is no secret sauce in the aircraft leasing business,” Hazy told analysts on a conference call. “ALC’s success is a result of a strong management team with extensive experience and solid industry relationships.”

Summary:

My problem with AerCap is the following: The financial part of the company, which I feel that I can judge to a certain extent, does not look attractive but rather risky to me. The Aircraft “buying and trading” segment on the other hand seems to be the more attractive part but for me too hard to judge in a reasonable way.

So for the time being, this is clearly not an investment for me. To look further into AerCap, two things need to happen: First they need to regain their investment grade rating and funding cost will need to drop to the 3% that Einhorn is assuming and secondly, there should be a clear impact on the share price from a potential sale from AIG.

In the current market environment clearly anything can happen and a multiple expansion could bring nice profits but personally, in a direct comparison I prefer the LLoyd’s case.