Gaztransport & Technigaz (GTT) – welcome back !!

Background:

Gaztransport & Technigaz is a company that I had looked at in early 2016 and most of what I have written back then still applies:

Imagine you could invest into a company with the following characteristics:

– Global market leader with 70-90% market share (95% new built)

– Net margins after tax of 50% or more

– business protected by patents

– almost no capital requirement, negative working capital

– a potentially huge growth opportunity

– conservative balance sheet (no debt) and “OK” management

Back then, I found the stock initially too expensive at EUR 34 per share, however I invested then at around 22 EUR but sold after a quick gain at around 31 EUR.

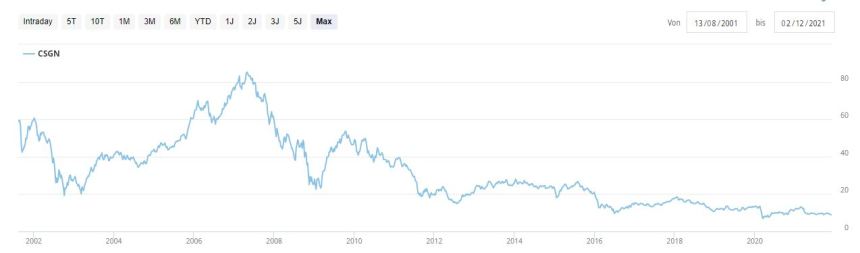

What did happen since then ?

Looking at the chart, I was clearly underestimating the value of the stock by a wide margin as the stock more than tripled until early 2021: